Scotia International Money Transfer is a new cost-effective digital solution for Scotiabank customers to send money internationally.

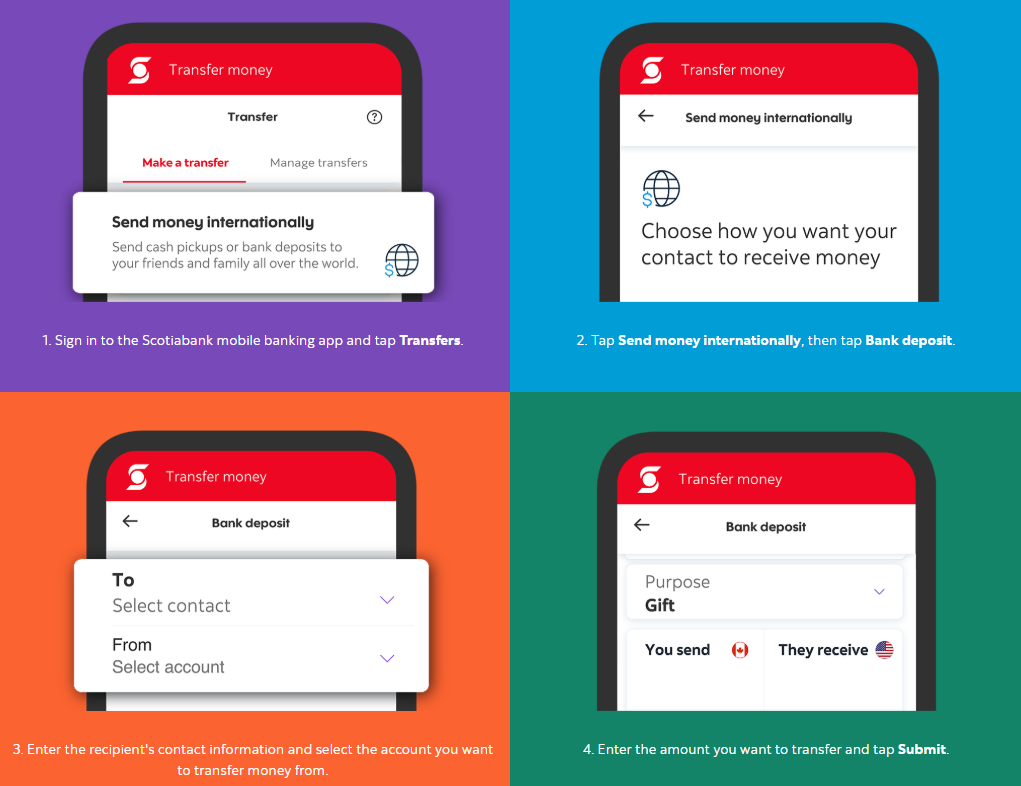

Moreover, Scotia International Money Transfer works using mobile banking or Scotia OnLine.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Specifically, Scotia International Money Transfer meets a critical need for millions of Canadians.

With a few steps customers can send money in a matter of seconds. Furthermore, recipients can access the funds in as little as one day.

“We’re ecstatic to be launching an innovative, digital solution,” says D’Arcy McDonald, SVP, Retail Deposits, Investments and Payments, Scotiabank.

“It allows customers to send money abroad in a simple, low-cost and secure way. By sending money internationally through mobile or online, customers can avoid the often lengthy, confusing and costly process that is typically involved with traditional global money transfers.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataScotia International Money Transfer: C$1.99 per transaction

Scotia International Money Transfer cost C$1.99 per transaction.

However, Scotiabank customers with its Ultimate Package or New to Canada customers, pay no transaction fee.

“Scotiabank has been undergoing a true digital transformation. It is developing solutions that make it easier for customers to bank with us,” adds Anya Schnoor, Executive VP, Retail Products, Scotiabank.

“We want to enhance the customer experience across all of our channels through simple and easy-to-use digital tools and solutions.”

Scotiabank digital progress

Scotia’s digital retail sales account for 28% of sales in fiscal 2019 up from 22% in fiscal 2018.

Meantime, its digital adoption rate grew from 33% to 39%. Other digital highlights include the milestone of selling over 50% of all retail products via digital in Chile.

In addition, Scotia successfully launched new mobile apps across the four 4 Pacific Alliance countries. And the bank began to deploy digital solutions in branches across key markets for enhanced customer experience and productivity.

For example, in Colombia more than 90% of saving accounts are completed through end-to-end digital solutions.