UK banking sector tax receipts rose by 5.7% y-o-y in the financial year to the end of March 2023. Specifically, the sector contributed £41bn to the UK Treasury for the fiscal, 4.6% of all government tax receipts.

This is comprised of £22.1bn in taxes borne including corporation tax and the bank levy. £18.9bn is derived from taxes collected (including income tax and employee national insurance). Taxes borne are a business cost and therefore directly affect a firm’s financial results. Taxes collected are generated by a firm’s operations but collected from others and reflect the wider economic contribution generated by the banking sector. Total employment taxes were £22.9bn, equivalent to 5.8% of all UK employment tax receipts. This reflects the large number of highly skilled workers employed in the banking industry across the UK.

International comparison

UK Finance’s banking sector tax report, prepared by PwC, compares the UK’s current and projected tax levels relative to other leading global financial centres.

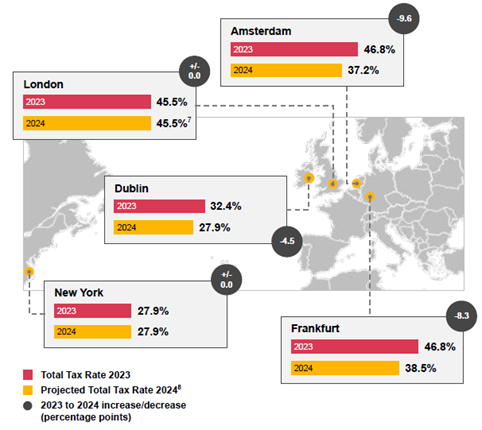

For 2023, London has a total tax rate for a typical corporate and investment of 45.5%. That is higher than New York (27.9%) and Dublin (32.4%). It is however slightly lower than Frankfurt and Amsterdam (both 46.8%).

Looking to 2024 the UK is forecast to have a notably higher total tax rate compared to these other jurisdictions.

This is because the European Single Resolution Fund (SRF) is scheduled to have reached its target level in 2023. The contributions to the fund in Germany, the Netherlands and Ireland are expected to reduce substantially, possibly to zero.

That would result in total tax rates of 38.5% in Frankfurt, 37.2% in Amsterdam and 27.9% in Dublin.

The rates in London and New York are projected to remain unchanged. This means the total tax rate in London could be 7 percentage points higher than in Frankfurt, the location with the second highest rate.