TD Q3 2020 net income beat analyst forecasts but drop by 31% year-over-year to C$2.2bn ($1.67bn).

TD’s Canadian retail banking unit net income is down by 33% y-o-y to C$1.29bn. This primarily reflects higher provisions for credit losses (PCL), lower revenue and higher insurance claims. Revenue is down by 2%, reflecting lower margins. This is partially offset by increased loan and deposit volumes and increased activity in the wealth and insurance businesses. Expenses are flat compared to the prior year and down 2% compared to the prior quarter. PCL increase by C$635m from a year ago, mainly on higher provisions for performing loans.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Average loan volumes increase by 3%, reflecting 2% growth in personal loans and 7% growth in business loans. Average deposit volumes increase 18%. This reflects 14% growth in personal deposits, 20% growth in business deposits, and 36% growth in wealth deposits.

On the other hand, net interest margin drops by 28 basis points to 2.68% reflecting lower interest rates.

TD Q3 2020: retail banking net income -48%

TD’s US retail banking unit posts net income of C$673m down by 48% y-o-y.

Revenue for the quarter drops by 7% y-o-y. Net interest margin of 2.50% is down by 77 bps, primarily reflecting lower deposit margins and higher cash and deposit balances. Average loan volumes increase by 11%, compared with the third quarter last year. Personal and business loans increased 6% and 15%, respectively. The increase in business loans reflects increased draws on commercial lines of credit and originations under the SBA PPP. Average deposit volumes increase by 29%, reflecting a 38% increase in business deposits, a 37% increase in sweep deposits, and a 14% increase in personal deposits.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTD Ameritrade contributes C$317m in earnings to the segment, an increase of 8% y-o-y. This primarily reflects higher trading volumes, partially offset by reduced trading commissions, lower asset-based revenue and higher operating expenses.

TD Q3 2020 highlights

TD’s wholesale banking unit posts net income of C$442m up by 81% y-o-y. This reflects higher revenue, partially offset by higher PCL and higher non-interest expenses. Revenue for the quarter is C$1.39bn, up 53% y-o-y. This reflects higher trading-related revenue and underwriting fees.

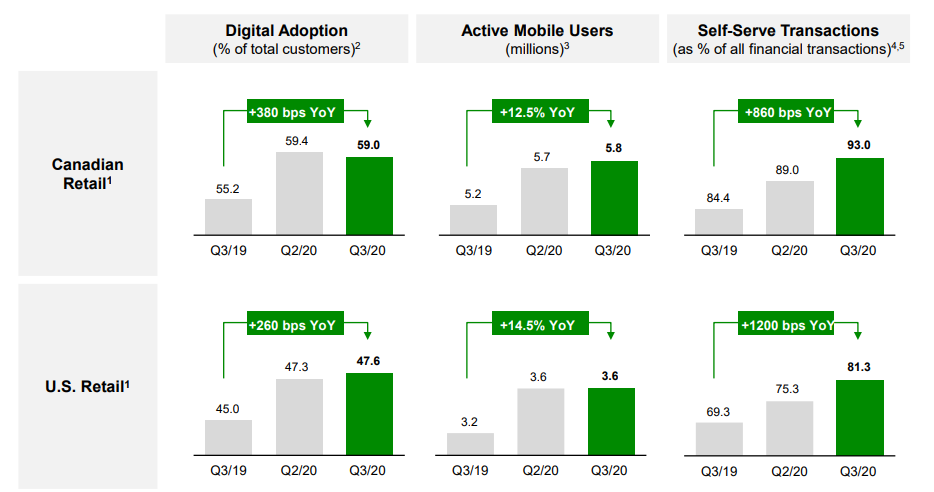

Digital banking highlights include a 12.5% rise in active mobile banking users in Canada to 5.8 million. In the US, TD’s active mobile banking users rise by 14.5% to 3.6 million.