Current account switching in the UK has picked up modestly in the third quarter. Specifically, there were 265,083 switches for the three months to the end of September, up 7% y-o-y. But for the year to date, total switches of 704.407 represents a 20% fall compared with the first three quarters of 2024.

In the past 12 months (1 October 2024 to 30 September 2025) there were 1,013,697 switches. This is down 22% from the prior 12-month period (1,311,084).

UK current account switching peaked in 2023

Account switching peaked in 2023 with 1,457,165 switches for the full calendar year. The number dipped to 1,190,676 in 2024, a fall of 18%. Calendar year 2025 is on course to record a further year-on-year decline. On a more positive note, a strong end to the year for switches is in prospect with a number of major banking brands offering switch incentives.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Nationwide: four successive quarters of most net gains

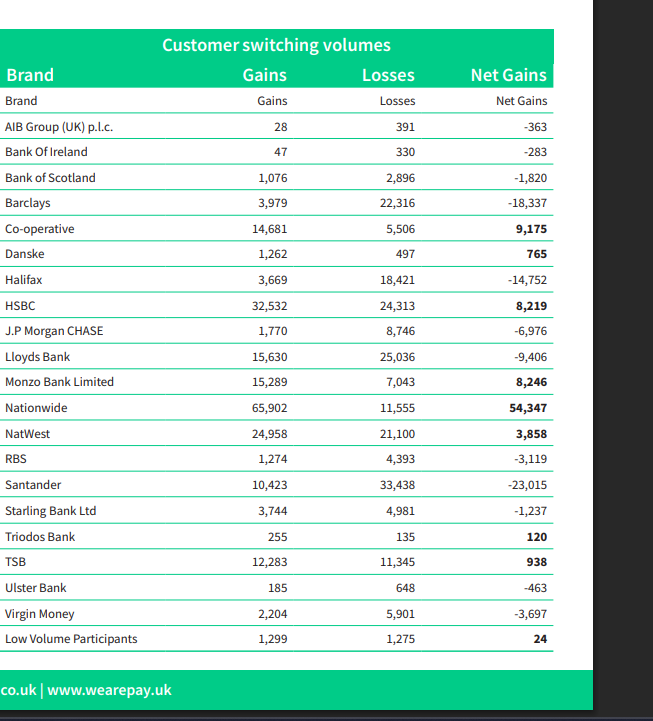

End user data on a brand-by-brand basis is reported three months in arrears. Accordingly, the numbers released today for each brand cover the period from April to June 2025. In the second quarter, Nationwide yet again posted the highest net switching gains with 54,347. In the previous three sets of quarterly stats by brand, Nationwide was top for highest net switching gains for the periods covering the third and fourth quarters of 2024 and the first quarter of 2025.

Other brands to post a net gain in switchers in Q225 include Cooperative Bank (9,175), Monzo (8,246), HSBC (8,219) and NatWest (3,858).

Cooperative Bank on a roll

The Coop Bank merits a mention for turning around its performance by this ranking. For 10 successive periods, from Q321 to Q423, the Coop Bank posted four figure net losses each quarter. But for the four quarters, from Q324 to Q225, the Coop has posted net gains by switchers each quarter.

Neobanks – Monzo remains out in front for net switches

Monzo continues to lead for switchers among the digital neobanks. In Q125, Monzo was the first neobank to feature in the top three for switching gains since 2022 and it remains in the top three in the latest numbers.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAt the other end of the table, Santander reports the highest net losses with 23,015 for the three months to end June, ahead of Barclays (18,337). In the prior two quarters, Barclays posted the largest number of net losses with 22,234 and 37,128 for Q125 and Q424 respectively.

Since the Service launched in September 2013 it has facilitated over 12.1 million switches and successfully redirected more than 170.1 million payments. The Service averaged a seven-day switch completion rate of 99.5% in Q2 2025. Public awareness levels remained high at 78%. 91% of customers who switched using the Service in the last three years said they were satisfied with the process.