Fintechs have been threatening to overthrow traditional incumbents for years but so far, have never really hit the mark. However, with fintechs now nearing profitability, could this be set to change? Evie Rusman writes

Intro: Capgemini’s World Fintech Report 2021 reveals that despite a volatile environment, the fintech sector reported 11% YoY deal activity growth in Q4 2020, after four consecutive years of decline. This is promising as 2020 has proved to be one of the toughest years in recent times, not only for financial services but across all sectors.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The report also shows that fintechs with a diverse product portfolio are the ones winning investor backing.

As a result, banks are moving quickly to create digital-only entities in a bid to attract specific customer segments.

Speaking on this, Anirban Bose, CEO of Capgemini’s Financial Services discusses how it is essential for banks to invest in digital to remain relevant.

He says: “Fintech-inspired digital journeys need to become crucial strategic paths for banks across the board. However, players need to be sharp and specific as they move. There is no one-size-fits-all approach, and banks cannot create all digital subsidiaries equally.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBose adds that players capable of achieving long-term growth and profitability today will be tomorrow’s Fintech-era success stories.

Fintechs remain vulnerable

Despite remaining resilient throughout the pandemic, fintechs also experienced a number of challenges. For instance, many faced increased platform downtime, high rate of unsuccessful transactions, and increased costs relating to staffing, onboarding, and data storage.

Capgemini’s research shows that more than half (51%) of fintechs expect their capital reserves to be affected as costs related to staffing, onboarding, and data storage surged during pandemic lockdowns.

Furthermore, consumers continue to put more trust into traditional banks over the newer players.

According to Capgemini’s Voice of Customer survey, more than three quarters of respondents trust their primary bank to support their financial needs and offer advice. They are also not considering switching to a new financial institution. In addition, 68% are willing to try a digital-only bank operated by their primary bank.

Investing in fintechs

However, it is not all doom and gloom as more and more investors are supporting mature fintechs.

Theadora Lau, founder of Unconventional Ventures in the US, says: “2021 is shaping up as a busy year in the fintech funding landscape. There is sustained interest among investors for big rounds and mature start-ups.

“On the other hand, increased crowdfunding from retail investors could lead to underrepresented demographics being more included in the innovation ecosystem, bringing in fresh perspectives from idea generation to funding and execution.”

Capgemini argues that the market is slowly becoming crowded with commoditised offerings versus proposals for unique services. It is the idea that an investor is less likely to fund an early-stage start-up when a more mature fintech can fill a market gap.

“Increasingly, investors are supporting mature fintechs with a keen understanding of unique large-market issues, having a diverse product portfolio and a sustainable business model,” the report notes.

For example, UK challenger Revolut entered the market with multicurrency payment services but now offers crypto trading, brokerage services, and deposit and savings accounts. The report highlights that adding new services helped the fintech secure $500m in funding in February 2020.

Journey to profitability

Last year, challenger bank Starling was the first digital-only bank to reach profitability in the UK, achieving £0.8m profit in October 2020. In the months since, Starling has continued to turn a profit.

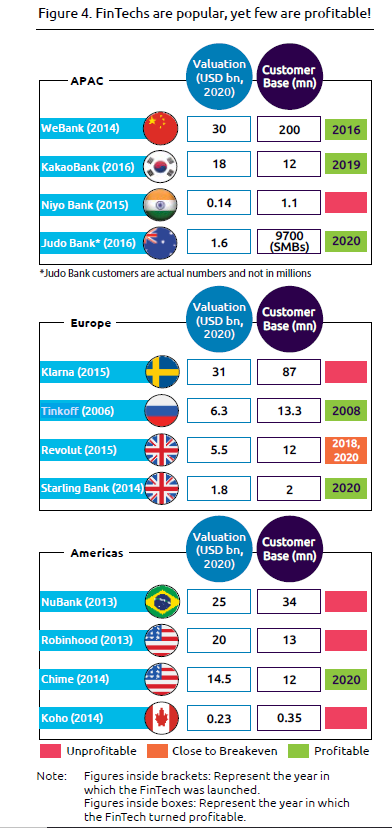

Other standouts when it comes to profitability include Russia’s Tinkoff Bank and South Korea’s KakaoBank.

Tinkoff Bank first achieved profitability in 2008 and now has a valuation of $6.3bn. Meanwhile, KakaoBank is valued at $18bn, first achieving profitability in 2019.

Aside from success stories, such as Starling Bank and Tinkoff, most fintechs in general are still waiting to turn a profit.

Capgemini cites weak monetisation, anemic product penetration and low use hamper profitability as the main reasons challengers struggle.

For example, the per-customer acquisition cost for UK challenger Monzo is $65, much lower than incumbents who spend around $250 per customer. Furthermore, Monzo’s unit economics only garner $24 per customer, whereas traditional banks can generate up to $800-900 per customer.

Capgemini has identified four steps to help fintechs reach profitability:

- Diversify offerings to build a profitable customer base – Successful fintechs start their maturity journey by first expanding their product portfolio within their initial markets. By prioritising a handful of viable products to solve customer issues, fintechs are more likely to attract a strong customer base.

- Orchestrate an ecosystem or join multiple ecosystems – Ecosystems can help fintechs transition from just another banking app to a hub central to customer lifestyles. For instance, by collaborating with different players, a fintech can offer various new products and services.

- Monetise via 360-degree approach – fintechs can diversify their revenue streams by adopting pricing strategies. Strategic pricing models aim to increase returns and earn the maximum potential value per customer. They also reduce a fintech’s reliance on interchange fees.

- Expand into new markets to maintain growth and momentum – Geographical and market expansion is the next step as fintechs scale and begin to break even. To do this, Capgemini suggests fintechs explore different entry modes and map out how to sustain competitive advantage in the new market. An offering similar to their home turf may not resonate with consumers in the new market.