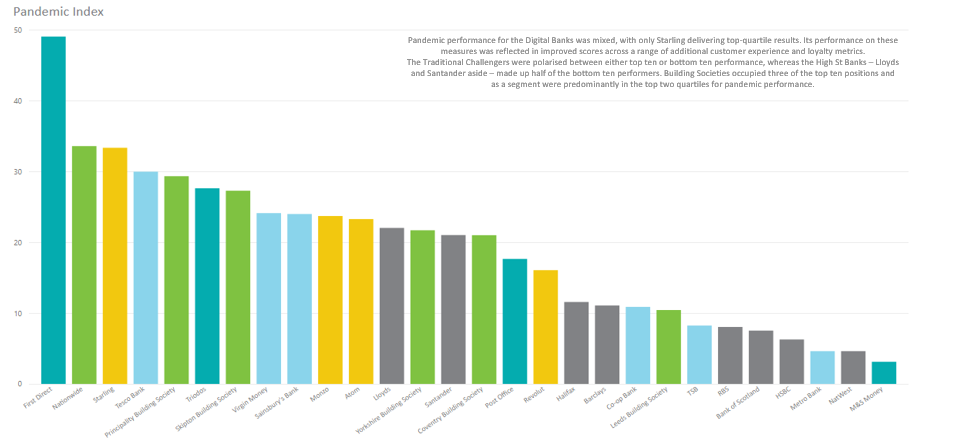

Starling Bank is the stand-out performer amongst the UK digital challenger sector according to SRM’S annual customer loyalty report. First Direct ranks top in the annual survey, a position it has held for six of the past eight years. But Starling is now almost matching another perennially high-ranking lender, Nationwide. Moreover, Starling soars up the rankings from 8th place last year. The pandemic has boosted the number of Brits utilising digital banking to around 73% of consumers.

UK customer loyalty report: Monzo 10th, Revolut only 17th

But according to SRM, the majority of the UK digital banks have failed to convert this into increased customer loyalty. Monzo is the only other digital challenger to make the top 10 in 10th place. Meantime, Revolut ranks in a distant 17th place. On the other hand, traditional high street banks represent half of the bottom ten performers. The SRM research covers 28 of the UK’s leading retail banks and building societies. It has been carried out since 2012 and covers a range of customer metrics. The aim is to uncover the factors that influence customer loyalty.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The 2021 report was carried out during July 2021. Specifically, it creates a post-pandemic baseline to help understand banking performance during Covid. And the factors shaping customer loyalty during this time.

SRM annual customer loyalty report: First Direct top in all areas

The research examines three key measures to discover how highly the customer feels valued. It also looks at how the brand has maintained expected service levels throughout the pandemic. Finally, it considers timely and relevant communication of information between the brand and its customers.

HSBC subsidiary First Direct is the brand with the strongest overall performance in all areas.

Inconsistent service finding hits Revolut ranking

“With such a marked increase in digital banking amongst the majority of UK consumers as a result of the impact of the pandemic, it would have been fair to assume that digital banking specialists would have shone in this research. That’s proven not to be the case in most instances, says Jehan Sherjan, Insights Director, SRM Europe,

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“Starling Bank has convincingly assumed its role amongst the leading pack. This is thanks to easy to use and functionally rich digital channels, a sense of relationship with its customers, and a strong pandemic performance. Inconsistent performance in service experience and aspects of pandemic performance have negatively impacted Revolut and, to a lesser degree, Monzo.”

SRM Europe’s research examines in detail the factors influencing levels of customer loyalty towards the bank they use. With factors covering experience, digital, emotional, social and relationship, as well as the pandemic experience, the findings are clear.

Critically, whilst digital experience and associated functionality are vital measures to get right, alone they do not equate to customer loyalty. SRM’s research clearly demonstrates that consistent delivery across all key measures, resulting in a combination effect, is what is required to secure and maintain customer loyalty. Excellence in one area alone simply won’t cut it.

Ethical factors: not crucial in consumers choice of bank?

Interestingly, when social conscience factors – so often considered a high priority amongst consumers – are examined more closely, First Direct scores relatively poorly yet maintains its overall position at the top. This suggests that whilst a commitment to making a positive social impact, tackling climate change, and ethicality remain important to the public, they’re not critical factors when choosing a bank.

Jehan concludes: “To maintain and grow loyalty, successful retail banking brands must provide a comprehensive focus on the customer beyond strong digital and transactional foundations.

“Those that have invested time and effort to develop the attributes of a relationship with their customers, together with an emotional connection and a sense of purpose, all alongside a strong digital offer, are those where loyalty remains strongest.

“Critically, social factors do not yet appear embedded in the banking offer with the exception of Co-op Bank and Triodos Bank. And they certainly don’t appear to be influencing customer loyalty. This may well change as younger age groups are most critical of brand commitment to climate change, a possible indicator of future customer demands.”