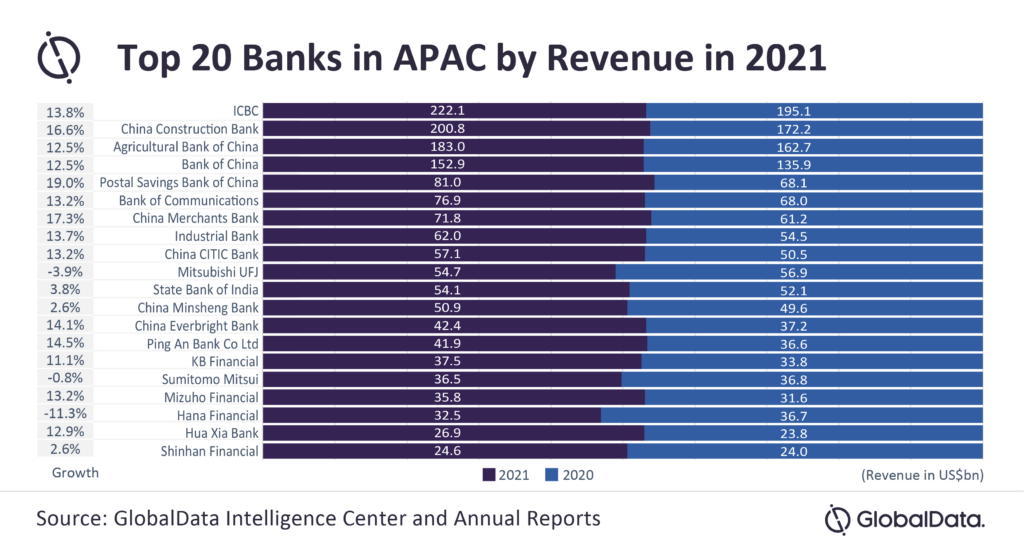

Most of the top 20 banks in the APAC region posted a huge growth in their revenue stream, with their total revenue jumping by 11.4% to $1.5tn given that economic activities almost touched pre-Covid-19 levels in 2021, stated GlobalData, a leading data and analytics company.

In terms of revenue, China continues to take the lead in the list of the top 20 APAC banks with 13 banking institutions, followed by Japan (3), South Korea (3), and India (1).

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The region’s 14 banks reported double-digit revenue growth, of which 12 were from China.

Among the prominent players were Postal Savings Bank of China (PSBC), China Merchants Bank (CMB), and China Construction Bank (CCB), which posted over 15% growth.

PSBC’s remarkable growth was due to 8.5% growth in interest income, 29.4% rise in fee and commission income, and 45% rise in net gains on investment securities.

CMB and CCB also witnessed increase in their interest income, fee and commission income, net trading gain, and net gain from investment securities.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData company profiles analyst Parth Vala said: “Over the past year, Chinese banking sector’s outstanding balance of loans to micro and small enterprises grew by 17% from CNY42.7tn to CNY50tn. The assets of large commercial banks went up by about 8% annually. Growing loan book along with stable asset quality (NPL of 1.7%) enabled the sector register a net profit of CNY2.2 trillion, reflecting an annual increase of 12.6%.”

Among the non-Chinese top performers experiencing double-digit growth were Mizuho Financial and KB Financial.

Mizuho Financial saw its revenue increase by 13.2% driven by 23.2% increase in interest income and a 162% surge in trading income.

KB Financial’s revenue increase was on the back of a 5% rise in its interest income due to about 8% growth in its loan book. This was further strengthened by 22.5% increase in net fee and commission income that was primarily driven by credit card fees on the back of consumption growth.

Increase in brokerage income and improved investment banking activities considering record level of stock market also supported the bank’s revenue growth.

Hana Financial, however, saw a 11.3% decline in revenue, primarily because of drop in income from non-interest activities including net loss on financial instruments measured at FVTPL, 70% plunge in net gain on financial instruments designated as measured at FVOCI, loss on derivative assets used for hedging, and 87% decline in gain on foreign currencies transactions.

Vala concludes: “2022 has brought its own new challenges with rapidly changing geopolitical landscape, increasing supply chain constrains, rise in energy prices, and stringent lockdown in China. With these headwinds, the top APAC banks are likely to find it difficult to maintain the recovery that they achieved in 2021.”