TD Q2 2019 earnings flag up the strength of its US retail banking unit.

The bank’s results for the quarter ending 30 April beat analyst forecasts with net profit up by 9% to C$3.2bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Notably, TD’s US retail banking unit reports a record quarterly net income of C$1.26bn, up 29% y-o-y.

Earnings growth reflects higher deposit margins and increased loan and deposit volumes.

TD Q2 2019 US retail reports net income of C$1.85bn up 1% year-on-year.

Revenue is up by 8% reflecting increased volumes, higher margins and more assets under management at its wealth management unit.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTD Q2 2019 highlights

Average loan volumes are up by 5% reflecting 5% and 9% growth in personal and business loans respectively.

Deposit volumes increase by 3%, reflecting 4%, 2% and 1% growth in personal, wealth and business deposit volumes respectively.

The bank’s Canada retail unit reports a 5 basis points rise in net interest margin to 2.99%.

Meantime, the bank’s US retail unit posts a healthy net interest margin of 3.38% albeit down by 4 basis points.

Average loan volumes increase by 5% due to a growth in personal and business loans of 3% and 6% respectively.

TD Q2 2019 channel highlights

TD ends the second quarter with 1,099 branches in Canada and 1,240 outlets in the US.

The bank now has 13.1 million digital banking customers out of a total 26 million clients. TD’s active mobile banking customers in Canada and the US are now 5 million and 3.1 million respectively.

In particular, the second quarter is notable for TD’s success in topping the JD Power Canada Retail Banking Satisfaction Study. In the process, TD knocks RBC, winner for the past three years, off top spot.

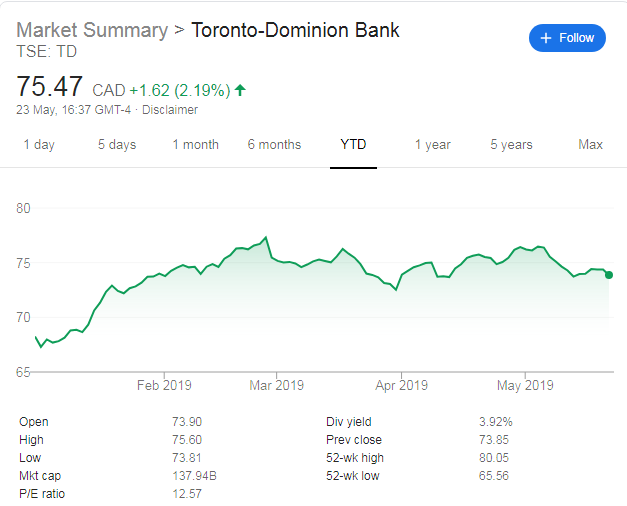

For the year to date TD’s share price is up by 10.5%.