RBS Q3 2019 earnings are worse than forecast with yet another £900m set aside for PPI claims.

For the quarter to end September, RBS posts an operating loss before tax of £8m. In the prior year quarter RBS reported an operating profit of £961m.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The bank’s NatWest Markets unit is particularly challenged, posting a loss for the third quarter of £20m. In the year ago quarter the unit reported a profit of £117m. Income at the unit drops to £106m in the quarter compared with £198m in the prior year quarter.

The results do however contain a number of positive metrics, especially the bank’s digital numbers.

RBS Q3 2019 highlights: digital

The bank ends the quarter with 6.8 million regular mobile app users and 8.8 million digitally active customers. This represents 73% of active current account customers. Total digital sales volumes increase by 25% compared with Q3 2018 and now represent 51% of all sales. 58% of personal unsecured loan sales, 68% of credit card accounts and 53% of current accounts are opened digitally.

The bank also reports mortgage lending growth. UK Personal Banking gross new mortgage lending is £8.6bn in Q3 2019 compared with £6.7 billion in Q2 2019. Moreover, there is positive news on impairments.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataQ3 2019 net impairment loss of £213m equates to 26 basis points of gross customer loans. This compares with 31 basis points in Q3 2018.

RBS Q3 2019: less positive metrics

On the other hand, across the retail and commercial businesses, income decreases by 3.1% year-over-year.

In addition, there is further evidence of margin pressure. Net interest margin of 1.97% is 5 basis points lower than Q2 2019. This primarily reflects the contraction of the yield curve and competitive pressures in the mortgage sector.

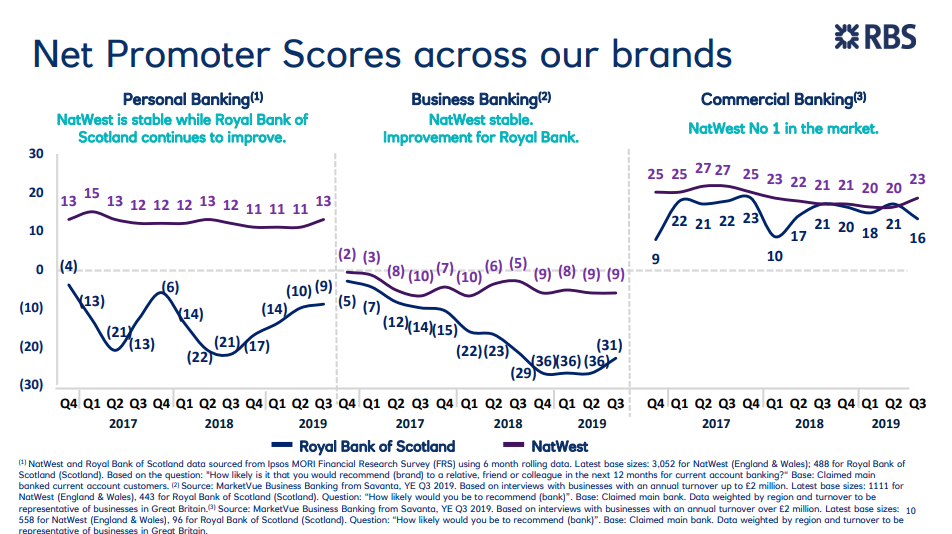

And then there is the issue of the bank’s hitherto dismal net promoter scores. While NatWest’s NPS is stable, the RBS brand remains in negative territory, albeit it is improving slightly from a dire base.

RBS’ share price dips 2% on release of the results but for the year to date is ahead by 16%.