Pan American Bank is to continue to extend microloans to lawful permanent residents through the Citizenship Microloan Program.

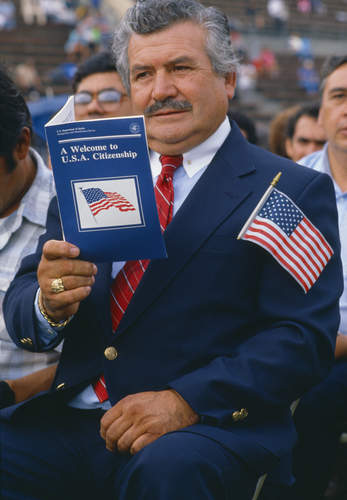

Developed in the summer 2011 in response to requests from local elected officials and community organisations, the Pan American Bank Citizenship Microloan Program provides a low-cost loan to lawful permanent residents eligible for naturalisation.

"For a great number of lawful permanent residents the only obstacle to naturalisation is the application fee. Across the country there are over eight million lawful permanent residents that are currently eligible for citizenship – 2.4 million in California," said Pan American Bank CEO Jesse Torres.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The loan of $1,000 is to cover the $680 fee to the United States Citizenship and Immigration Services with the remaining $320 to finance additional costs such as citizenship or English language classes.

Pan American Bank receives a consistent flow of applications for the Citizenship Microloan as a result of its close relationships with community-based organisations that serve the immigrant community.

Pan American Bank has a network of eight branches across East Los Angeles, California.

Related articles

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCalifornia Bank & Trust upgrades online platform, launches iPad app

Wells Fargo expands remittance service in 7 countries