UK fintechs best placed to ride out the Covid-19 crisis will be those involved in lending, argue recruitment specialists Robert Walters, reports Douglas Blakey

The unexpected market freeze is placing pressure on banks and financial services firms as borrowing, defaults and payment holidays are required en masse. With calls for banks to improve their digital offering, improve customer service and shake-up traditional methods of lending, the pandemic provides fintechs with the opportunity to prove their worth.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In addition, as normal restrictions on lending are waived to enable companies to ride out the crisis, artificial intelligence (AI) will play a key part in enabling the financial services sector to provide simultaneous support to thousands of businesses. And this at a rate far greater than the capacity of their current underwriting team.

As a result, AI-driven fintech lenders will be the biggest ‘winners.’ That is the key takeaway of the report entitled ‘Fintech: challenger to competitor’ published by recruitment consultancy Robert Walters.

The UK has one of the highest adoption rates of digital and online banking – growing by 32% in the last 10 years. Adoption rates of online banking in the UK were at an all-time high of 73% in 2019, with the majority of users accessing platforms via smart phones (64%) rather than over tablets (34%). The adoption rate is predicted to be significantly higher in 2020.

This trend coincides with an increase in the number of tech vacancies within banks. The percentage of tech vacancies in overall job roles advertised within banking increasing from 23% in 2017 to 30% in 2019.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

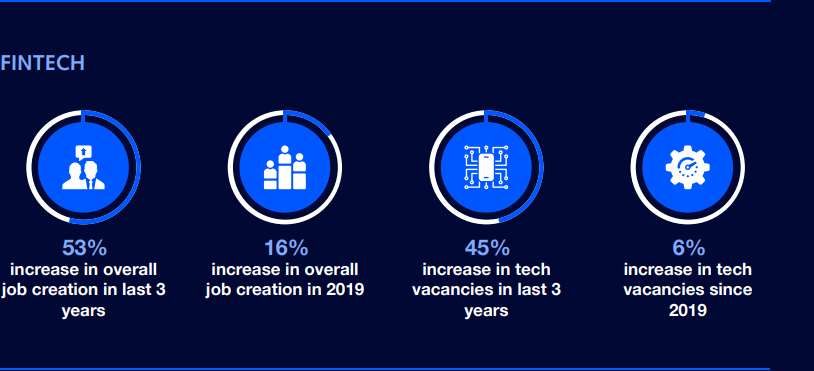

By GlobalDataDespite Brexit, the UK remains an attractive hub for fintechs. Growth of the sector can be illustrated by the ongoing increase in vacancies since 2018 – up +16% in 2019, and +53% since 2017.

Comparatively, tech roles within fintechs have grown at a slower pace, with volumes up +6% since 2019 and 45% since 2017. However, the percentage of tech vacancies in overall job roles advertised within the fintech sector has decreased by around 4% in the last year.

London v the regions

There has been significant growth outside the capital in banking and financial services, where tech vacancies have increased by +50% since 2017, and +7% in 2019. In London, tech vacancies within banking have increased by +23% over the past three years, but stagnated last year – growing by only +0.45%.

Traditional banks are taking advantage of the talent pool and cost savings available in regions outside of London – with job creation within banks for tech roles increasing by 50% in the last three years.

This jump in recruitment has resulted in the emergence of ‘tech hubs’ in Birmingham, Manchester, and Leeds – mirroring what we see in London’s Shoreditch. On the other hand, UK fintechs continue to recruit tech professionals in London. Specifically, London tech vacancies have increased by +31% since 2017. The concentration of VC funding in London is evidenced by the downturn in regional vacancies in 2019 compared to the previous year, with investment typically going into firms based in the capital.

For context, in 2018 there were 50 fintech deals of $1m or more within the UK, of which 45 were in London. In 2019, the number of investments had nearly doubled (96) yet only eight were into regional businesses (under 10%).

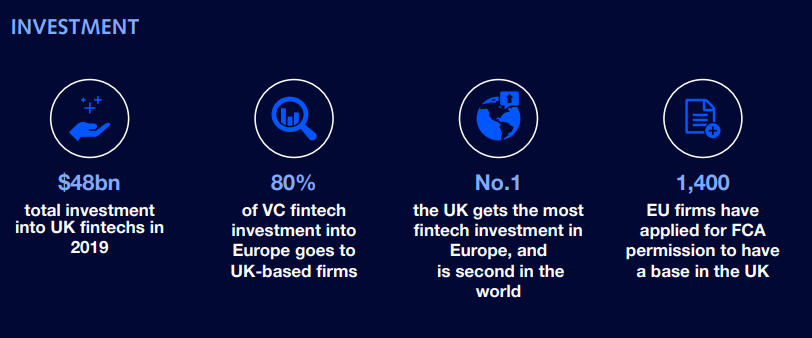

In 2019, UK fintechs attracted $48bn in funding – confirming the country’s position as the number one spot for fintech investment in Europe and second in the world.

Ben Litvinoff, Business Director at Robert Walters “In Q1 this year, UK fintechs generated almost as much investment as they did for the entire year of 2017 – highlighting the significance of 2020 for the sector.”

The UK continues to demand 80% of total VC fintech investment into Europe and is outstripping the USA when it comes to the growth of VC investment. In fact, over the past three years, fintech investment in the UK has grown explosively by 500%, with the USA expanding by 170% and Europe by 133% comparatively.

Job trends: UK banking

The number of people employed in traditional roles within the banking sector will continue to fall, concludes Robert Walters. At the same time, tech vacancies will continue to hold strong. Already, total employment in the industry has fallen in the UK by nearly 100,000 in the last five years.

Focusing on vacancies within financial services and banks over the last three years, the more traditional job roles have declined by -42%, while tech vacancies have increased by +46%.

It is important to note, however, that the decline in traditional roles refers mostly to those jobs that can be easily automated or offshored.