The latest Xinja capital raise is targeting retail and mass affluent investors.

Specifically, the offer is open to participants with a minimum of A$20,400 ($13,500) to invest.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Xinja has raised A$70m through Series A, B, C funding rounds and the first 40% of Series D.

This includes two equity crowdfunding rounds, in January 2018 (Australia’s first ever equity crowdfund) and January 2019.

Xinja: Stash deposits top A$300m in 7 weeks

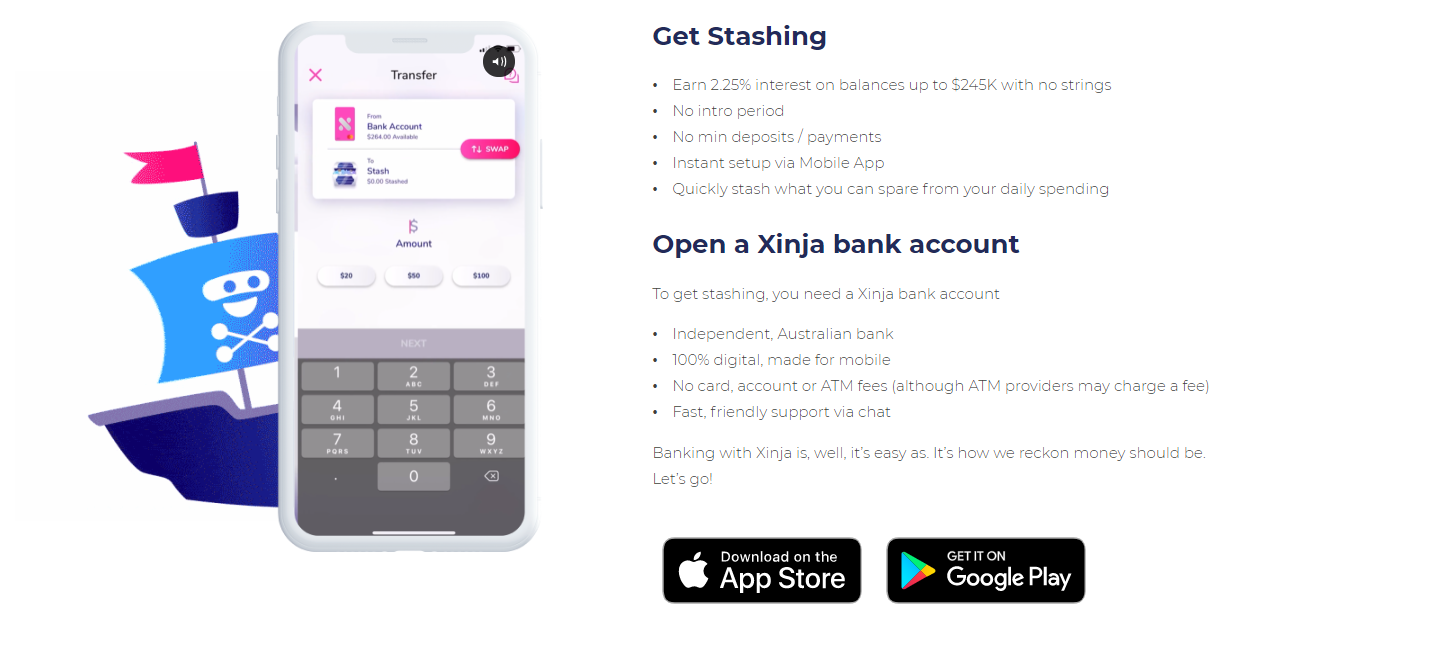

Australia-based digital neobank Xinja launched its Stash high interest savings account on 15 January. Within seven weeks of its launch, the account offering 2.25% on savings attracted more than A$300m million in deposits.

Local digital neobanks Xinja, Volt, 86 400 and Up all offer rates between 2.15% and 2.25%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataXinja now has 25,000 customers and more than 41,000 accounts.

“This is a massive response from customers,” says Xinja Bank founder and chief executive Eric Wilson.

“It’s a big vote of confidence in Xinja’s style of banking. People expect seamless technology in almost everything they do daily: from ordering food, to booking holidays or a ride home. Xinja is in that category. We have built a bank from scratch. The technology is intuitive and fun, and offers a better way to bank.”

Xinja capital raise: shares priced at A$4.08

The series D funding round prices the Xinja Bank shares at A$4.08 a share.

The 1,220 investors in the first crowdfunding bought shares at A$1.25 each. A year later, in January 2019, Xinja issued shares at A$2.04 each. This attracted another 1500 investors, with a minimum parcel of A$255 for each investor.

Xinja obtained its full banking licence last September having obtained a restricted licence in 2018.

Meantime, local digital rival Judo Bank is just ahead in terms of retail deposits with almost A$500m. Including business deposits, Judo Bank topped A$1bn in deposits during January.