Data analytics has made monitoring customer demands and trends significantly easier; however, many banks are failing to fully utilise the information in their own databases. Briony Richter looks at new research by Cornerstone Advisors

A research paper by Cornerstone Advisors, commissioned by analytics firm Cubeiq, looks at how banks are not using key pieces of information that could help them improve marketing and customer loyalty.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Areas such as where else customers bank, what they spend their money on, or how long their commute to work takes are all valuable pieces of information, and banks are missing out on it.

Leveraging data

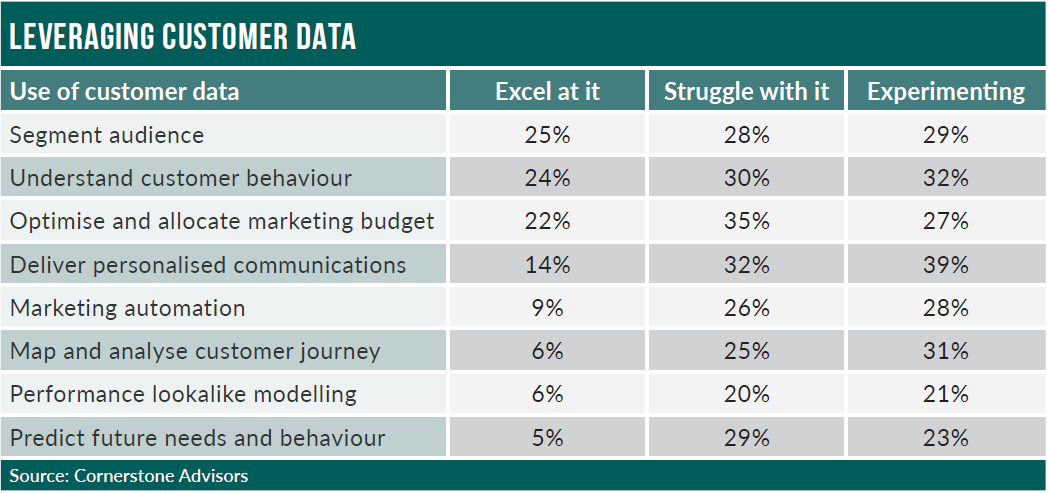

It is clear that banks do not make the most of the data they have. The report found that while 14% of banks say they use data to deliver targeted communications, nearly a third struggle to do so.

Only 6% of banks think they excel at analysing customer journeys, while three in ten are just beginning to experiment in this area. By designing personalised product offerings, banks can potentially create more meaningful customer relationships. The data can be used to identify customer trends and, if harnessed correctly, will significantly improve marketing results.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMobile location data is not just about pinpointing where a customer is; it reflects how frequently consumers visit a given location, how long they stay there, what they purchase and where they go next. The report noted that banks and financial institutions rarely issue all the credit cards their customers have. Therefore, many do not have accurate data on where the customer’s money is going. Many customers receive better offers from other banks, despite being long-term customers to one.

Competitive intelligence

Customer segmentation enables banks to better target their customer base with relatable marketing campaigns tailored to their requirements.

The report found that 55% of Bank of America (BofA) customers visited JP Morgan Chase branches in March 2017, with fewer visiting in April and August. Furthermore, the number of BofA customers that visited PNC consistently increased throughout the year. This could be because Chase and PNC were offering better deals to consumers, making them less willing to go to BofA for those particular products or services.

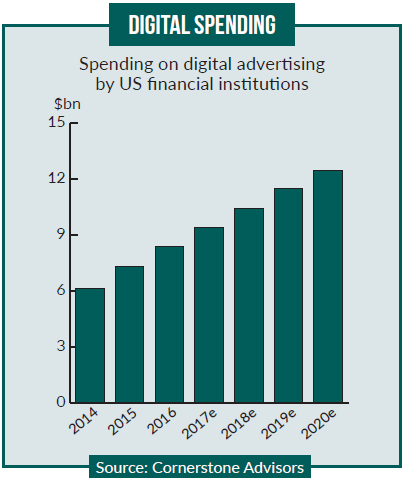

Digital spending

Although banks and other financial institutions can fall short in terms of efficient use of data, they do see the importance of digital channels to improving marketing success. According to the report, in 2016 financial institutions spent over $8bn on digital advertising. This figure is expected to increase by 50%, a CAGR of 11.2%, to more than $12bn in 2020. Some 62% of the money spent in 2016 was allocated to the mobile channel.

Despite this, many marketers are not investing enough in mobile-related consumer data. The report noted that spending on customer data – which accounts for just 2% of a typical bank’s marketing budget – increased by 5% between 2014 and 2015, far below the 19% rise in digital advertising over the same period.

Overall, the report found that banks are not taking advantage of all the available consumer data they have through mobile channels. This risks leaving customers to go elsewhere to find a bank that can provide services that cater to their specific needs.

To survive in an ever-increasing digital world, it is vastly important that banks and financial institutions harness the data they have available. Not only will it strengthen their existing customer base, but it will attract new customers as well.