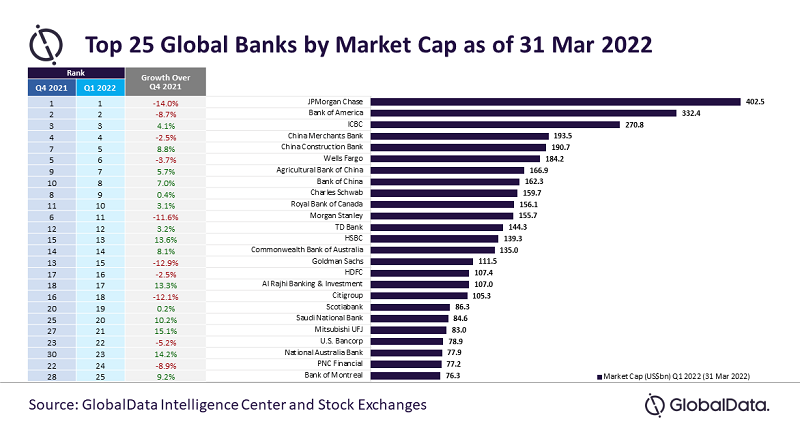

The aggregate market capitalisation (MCap) of the top 25 banks across the globe stayed flat at $3.8tn in Q1 2022 despite the Ukraine conflict, stated data analytics and consulting firm GlobalData.

Mitsubishi UFJ, National Australia Bank, HSBC, Al Rajhi Banking & Investment, and Saudi National Bank emerged as the top performers, with more than 10% quarter-on-quarter rise in their market values.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Eight of the top 10 market value losers were from the US, whose losses were largely driven by Russia’s invasion of Ukraine.

These included Goldman Sachs and Citigroup that together made up for around 75% of the US banks’ Russia exposure.

Goldman Sachs’ and Citigroup’s Russian exposure was nearly $1bn and $10bn, respectively. While the former withdrew from Russia, Citi had to wind down its Russian consumer banking business that it was planning to divest.

In Q4 2021, JPMorgan Chase reported a profit of $10.4bn, marking a 14.3% year-on-year decrease and 11% quarter-on-quarter fall.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData Company Profiles Analyst Parth Vala said: “With the global economy on uncertain ground following fast changing geopolitical scenarios and the potential threat of new Covid-19 variants, 2022 is likely to be another challenging year for the banking sector.”

The study revealed that 15 of the 25 banks registered growth over the final quarter of last year.

Higher trust fees and fees and commission income along with fall in interest expenses resulted in Mitsubishi UFJ posting a growth of around 76% for the nine months to 31 December 2021 compared to the same period a year ago. This resulted in its market value increasing by 15.1%.

Market value of National Australia Bank increased 14.2% to $77.9bn in its first quarter ending 31 December 2021 from $68.2bn in the previous quarter.

The lender’s reported cash earnings of A$1.8bn in Q1 marks a rise of around 12% and 9.1% over the quarterly average of the second half of 2021 and first quarter ending 31 December 2020, respectively.

HSBC benefitted from a release of expected credit losses and impairment charges last year, with its profit after tax surged around 141% year-on-year to $14.7m in 2021.

Al Rajhi Banking & Investment saw a 13.3% rise in its market value.

This was the result of a 39% year-on-year growth in its net income in 2021, and an operating efficiency of 26.9% in FY2021 versus 32.5% in FY2020.

Saudi National Bank, which snapped up Samba Financial Group earlier this year, saw a 10.2% growth in MCap.