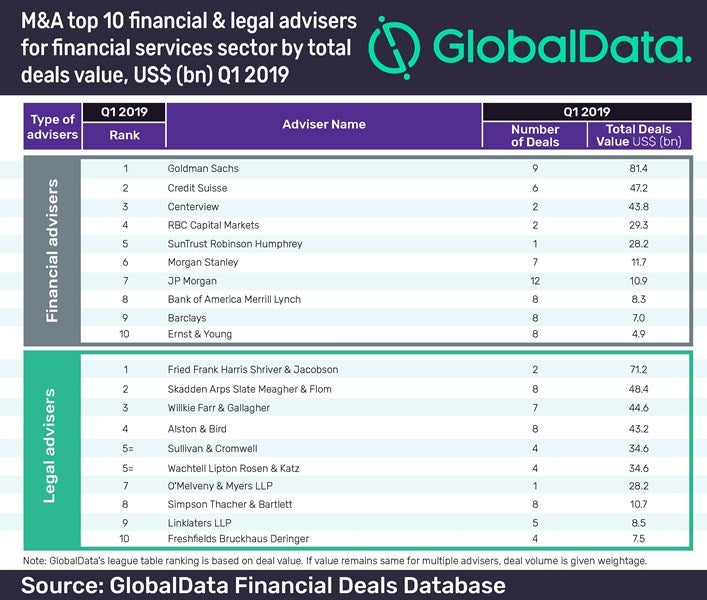

Goldman Sachs was the leading financial adviser globally for mergers and acquisitions (M&A) in Q1 2019 in the financial services sector, according to GlobalData.

The top spot was secured based on the total advised deal value of $81.4bn. However, in terms of deal volume, it came second behind JP Morgan with nine deals.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

It figured in the second position in GlobalData’s Q1 2019 ranking of top 20 financial advisers for global mergers and acquisitions.

GlobalData has published a top ten league table of financial advisers ranked according to the value of announced M&A deals globally. If value remains the same for multiple advisers, deal volume is given weightage.

Credit Suisse and Centerview came in second and third positions, advising on deals worth a total of $47.2bn and $43.8bn, respectively.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRavi Tokala, financial deals analyst at GlobalData, said: “Goldman Sachs emerged as the top financial adviser in the financial services sector, mainly driven by its involvement in two big-ticket deals – merger of Fidelity National and Worldpay for $43bn and BB&T and merger of SunTrust Banks for $28.2bn. Though JP Morgan advised on the highest number of deals among the top 10 advisers, it remained at seventh position in value terms due to its involvement in low-value transactions.”

The financial services sector saw a rise of 38.8% in deal value, from $101.1bn in Q1 2018 to $140.3bn in Q1 2019. Deal volumes too complemented, with a growth of 41.3% from 760 in Q1 2018 to 1,074 in Q1 2019.

US-based Fried Frank Harris Shriver & Jacobson led the top ten legal advisers table for Q1 2019 with a value of $71.2bn through two deals. Skadden Arps Slate Meagher & Flom stood a distant second with $48.4bn through eight deals. In the global league table of top 20 legal advisers for Q1 2019, Fried Frank Harris Shriver & Jacobson was ranked five. The global league table was led by Kirkland & Ellis.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website