Greenwood, the digital banking platform for Black and Latino individuals and business owners, is raising $40m from US banking giants. Specifically, Truist, Bank of America, PNC, JPMorgan Chase, Wells Fargo, Mastercard and Visa are backing Greenwood.

The backers are joined by tech provider FIS and Banco Popular, the largest Hispanic-owned bank in the US. Other backers include venture capital firms TTV Capital, the SoftBank Group Corp’s SB Opportunity Fund and Lightspeed Venture Partners.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

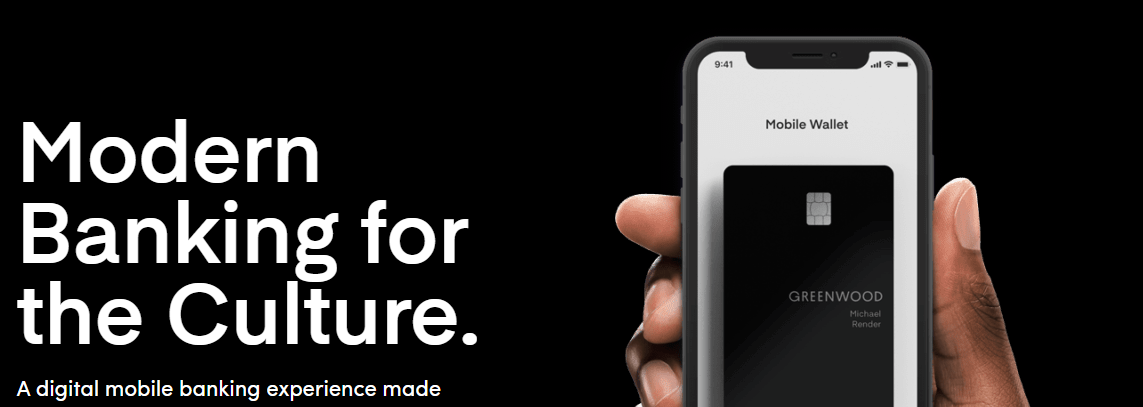

Greenwood continues to build a community focused on financial empowerment and deliver a range of financial products and services.

“The net worth of a typical white family is nearly ten times greater than that of a Black family and eight times greater than that of a Latino family. This wealth gap is a curable injustice that requires collaboration,” says Ryan Glover, Chairman and Co-founder of Greenwood.

Greenwood capital raising led by Truist Ventures

“I am elated that many of the world’s top fintechs have invested in Greenwood and join us in this mission. The backing of six of the top seven banks and the two largest payment technology companies is a testament to the contemporary influence of the Black and Latino community. We now are even better positioned to deliver the world-class services our customers deserve.”

The company’s $40m capital raise is led by Truist Ventures. That is the corporate venture capital division of Truist Financial Corporation. The investor group is committed to advancing economic empowerment of minority and underserved communities and racial equity in financial services.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGreenwood: best in class online banking

Greenwood says it will feature best-in-class online banking services. It aims to offer innovative ways to support Latino and Black-owned banks and give-back programs focused on Black and Latino causes and businesses.

“We think it is critical that our actions live up to the promise of our name,” adds Glover. This refers to Tulsa, Oklahoma’s Greenwood District of the early 20th Century, which included the prosperous “Black Wall Street”. The Greenwood District of Tulsa is an enduring symbol of the economic potential of community solidarity and empowerment.

Greenwood was announced in October 2020 and has signed up more than 500,000 community members.

Advanced account features include Apple, Samsung, and Android Pay. It also features virtual debit cards, peer-to-peer transfers, mobile cheque deposits, and surcharge fee-free ATM usage at over 40,000 ATMs.