NatWest is to deliver the UK’s first SONIA loan alternative to a LIBOR loan.

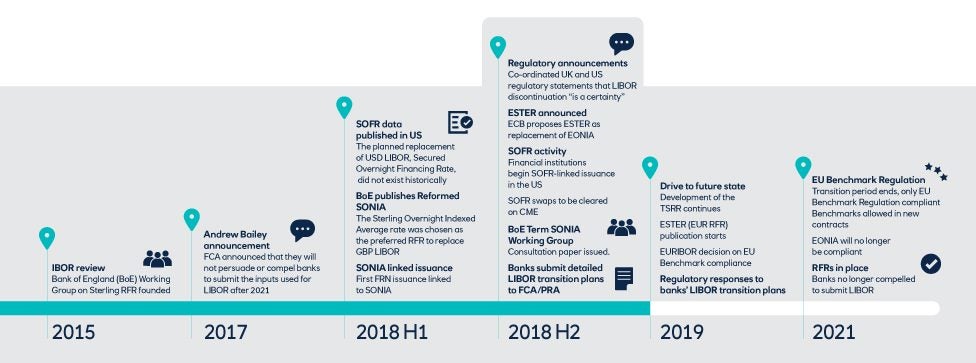

The Financial Conduct Authority wants banks to transition away from loan products that use the London Interbank Offered Rate. In particular, the FCA wants banks to move towards Risk-Free Rates (RFRs) by the end of 2021.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Instead, NatWest’s new loan uses the Sterling Overnight Index Average (SONIA) rate.

The NatWest SONIA loan will be piloted initially with a limited number of large corporate customers.

NatWest says that the new SONIA loan rate is based on transactions carried out in the market the day before. Thus it gives customers a more transparent, data-led benchmark.

NatWest’s new bilateral facility is a first for the UK market as well as for the bank. It uses methodology already seen in the Sterling Floating Rate Note issuance market, including compounding of interest.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“The FCA has made clear that it wants to see early adoption of the SONIA rate in all financial markets. As the UK’s biggest lender to businesses, we are committed to helping lead the development of SONIA-based lending. And we are committed to supporting our customers through the transition away from LIBOR,” says Alison Rose, deputy CEO NatWest.

SONIA loan: planning for LIBOR transition

The bank expects to launch the SONIA loan product to the wider market in the second half of 2019.

Interbank Offered Rates (IBORs) are expected to be replaced by new RFRs across the global financial markets. There is considerable work being done across the industry to develop new Risk-Free Rates.

Work is also underway for the replacement of other global IBORs.