UK current account switching is on the rise-albeit from a pretty low base. Let us deal with the positives first. And while we are at it, say a hearty well done to Nationwide.

PayUK has released the latest current account switching statistics. The numbers cover the three-month period to end March. There were 341,075 switches in Q1 2023, the highest total ever. The customer data relating to switching by brand is always released three months in arrears. So, the brand-by-brand figures released today cover the three-month period to end December 2022.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

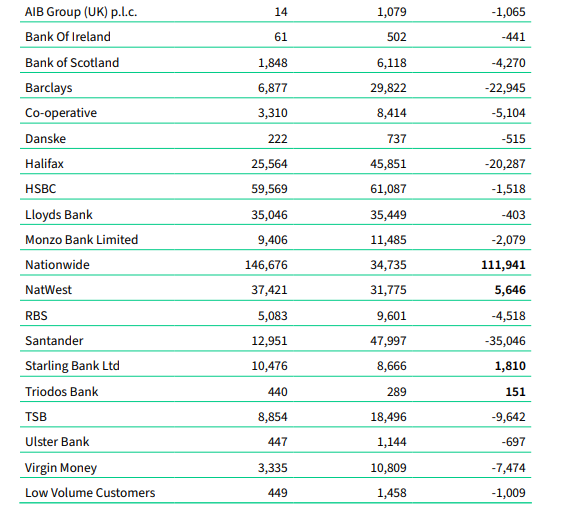

Nationwide had the highest net switching gains by some distance with net gains of 111,941 customers. NatWest follows in a distant second with net gains of 5,646. Starling Bank (+1,810) and ethical lender Triodos (+151) are the only other brands with net gains.

7-day current account switchers Q4 2022: Santander, Barclays, Halifax the big losers

Santander is the biggest loser in the latest PayUK statistics. For the three months to end December, Santander suffered a net loss of switchers of 35,046. This is in marked contrast to the last quarterly numbers released at the end of January.

On that occasion, the brand-by-brand switching data for the period from July to September 2022 showed Santander with the highest net switching gains (29,105). The net gainers tend to be brands that fall into one or two-or both categories. Namely the brands with the best current switching initiatives and the brands with the best reputation for customer service. Exactly what one would expect. For Q3 2022, Santander offered generous switching incentives. Once the incentives end, there tends to be a marked change in switching statistics.

The latest numbers highlight Barclays (-22,945) and Halifax (-20,287) as the other big losers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe UK leads the way in terms of ease of current account switching. PayUK continues to do an excellent job. Specifically, it cannot be faulted as regards its promotion of 7 day switching and administration of the switches themselves.

Consumer awareness of the Current Account Switch Service is at an average of 79% through Q1 2023. During Q1 2023, 86% of those that had used the Current Account Switch Service in the last five years said they are satisfied with the overall process. Notably, some 99.4% of switches are completed within the target seven working day timescale.

The total number of switches since the service launched in 2013 now stands at 9.1 million. In the past 12 months (1 April 2023 to 31 March 2023), there were 1,131,067 switches. For comparison, for calendar year 2022, there was a total of 986,959 current account switches.

A running total of 1.1 million switches for the past 12 months represents progress. But the latest running 12-month total is still less than the annual figure when seven-day switching was rolled out in 2013. Specifically, in 2012 there were 1.2 million switches.

7-day switching peaked in 2014 but 2023 is on target to set a new record

The annual figure peaked in 2014 at 1.16 million. The annual total dipped then in each of the next four years, to 1,033,939 in 2015 and to 1,010,423 in 2016. By 2017 (931,956) the figure was back below the one million total and fell again to 929,070 in 2018. By 2021, the annual number had fallen even further to 782,223. The latest quarterly numbers will give PayUk optimism that 2023 is on target for a record year.

Nationwide again the big winner

Nationwide topping the latest quarterly numbers for most net gains is not a surprise. Nationwide regularly offers account switching incentives. It has also been on a roll in terms of growing its current account market share. For example, in 2013, Nationwide held a current market share of about 6.2%. Today, that figure has risen to around 10.5%. As previously mentioned by the writer, growing current account market share by four percentage points does not happen by accident. So, take a bow, the product and marketing teams at Nationwide.

PayUK account switching by brand – gains and losses for 3 months to end December 2022