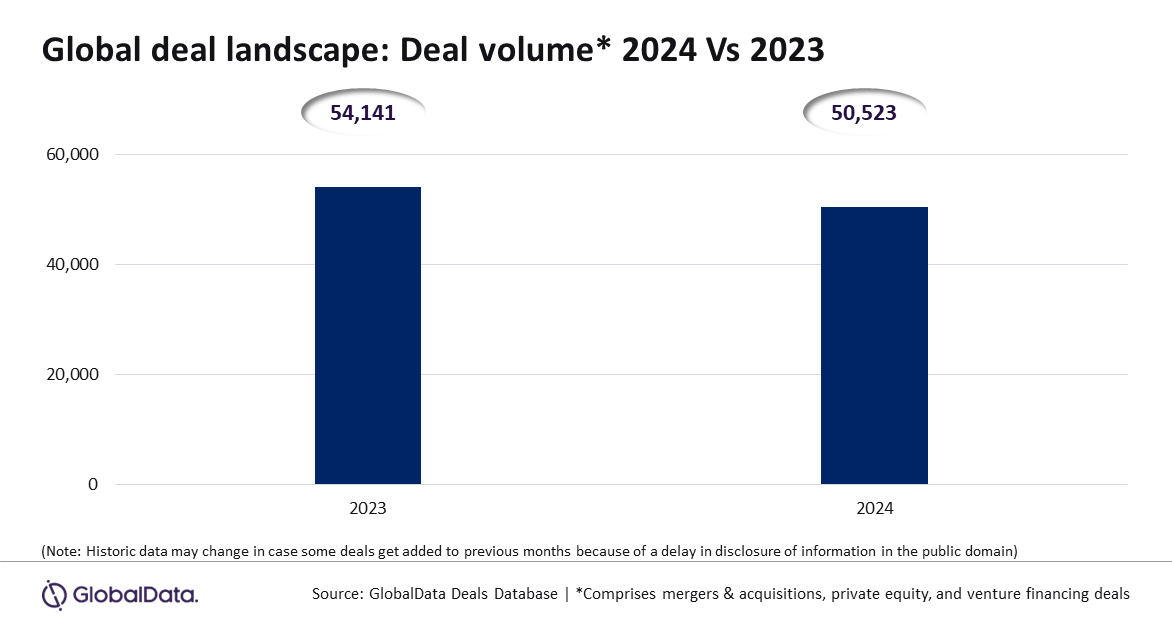

A total of 50,523 deals across mergers & acquisitions (M&A), private equity, and venture financing were announced globally during 2024, reflecting a 6.7% year-on-year (y-o-y) decline from 54,141 deals announced in 2023. Despite the overall downturn, certain markets demonstrated resilience, highlighting the nuanced dynamics of the global deal-making landscape, according to GlobalData, publishers of RBI.

Aurojyoti Bose, Lead Analyst at GlobalData, said: “Even though all the regions and all the deal types registered a decline, the impact varied widely with some experiencing massive double-digit fall in deal volume while some witnessing marginal declines. Notably, some countries registered improvement in deal activity during the year.”

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

An analysis of GlobalData’s Deals Database revealed that of all the deal types, venture financing deals saw the highest y-o-y decline of 17.2% during 2024 while private equity deal volume fell by 2.1% and the number of M&A deals decreased by only 0.4%.

North America and South and Central America saw their respective deal volume fall by 10.6% and 15.2% y-o-y in 2024, whereas Europe and Middle East and Africa witnessed decline in deal volume by 6.7% and 4.7%, respectively. Meanwhile, Asia-Pacific showcased relative resilience compared to other regions with its deal volume registering a much lesser decline of 1.4% during 2024 compared to the previous year.

Bose added: “Meanwhile, the trend remained a mixed bag among the different markets with some experiencing subdued deal activity while some registering growth in deal volume.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor instance, the US, China, Canada, Germany, France, Italy, Spain, the Netherlands, Sweden, and Singapore, experienced y-o-y decline in their respective deal volume by 10%, 20.8%, 15.3%, 9.7%, 17.9%, 3.7%, 9.6%, 13%, 8.8% and 13% during 2024 compared to the previous year. However, the UK, India, Japan, Australia and South Korea witnessed improvement in deal volume by 0.8%, 13.7%, 30.2%, 6.7% and 8.2%, respectively, during 2024 compared to 2023.

Bose concluded: “Overall, while global deal activity experienced a downturn in 2024, the landscape remains highly dynamic, with certain markets showing resilience and even growth. This mixed performance underscores the complex nature of the current deal-making environment, where regional and sectoral variations continue to drive divergent trends in M&A, private equity, and venture financing.”