As ever, the quarterly UK current account switching statistics are a must read. Taking the positive metrics first:

- In the fourth quarter of 2025, the Current Account Switch Service reported some 350,114 switches, the busiest quarter of the year.

- 2025 is the third year in a row with total switches across the sector in excess of one million for the full year.

- The service averaged a seven-day switch completion rate of 99.2% in Q4 2025 and public awareness levels were 77%. An overwhelming majority (93%) of switchers who used the Service in the last three years said they were satisfied with the process, and 91% would recommend it.

- The switch service, administered by PayUK, has now recorded 12.4 million switches since its launch in September 2013.

On the other hand, switching for calendar year 2025 is down by 11.4% year-on-year compared with 1,190,676 switches in 2024. Moreover, the 2024 figure represented a sharp drop of 18% from the 1,457,165 switches reported in 2023, a record year for switching.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Nationwide: In a league of its own

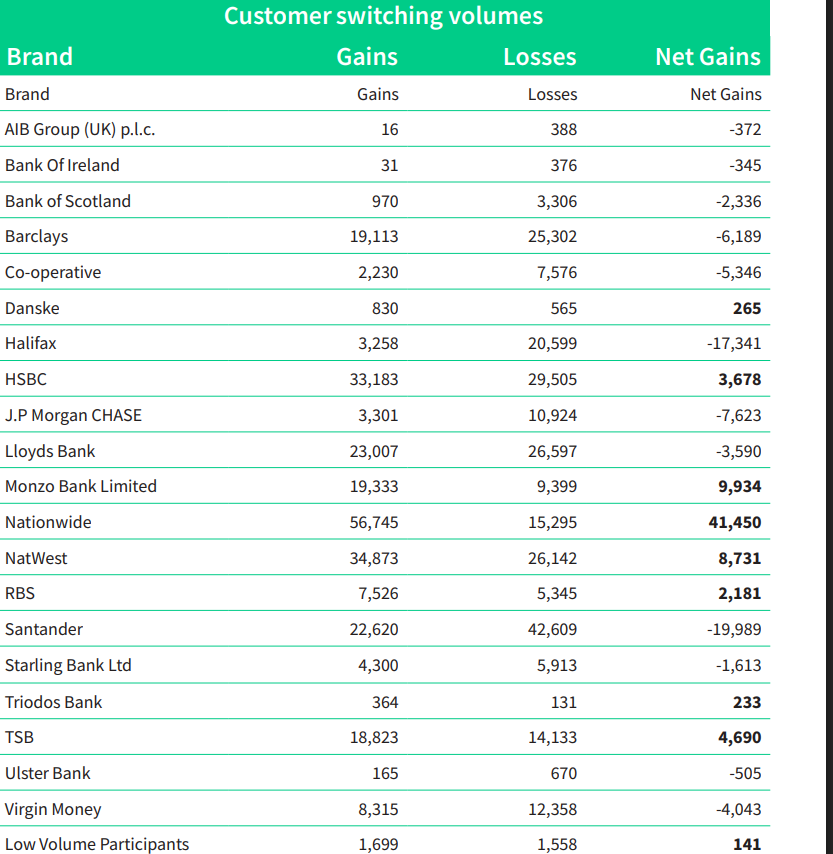

Brand-by-brand end-user data is reported three months in arrears. This means that the latest data released covers brand-by-brand switching data for the three-month period between July and September. Once again, Nationwide had the highest net switching gains for this quarter (41,450) in a league of its own, ahead of next best Monzo (9,934) and NatWest (8,731).

In the previous four sets of quarterly stats by brand, Nationwide was top for net switching gains for the periods covering the third and fourth quarters of 2024 and the first two quarters of 2025.

In Q125, Monzo was the first neobank to feature in the top three for switching gains since 2022 and it continues to lead for switchers among the digital neobanks.

At the other end of the table, Santander reports the highest net losses for the three months to end September (-19,989). Santander was also bottom in the end-user brand-by-brand stats for the three months to end June (-23,015).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Source: PayUK; switches-net gains/net losses by brand for the period July-September 2025