The Covid-19 crisis has shown it is more important than ever for banks to be able to gauge and help improve the financial wellbeing of their customers.

The first half of 2020 has created colossal problems for UK banks and their customers to overcome. Subdued consumer confidence combined with millions facing a reduced income has left major banks facing losses this year, with billions of pounds now set aside for expected loan defaults.

While the crisis was unexpected, banks will continue to face this problem until they can assess and improve the financial wellbeing of their customers. This involves not just knowing someone’s financial position but their financial awareness in order to predict future financial behaviour.

This is unlikely to be an easy task, as banks will have a hard time convincing customers that they are the place to divulge money worries. Research by First Direct in partnership with YouGov found just one in eight customers with financial worries would turn to their bank for help.

Yet several banks are already trying to remedy this issue. In preparing for many of its customers to face financial difficulty, in early April 2020 Virgin Money launched Money on your Mind, a financial wellness service for bank and non-bank customers alike. Customers send in questions online and receive an answer via phone call from one of 300 members of Virgin’s Red team (who were previously branch staff).

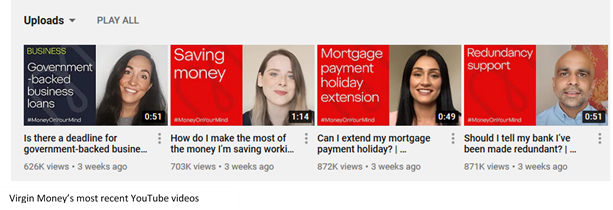

Virgin has also taken advantage of alternative digital channels such as YouTube, posting answers to common financial wellness questions. Virgin has gone straight to the elephant in the room, focusing on videos designed to dispel myths and preconceptions about ruthless banking practices and instead emphasise the help and support available to struggling customers. The bank has been successful in this, with videos such as “Should I tell my bank I’ve been made redundant?” receiving well over half a million views within weeks.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Virgin benefits from this approach in multiple ways. While its branches weren’t open, the bank could still offer a personalised bank channel that can accurately assess whether customers truly need payment holidays or overdraft extensions. This helps the bank maintain and develop a relationship with customers as well as attract new consumers whose own bank hasn’t been so responsive.

Additionally, it acts as a channel to sell products such as loans or to attract deposits. While these factors are less than revolutionary, they will at least help Virgin Money navigate its way through 2020 by taking pressure off its call centre network and keeping a check on payment holidays.

Similarly, First Direct has sought to prioritise wellness for its customers, although its strategy has been quite different. The digital-only bank has aimed to integrate wellness throughout its proposition, such as enabling customers to talk to a human straight away and training its staff in mental health first aid. The bank also has a core team of staff that identifies, reaches out, and tries to help vulnerable customers before they get into financial trouble.

And while these current changes are fairly light-touch for a well-established banking player, First Direct has also commissioned and published the first edition of its annual Money Wellness Index. This survey collaboration with YouGov will examine the top money anxieties nationally, as well as how this correlates with happiness and household disposable income.

The bank aims to use this information to inform it “how well we can help deliver money wellness for our customers” as well as use it as a marketing tool to attract new, more socially conscious customers, with advertisements prominently featuring the #moneywellness hashtag.

However, while some banks have begun to address the financial wellness of their customers, to date none have sought to build a level of trust to the extent that customers will want to divulge their negative or embarrassing financial secrets. Trying to understand as well as improve the financial habits and thinking of customers will not only enable banks to offer a more personalised experience, it will help banks learn the true risk of the loans they’re making and ultimately help them prepare for the unknown.