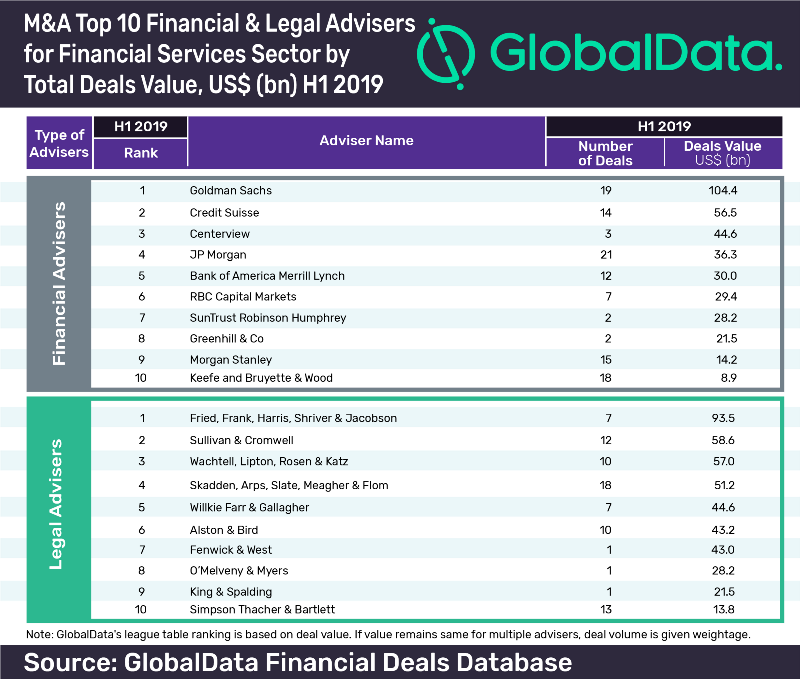

Goldman Sachs has topped the latest mergers and acquisitions (M&A) league table of the top ten financial advisers in the financial services sector in the first half (H1) of 2019, according to GlobalData.

The US-based multinational investment bank secured the top spot based on the total advised deal value of $104.4bn. However, in terms of deal volume, it came second behind JP Morgan with 19 deals.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It figured in the first position in the GlobalData’s global league table of top 20 M&A financial advisers for H1 2019.

GlobalData has published a top ten league table of financial advisers ranked according to the value of announced M&A deals globally. If value remains the same for multiple advisers, deal volume is given weightage.

Credit Suisse and Centerview came in second and third positions, advising on deals worth a total of $56.5bn and $44.6bn, respectively.

Nagarjun Sura, financial deals analyst at GlobalData, says: “The $43bn merger of Fidelity National and Worldpay and the $28.2bn merger of BB&T and SunTrust Banks were instrumental in determining the financial services H1 2019 league table. Eight out of the top ten financial advisers and nine out of the top ten legal advisers took part in these high value transactions.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe financial services sector saw a decline of 7.5% in deal value from $236.5bn in H1 2018 to $218.8bn in H1 2019. Deal volume, however, grew by 31.72% from 1,658 in H1 2018 to 2,184 in H1 2019.

US-based Fried, Frank, Harris, Shriver & Jacobson led the top ten legal advisers table for H1 2019 with a value of $93.5bn through seven deals. Sullivan & Cromwell stood a distant second with $58.6bn through twelve deals. In the global league table of top 20 M&A legal advisers, Fried, Frank, Harris, Shriver & Jacobson was ranked five. The global league table was led by Wachtell, Lipton, Rosen & Katz.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website