Charles Schwab Q2 2019 results represent a record second quarter for the firm.

Net income rises by 8% from the year ago quarter to $937m. Meantime, net income for the first half rises by 15% from the year ago period to $1.9bn, another record.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Schwab Q2 2019 revenues rise by 8% y-o-y to $2.7bn marking sustained business momentum.

At the same time, core net new assets grow to $37.2bn with client assets hitting a record $3.7trn up 9%.

CEO Walt Bettinger says “Our ‘no trade-offs’ approach to combining value, service, transparency, and trust continues to resonate with clients. These strong flows reflect our ability to win in a competitive marketplace. Clients have transferred nearly two dollars of assets in for every dollar out over the past six months. This helps total client assets climb to a record $3.7trn trillion as of 30 June, an increase of $305bn or 9% from a year ago.”

Schwab Q2 2019 highlights:

- Schwab clients opened nearly 400,000 new brokerage accounts during the second quarter;

- Year-to-date new accounts total 772,000, helping push active accounts to 12 million, up 7% y-o-y;

- Organic growth exceeds 5% during the second quarter.

Other notable highlights include a 10 basis point rise y-o-y in the net interest margin to 2.40%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSchwab ends the quarter with 61 independent branches, up from 53 at year end.

Bettinger adds: “These offices help extend our traditional branch network, delivering Schwab’s capabilities through local, community-based professionals. For clients exploring our lending capabilities, we have introduced new features to our Pledged Asset Line.”

This includes loans with no preset term, streamlined origination and a new application process available via any web-enabled device.

Less positive metrics include a 7% rise in expenses. CFO Peter Crawford comments: “This reflects planned growth in staffing and our investments to drive efficiency and scale as we support our expanding client base.

“Our ongoing focus on driving efficiency while managing our spending in a disciplined manner enabled us to maintain our ratio of expenses to client assets at 16 bps for the quarter and achieve a pre-tax profit margin of 46.1% – our fifth consecutive quarter of at least 45%.”

Other 2019 highlights include a strong showing in the JD Power ranking of the leading digital banks. Schwab, Ally and Discover fill the top three places in JD Power’s ranking of the best US digital banks.

USAA bid talk

Meantime, Schwab is reportedly interested in USAA’s wealth management unit, according to a report in the Wall Street Journal. If such a deal comes off Schwab will add around $100bn of assets under management. The WSJ reports that such a deal would be in the region of $2bn.

USAA agreed an $850m deal last November to sell its asset management unit to Victory Capital.

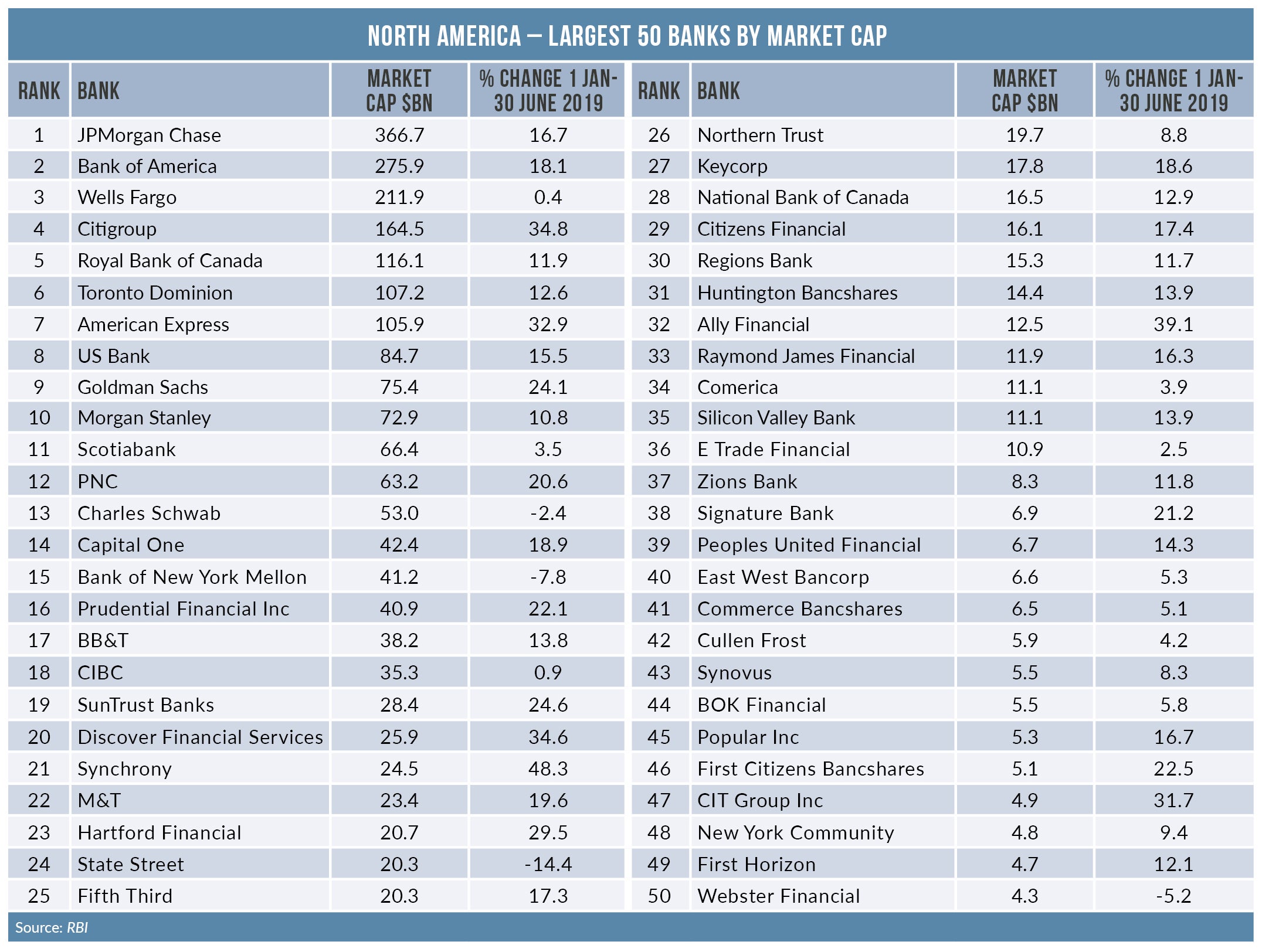

In the first half Schwab’s share price has been muted, down by 2% despite a booming US stock market.