Open banking has broken out beyond the buzz to become a global movement with the power to transform the banking sector worldwide. Here, Oliver Dlugosch, CEO of ndgit looks at what’s stimulating the market towards these brave new ecosystems and the trends that will drive development.

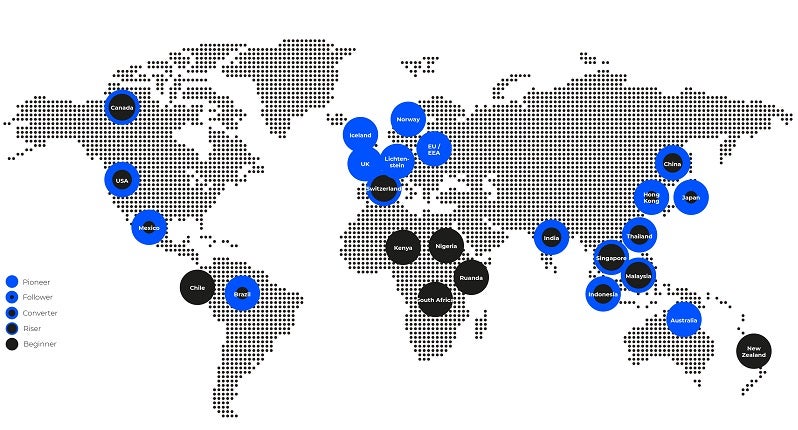

There is a wholescale global revolution underway in the banking sector. Beyond Europe, open banking projects are rapidly gaining momentum, opening up customer account information to authorised third parties, empowering the most diverse of markets and accelerating new financial inclusion and services using open APIs.

In some countries, legislative guidelines (such as PSD2) have created the need for disruption. In others, it’s neither banks nor legislators but other industry players such as Telcos who are seizing the ‘open’ initiative to facilitate a new breed of next-generation digital and mobile money-based services.

Fuelling this global momentum is a powerful cocktail of catalysts, which are combining to open the banking market and empower businesses and consumers. ndgit believes the big four market openers are:

• New Regulation

Forward-thinking regions are paving the way with laws and regulations designed to create a level playing field and the necessary framework for the development of open banking. For example, PSD2 in Europe, Open Banking in the UK, the Open API Framework in Hong Kong and the Consumer Data Right Act in Australia.

• Increased Competition

Challenger banks and digital-first FinTechs are exploiting open banking‘s new rules. Innovative approaches from new players (like Starling and Monzo in the UK) are transforming the playing field, generating new market perspectives and increasing pressure on traditional banks to up their game.

• Strategic Innovation

Established players are now challenged to compete with digital-first players while coping within the framework of their legacy and increasingly obsolete IT systems. Some countries like Switzerland are approaching Open Banking from the technical side by encouraging collective investment in industry-wide standardised APIs.

• Customer Expectation

GAFA (Google, Amazon, Facebook and Apple) have already transformed B2B and B2C interaction globally. To retain existing customers, and win new ones, banks must be able to accommodate customers’ needs in the new ‘real-time’ transactional world. This is fuelling the trend for personalisation, customisation and targeted service offerings. WeChat in China is a great example of ‘if you build it they will come.’

Empowering change

‘First-pioneers’ are already responding to these market forces, creating new customer experiences and setting new standards for the financial services. Those that cannot deliver, will fall behind. The wholesale disruption of the financial market – similar to that previously seen in sectors such as the media industry – is already in full swing. Banks that have not yet charted their Connected Banking roadmap – from the proactive opening of accounts to the design of platform banking – must begin today.

At ndgit, we see open banking as a value-adding business model that uses Open APIs to generate new revenue streams. Open API’s are different from regulated PSD2 APIs, as banks can decide for themselves to what extent they open up their bank data and processes. They form the essential basis for implementing future networked business models of banks with the wider ecosystem.

The key requirement is the introduction by banks of a suitable open banking platform, which will facilitate the technology required to truly ‘open’ the bank and create a networking strategy beyond the regulatory Open APIs.

Some banks are already employing FinTech innovations and partner modules in their end-user applications to cover functions that they would only be able to offer with great effort such as account aggregation, financial management or robo-advisory. Increasingly, these services are based on PSD2-regulated account access with which data from any third-party banks of the customer can be included.

From closed cycles to ecosystems

The next generation of open banking models will further extend open banking services to enable third-party services and products to be released enabling TPPs to service customers with integrated and networked banking services known as value-added services.

As a rule, they use API platforms – similar to a marketplace – to deliver a set of bank functions. These banking APIs go well beyond the PSD2-like open banking APIs and open banks in all product areas, such as accounts, investment products or credit processes. This enables new digital service providers to network their applications and value chains with banks’ services, data and infrastructures. In this way, external third-party vendors become new channels between the bank and the customer, thereby scaling the reach of the bank.

Ecosystems are the last development stage of open banking. Banks will offer affiliated partner services to specific customer target groups, complementing their own digital offerings and creating true end-to-end financial services. Think smartphone App stores but for banking.

Whether a bank itself builds an ecosystem or cleverly links up with existing ones is up to each bank. With or without its own ecosystem, what a bank needs is an open banking platform that makes it super-easy to board partners. In an open world, the future is networked so it’s up to banks to make sure they have the right tools to connect.