Current account switching is down by 65% in the second quarter as a result of the Covid pandemic and social distancing.

Specifically, some 98,192 UK current account switches took place in Q2 2020,182,328 fewer than in the first quarter.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

On the other hand, awareness and satisfaction of the service remain consistently high, at 81% and 92% respectively.

Moreover, the switching service retains its impressive seven-day switching success rate of 99.5%.

In addition, of those who switched using the service over the past three years, 83% would recommend it.

In Q2 consumers favoured new accounts with improved customer service and digital banking rather than better rates and lower charges.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor example, the most commonly cited reason for favouring a new account is improved online banking facilities at 43%.

Better customer service (38%) and preferable mobile banking systems (36%) follow ahead of better interest rates (28%).

The next most popular reasons to switch are currently better interest rates (28%) and preferable account fees or charges (23%).

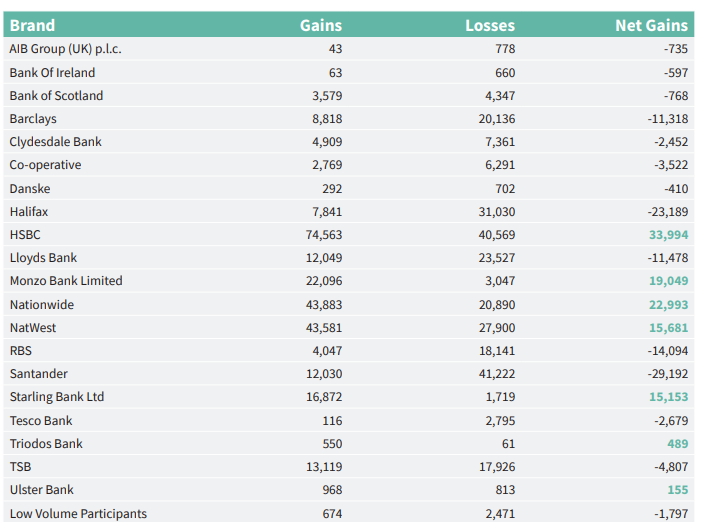

UK current account switching: winners and losers

Current account switching data by brand is reported three months in arrears. As a result, the most up to date switching data for the 49 participating brands relates to the quarter ending March 2020.

In the first quarter, HSBC has the largest net switching gains with almost 34,000 net new accounts.

Nationwide (+23,000 net switches) ranks second ahead of Monzo (+19,000 net switches) NatWest and Starling.

At the other end of the scale, Santander is the biggest loser with a net loss of over 29,000 switches.

Santander has suffered a reversal of fortune since scaling back the benefits of its 123-current account.

For example, back in the third quarter of 2015 Santander ranked top for net account gains with +51,000.

Halifax has a net loss of over 23,000 switches away to rivals with RBS down by 14,000.

Looking ahead, the proportion of consumers considering switching is unchanged from last quarter at 13%. In addition, some 15% of current account are thinking about switching.