RBC Q3 2020 net profit of C$3.2bn ($2.43bn) beats analyst forecasts and inches down by just 2% year-over-year despite Covid.

In particular, the strong performance is driven by rising earnings in capital markets and positive news on loan losses. Moreover, RBC Q3 2020 highlights include maintaining its quarterly dividend at C$1.08 per share.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

On the other hand, net income at the bank’s Personal & Commercial banking unit is down 18% y-o-y to C$1.37bn. Primarily, this is attributable to lower spreads largely reflecting lower interest rates, and higher PCL. These factors were partially offset by average volume growth of 5% in loans and 18% in deposits in Canadian Banking.

At the same time, RBC’s wealth management unit posts net income of C$562m, down by 12% y-o-y. This is largely due to a decline in net interest income as average volume growth is more than offset by the impact of lower interest rates. Higher PCL also contributes to the decrease. These factors are partially offset by higher average fee-based client assets and an increase in transaction and other revenue.

RBC Q3 2020 highlights

The fall in personal & commercial and wealth management net income is largely offset by the bank’s capital markets unit. The division posts net income up 45% y-o-y to C$949m.

Higher returns from fixed-income and equities trading is the main driver of the earnings growth.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn addition, RBC’s insurance unit posts net income ahead by 6% to C$216m.

In the US, City National deposits are up by 38% from a year ago. RBC also reports strong growth in its US Private Client group with AUA up $28bn from a year ago

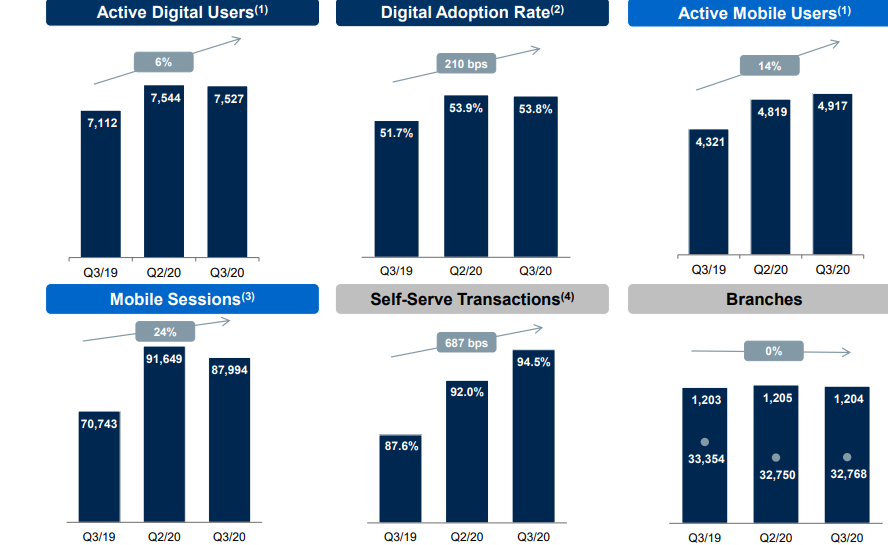

Third quarter digital highlights include 90-day active mobile users up 14% to 4.9 million. This results in a 24% increase in mobile sessions. Meantime, RBC’s digital adoption rate increases to 53.8%.

RBC CEO Dave McKay says: “As stores continue to open, we have seen our over 9 million cardholders spend more this July than last year. This is the first year-over-year positive trend since mid-March. We’re also seeing strong activity in housing markets across North America. In Canada, home sales, house prices and housing starts have shown surprising resilience. This partly reflects pent-up demand and low interest rates.”

McKay adds that RBC sees very strong mortgage growth of 10% year-over-year. This picks up from similarly robust levels at the start of the year.

RBC cross-sell success

Some 85% of RBC mortgage clients have an existing relationship with the bank before requesting mortgage funding. Nearly 95% of mortgage clients have more than one product with RBC, with the majority having a checking account. And 19% of clients have all four transaction accounts, credit cards, investments, and borrowing products with RBC.