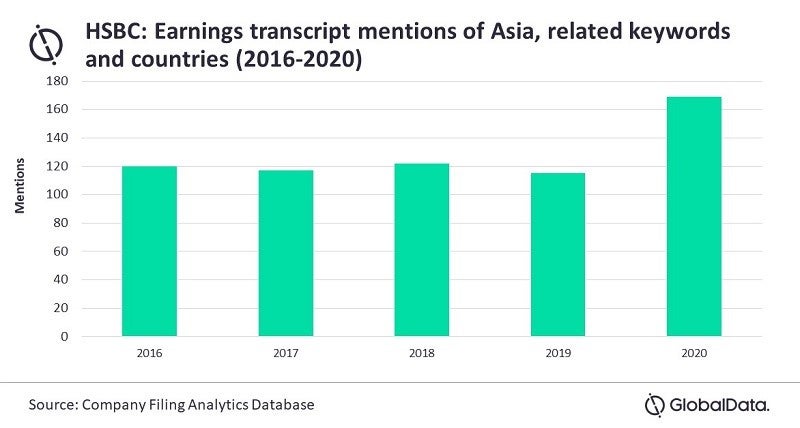

Fluctuations in the markets due to the Covid-19 pandemic is compelling London-based HSBC Holdings (HSBC) to move its focus away from the low-return US and Europe markets to Asia. Against this backdrop, the mentions around Asia and associated keywords increased by around 47% in HSBC’s earnings transcripts in 2020 as against 2019, reveals GlobalData, a leading data and analytics company.

According to an analysis of GlobalData’s Company Filing Analytics Database, HSBC’s earnings transcript sentiment score grew by around 20% in Q1 2021, due to the positivity around digital banking, mobile payments and sustainability.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Furthermore, the online shift pushed the bank to focus on office space reduction. Due to this, discussions around office space reduction and WFH arrangements increased by 4X in the same period.

GlobalData Business Fundamentals senior analyst Rinaldo Pereira said: “Cost-cutting and capital conservation are among the top strategies for the bank in 2021. Discussions around the US rose by around 35% in 2020 as the financial services provider is considering the US retail banking market exit.”

As per the GlobalData’s Financial Services Database, HSBC has meagre shares of the US’ retail banking market. In its latest earnings transcript, the bank acknowledged the lack of competitiveness and high returns in the US. Due to this , the bank allocated $6bn to invest in its wealth management and wholesale banking operations across Asia over the next five years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s Jobs Analytics Database found that around 85% of HSBC’s active jobs (between September 2020 and March 2021) were in the Asia-Pacific region.

Additionally, active jobs in Asia-Pacific have witnessed an uptrend since September 2020. Big data, cloud and cybersecurity were among the top job themes, with the UK-based lender pushing its digital initiative to benefit from the digital banking and mobile payments boom.

Pereira concluded: “The bank expects to reduce its manual workflow and re-skill the employees involved in digital processes. HSBC’s Asian drive also seems to be a step in the right direction as GlobalData expects retail banking to recover more in Asian economies in 2021 as compared to the US and Europe.”