Goldman Sachs Q2 2019 results reveal a 6.4% fall in net income to $2.2bn for the quarter to end June.

This compares to net income of $2.35bn for the year ago quarter.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The results reflect flat fixed income trading activity and weakness in debt underwriting.

For Goldman Sachs Q2 2019 total net revenue is down by 2% y-o-y to $9.5bn.

On the other hand, the Goldman Sachs Q2 2019 results are ahead of analyst forecasts.

Less positive metrics include a rise in the bank’s cost-income ratio. In H1 2019 the cost income ratio of 65.6% is up by 1 percentage point from H1 2018.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInvestment banking, management and institutional client services, post yearly declines in revenue.

Operating expenses of $6.12bn for the second quarter of 2019 are essentially unchanged compared with the second quarter of 2018. But the Q2 2019 operating expenses are up 4% compared with the first quarter of 2019.

Total assets are up by 2% at $945bn. Deposits inch up by 1.2% from a year ago to $166bn.

Goldman Sachs Q2 2019 results: dividend increase

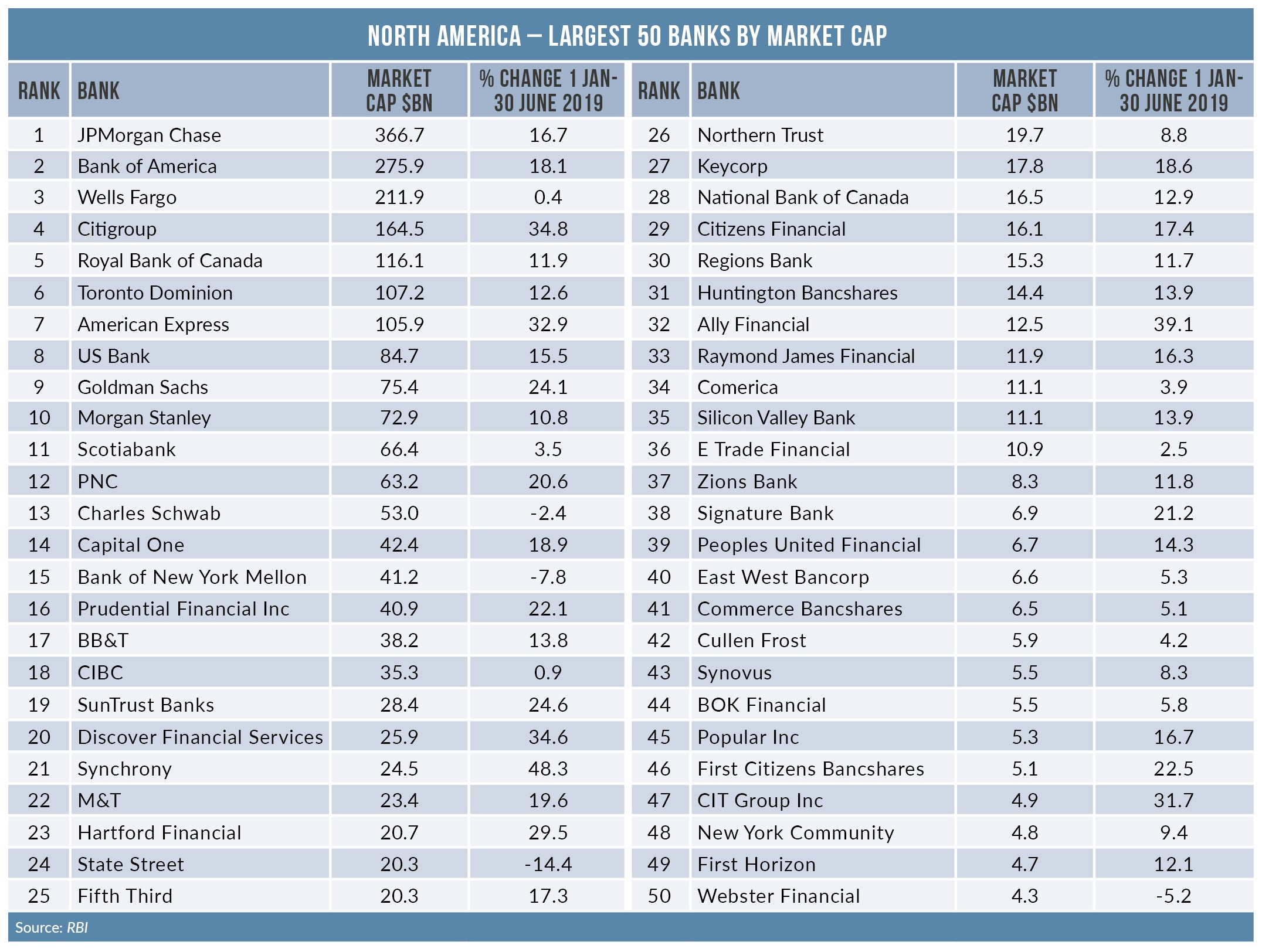

Goldman Sachs’ share price is up by 24% for the period 1 January to 30 June (see table).

“Given the strength of our client franchise, we are well positioned to benefit from a growing global economy. And, our financial strength positions us to return capital to shareholders. This includes a significant increase in our quarterly dividend in the third quarter,” says CEO David Solomon.

Specifically, Goldman Sachs increases its quarterly dividend to $1.25 from $0.85.

Meantime, Goldman Sachs is investing $25m in EU-based deposit marketplace Raisin. The German start-up has now raised €195m. The fresh capital injection will help Raisin’s plans to expand to the US.

Raisin has brokered €14bn for more than 185,000 customers across Europe since launching in 2013.