The large US retail banks have all now reported their second quarter earnings. The results were generally positive. Citi, for example, beat second quarter analyst forecasts with revenues ahead by 8% y-o-y and net income up by 25% y-o-y. This resulted in the Citi share price hitting heights not enjoyed since the 2008 financial crisis. Meantime, JPMorgan Chase also beat forecasts and raised its net interest income forecast for the full fiscal after especially strong results in investment banking and trading.

It was a similar story at Bank of America, with results also ahead of forecasts and revenues and net income rising by 4% and 7% respectively.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

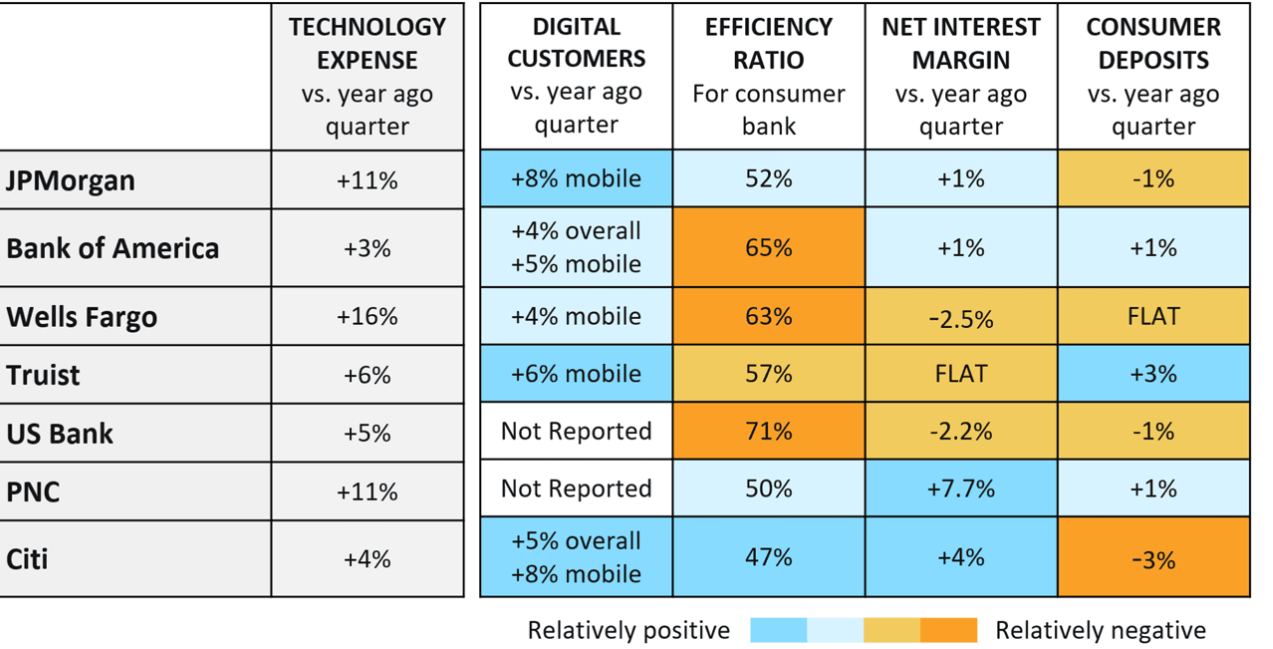

A common theme within all of the banks earnings presentations is the positive benefits enjoyed by the banks as they realise tech-driven efficiency gains, with more to come from AI.

Bank of America highlighted, for example, that nearly 80% of consumer households are now fully digitally engaged, with 65% of its consumer product sales conducted digitally.

The success of the banks tech investments are examined in a flash report from Celent’s Michael Bernard, senior analyst, retail banking, details of which are available via this link.

Bernard notes that sustained consumer strength, increased digital engagement, and in many cases, continued expense reductions, all boosted the second quarter earnings.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataChallenges remain

On the other hand, interest rates are still “high-ish” and in a holding pattern, putting pressure on deposit costs. The home lending market remains cool, limiting the ability to capitalise on widening net interest margins. With these factors providing constraints to top-line growth, expense efficiency has become a primary focus for most.

In this flash report, Celent evaluates the public presentations and earnings calls from seven of the largest US banks through three lenses:

- Balancing digital and human support

- Metrics for digital customer engagement

- Value of technology to the franchise

Celent concludes that most banks are seeking and achieving operational efficiencies through prior technology investments.