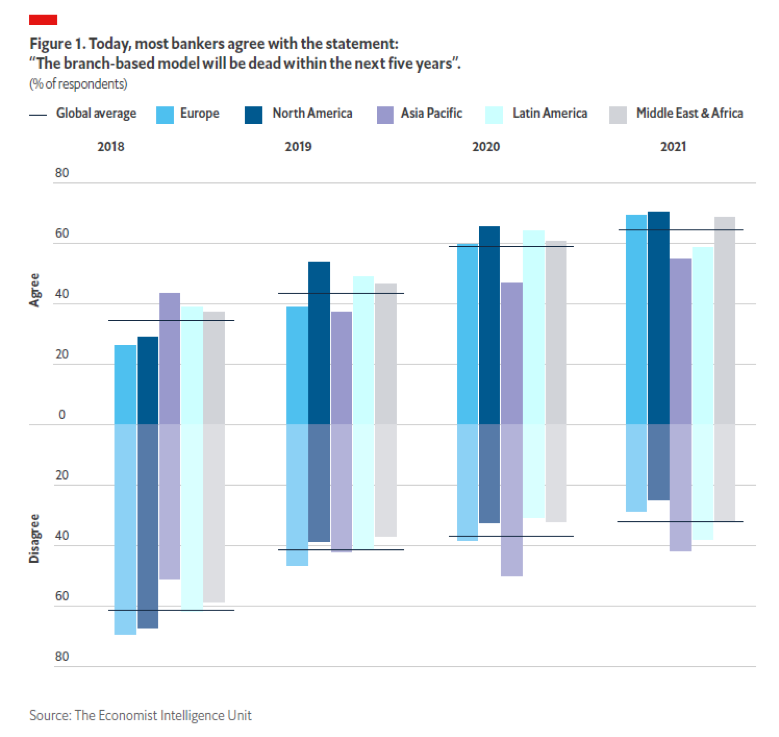

The physical bank branch has been suffering for some time now, and since the pandemic began, bank branch closures have accelerated significantly. But what does the future look like? Evie Rusman writes

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“Bank branch closures is a trend that we’ve been observing for many years and it’s a structural trend throughout the world, particularly in North America and Europe,” she says. “In Latin America and emerging Asia, this trend is not as mature.

“In the initial first instance, it was just lockdowns that prevented people from visiting branches and as a result banks were forced to rethink their operations.”

She continues: “Digital banking existed before the pandemic, but you always knew that for a complex transaction or to seek advice on a complex digital product, you could always drop in on the branch. But Covid meant that suddenly could not happen anymore, and therefore, banks had to adapt.

“Now, it is essential, banks ensure that even the most complex customer journeys and the most complex products, which were never originally meant to be sold or serviced digitally, have a digital equivalent.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Customer behaviours will endure

With excessive bank branch closures, there is a danger of isolating older demographics, who are unable to access online services. Although, according to Hope, several banks are offering tools to help the older generation “get comfortable with digital”.

For example, Hope says banks across China and Asia have launched online tutorials to help vulnerable customers. She also says they are providing direct support.

Hope further warns that the few bank branches left may be different to what we know them to be currently.

“The nature of the bank branch may change – there may even be co-located branches,” she says. “There are lots of ideas being thrown about and it may be that multiple different banks share a branch. Banks could even share space with supermarkets or department stores. The idea is that banks co-locate so they are still able to provide a physical in-branch service to help the vulnerable.”

“The other category of use cases is more internally focused, where banks are using AI and robotic process automation to optimise their own operations, their own ID their own back office, and their own efficiency. Efficiency is a very big driver of AI use.”

According to the report, the most common use of AI is in digital advisors and voice-assisted engagement channels.

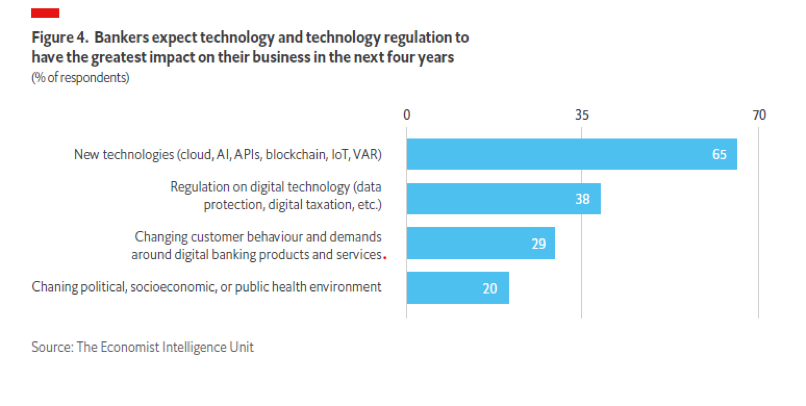

Although technology drives industry change, bankers are also mindful of the impact of its regulation—in data protection, digital taxation and the like. Regulation is the second most impactful trend that bankers identify in the sector.