Despite a growing and significant body of thought leadership on Environmental, Social and Governance (ESG), it remains an area many executives are grappling with, concludes Strategy&, PwC’s global strategy house in its report entitled ESG & Banking: A chance to rethink strategy, reports Douglas Blakey

PwC UK’s 24th Annual CEO Survey shows that organisations are increasingly focusing on purpose and sustainability. This year, 70% of CEOs report that they are now concerned about climate change, compared with just 44% in 2019.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

ESG encompasses some 12 broad areas that impact banks big and small. The ‘E’ in ESG incorporates climate change, pollution, biodiversity and natural resources. S for social ranges across human rights, diversity and inclusion, health and safety and community impact. G for governance takes in corporate structure, risk management, corruption and bribery and ethics.

But first off, it is timely to dispel a number of myths as regards ESG. The first is that consumer concern remains the preserve of the younger generations among a liberal minded metropolitan elite. Not so. PwC notes that contrary to popular belief, older segments are even more concerned than millennials. A PwC survey of UK consumers finds that 67% of respondents want businesses to operate sustainably, by minimising their environmental and social impact.

This is also supported by a UNDP/University of Oxford survey of 1.2 million people globally, with 81% of UK people saying we face a climate emergency.

Separate consumer research undertaken by GlobalData notes that the importance of ethical/environmentally responsible strategy often influences 23.7% of the boomer generation. For Generation X, the figure is almost the same, at 25.5%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

ESG is in no way a new concept

A second myth that needs to be dispelled is that ESG is something of a novelty, that banks have not grappled with the issue until recently. Or that environmentally themed products are in any way a recent innovation.

Dutch bank Triodos launched as long ago as 1980 and has a presence in six Western-European markets. Triodos rolled out the first green fund in Europe in 1990. But it was not until 2006 that it launched its first current account and its first green mortgage debuted in 2012.

It remains a small, niche player but reported 20% growth in current account holders in 2020 while also posting a 22% growth in deposits, and 10% growth in assets under management based on net inflows of 8%.

On an entirely different scale, fellow Dutch lender ING is also not coming late to prioritising its ESG strategy.

ING has been a leader in carbon neutrality since 2007. ING has been a member of the UN Environment Program Finance Initiative since 2007. It was the first major Dutch organisation to be 100% carbon-neutral and the first major international retail banking group. The bank now plans to procure 100% of renewable electricity for all the buildings it operates by 2020, slightly easier for a bank whose hallmark is a lack of branches outside of its home markets.

Remaining with the incumbent larger banks, take credit cards for example.

Many charities have linked up with branded cards, giving card holders the opportunity to flash their values when they flash their plastic. Nature Conservancy says its Bank of America affiliate card has generated $13m over nine years for its programmes.

More recent examples of green retail banking products include Bank Transylvania offering a green mortgage in December 2020 with a 5% discount on standard rates.

DBS rolls out green car loan product

And in February 2021, DBS launched Singapore’s first green car loan in February 2021. DBS’s Green Car Loan provides a 1.68% (APR) car loan to all customers purchasing new and used electric and hybrid vehicles. It’s the lowest rate car loan in Singapore at launch. In addition, DBS will donate a tree planting towards NParks’ OneMillionTrees initiative. The product positions the bank as a leader in the EV market ahead of the government’s phasing out of ICE vehicles.

More stakeholders to manage

More stakeholders to manage Banks are no longer answerable just to shareholders but a new set of stakeholders: customers, employees, suppliers, communities, the press and regulators. These broader and more vocal groups are increasingly interested in how ESG drives corporate performance.

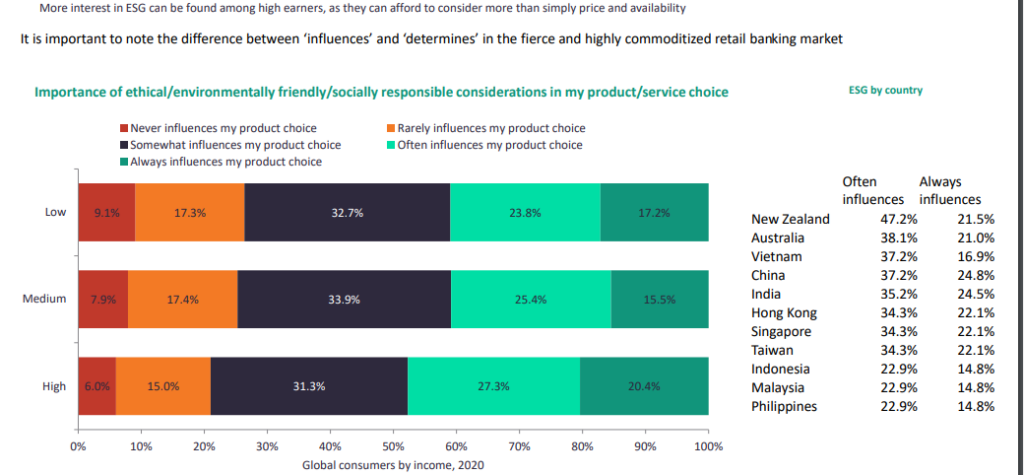

There is however evidence that ESG matters more to consumers who have choice. GlobalData research notes that the more interest in ESG can be found among high earners, as they can afford to consider more than simply price and availability.

It is important however to note the difference between ‘influences’ and ‘determines’ in the fierce and highly commoditised retail banking market.

What more should banks be doing?

If there is a general consensus that ESG continues to rise up the ladder as regards C-Suite priorities, what more can banks do? PwC argues that many lenders can do to set out practical initiatives to embed ESG into business and operating models.

PwC says that leaders should consider their level of ambition, overall and for each sub-element, against the expectations of those stakeholders who matter most to the long-term viability of their businesses.

Should they view ESG as an opportunity to re-align their market participation strategy with major long-term customer trends, for example supporting the transition to a low carbon economy. How ambitious a bank is on ESG will determine whether they develop an ESG strategy that complements their existing corporate strategy, on the side, or develop a new, ESG-aligned corporate strategy.

Moreover, banks will need to be pragmatic in executing and rolling out initiatives, communicating timely progress and outcomes to stakeholders. While some initiatives will be more short-term focused, often driven by regulatory timelines, others may require a multi-year phased approach. Success will be influenced by the tone at the top of organisations and a ‘critical few’ behaviours that can enable a purpose-orientated culture.

Changing competition, with winners and losers

ESG could be a point of differentiation or a source of cost, particularly where it is not aligned with a bank’s corporate strategy. While some may be able to meet stakeholder needs and achieve attractive returns, others may experience an increase in costs without the impact they expect. Others still may not act on ESG, avoiding the costs but seeing revenues reduce and risks increase over time.

Meantime, GlobalData senior analyst Andrew Haslip argues that Covid has boosted the prominence of ESG in all aspects of consumers’ lives, including banking. The enduring importance of ESG over the course of 2020, from initial lockdown to the end of the year, suggests a permanent change.

Haslip concludes: “Adopting ESG principles needs to be embedded in the structure and operation of the bank as a corporate entity. No one will buy a green mortgage from a bank that has poor labour relations and a large carbon footprint and that is known for cutting small-town bank branches.”