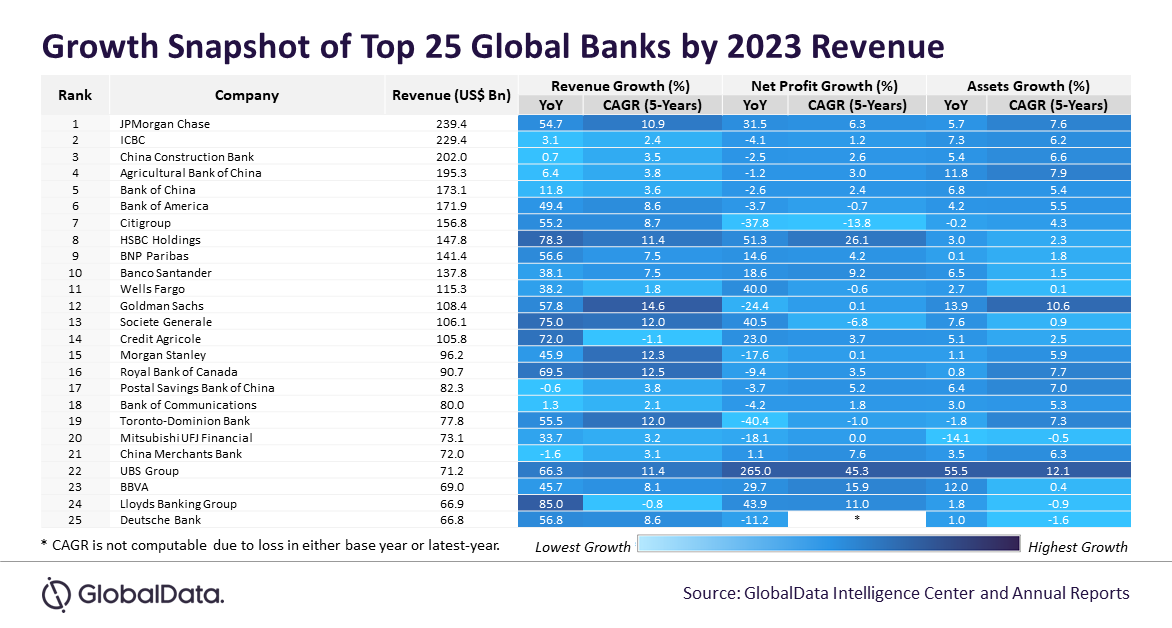

Despite facing inflationary challenges and operating in a high interest rate environment, most leading global banks performed exceptionally well last year. The top 25 global banks experienced year-on-year (year-over-year) top-line growth of 33.3% and a 5.1% increase in total assets in 2023, reports GlobalData, publishers of RBI.

Top performers: Lloyds, HSBC and Société Générale

Most of the top 25 banks reported y-o-y growth in their top-line performance, with Lloyds Banking Group and HSBC emerging as top performers, posting a growth of 85% and 78.3%, respectively. Société Générale also registered a growth of 75%.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Murthy Grandhi, Company Profiles Analyst at GlobalData, said: “Lloyds Banking Group experienced a £38,036 million increase in its net trading income, helping the firm to make a turnaround from a previous loss of £19,987 million in FY2022 into a gain of £18,049 million in FY2023. Its interest income also increased by 59%, driven by stronger margins and higher average interest-earning assets. This growth included expansions in the open mortgage book, retail unsecured loans, and the European retail business.”

Similarly, HSBC achieved a significant 90.9% growth in interest income, driven by the impact of higher market interest rates. Additionally, its net income from assets and liabilities of insurance businesses, including related derivatives, measured at fair value through profit or loss, reached $7.9bn in FY2023. This marks a significant turnaround from a net expense of $13.8bn in FY2022, driven by favourable movements in debt securities and equities, particularly in portfolios in Hong Kong and France, due to changes in interest rates.

Another bank to deliver outstanding results was Société Générale, which reported a significant 72.7% growth in interest income driven by a 47% rise in customer loans and deposits and a 67.3% increase in non-interest income driven by a rise in securities and primary market transactions.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataRevenues boosted by margin gains and equity markets

Grandhi added: “Despite the ongoing macroeconomic challenges, the banks demonstrated resilience and achieved robust revenue growth, primarily attributed to a notable increase in interest income, thanks to higher interest rates and booming global equity markets.”

In contrast, China Merchants Bank suffered a 2.1% decline in fee and commission income, owing to a decline in income from wealth management, asset management, and bank card fees. The bank also faced challenges such as insufficient effective credit demand and the continued downturn in the Chinese capital markets.

UBS and HSBC exhibited impressive profitability growth over the past five years, with a compound annual growth rate (CAGR) of 45.3% and 26.1%, respectively. On the contrary, Citigroup and Société Générale experienced a decline in profitability, with a negative CAGR of 13.8% and 6.8%, respectively.

UBS achieved a significant y-o-y growth of 55.5% in its total assets. This notable increase was primarily propelled by the acquisition of the Credit Suisse, which contributed $604.1bn. Conversely, Mitsubishi UFJ Financial Group’s total assets experienced a 14.1% decline, with reduced loans and bills discounted being the contributing factor.

Grandhi concluded: “Among the top 25 banks by revenue, only UBS and Goldman Sachs reported a 10% CAGR in total assets over the past five years.”