To support customers with money management, RBC launches NOMI Budgets.

The AI-powered solution is accessible through the RBC mobile app. It will support customers in keeping track of their finances and help them budget.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Keeping a budget is a massively important part of many consumers’ financial journey. Subsequently, bringing convenience to that process makes it much easier for customers to control their spending.

There’s no doubt that people are increasingly using their mobile devices to take care of their finances.

RBC NOMI Budgets harnesses the power of AI to precisely analyse a customer’s spending history and behaviour. By doing this, RBC can make tailored recommendations on a budget that would work for each individual user.

Senior Vice-President of Digital at RBC, Peter Tilton, stated: “We know that so many of our clients look for helpful tools and support when it comes to budgeting and managing their day-to-day finances.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“NOMI Budgets is the latest of our personalised digital capabilities that, using the power of AI, provides our clients with deeper insights that can increase their financial confidence.”

RBC NOMI Budgets: how it works

Making financial tasks like budgeting and keeping track of spending goals more accessible will help customers manage money more conveniently. Furthermore, it will educate them on what works for them.

RBC NOMI Budgets keeps a close eye on it’s users spending habits, storing and analysing their financial trends while they get on with their day-to-day lives.

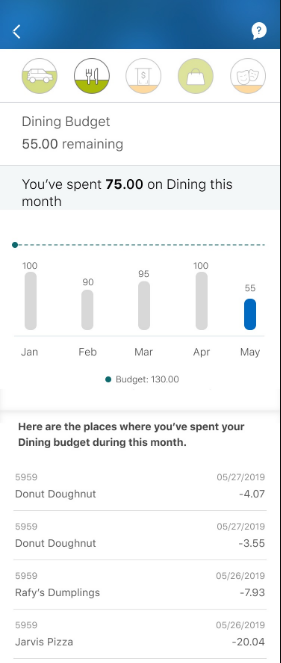

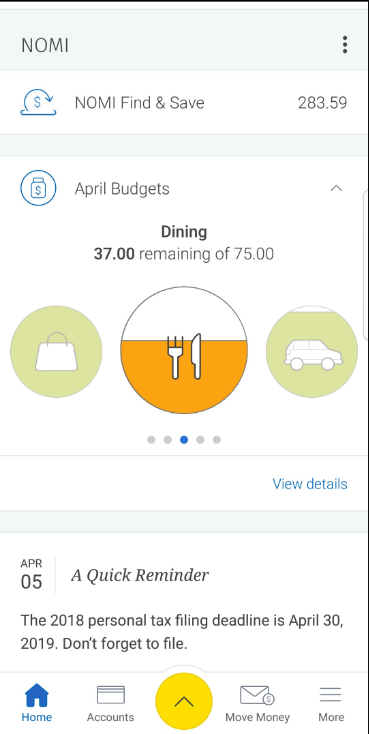

Furthermore, the solution is powered by NOMI Insights and will recommend a monthly budget tailored to the individual in one of five key areas:

- Entertainment,

- Shopping,

- Cash Withdrawals,

- Transportation and

- Dining

Furthermore, customers can seamlessly adjust the budget should they wish to. Keeping users on track, NOMI Budgets will send notifications to the customer when they reach 50%, 75% and 100% of their budget.

Vice-President of Digital Product at RBC. Rami Thabet, commented: “Our NOMI capabilities have been developed to help our clients manage and be more mindful of their finances.

“The advancements that we’ve made in AI technology enable our customers to receive financial insights, savings and personalised budgets with ease, and we’re quickly seeing the value that these solutions provide to so many people.”

Merging AI and data for enhanced solutions

The budgeting feature merges AI and customer data to identity common trends and habits to seek out potential saving opportunities.

The budgets solution now joins the NOMI family which includes:

- NOMI Insights: Provides personalised financial insights and also advice to help with day-to-day finances.

- NOMI Find & Save: Proactively analyses spending behaviours to find extra money that can be saved. Furthermore, from February 2019, NOMI Find & Save clients have saved more than C$83m with active users saving an average of C$180 per month.