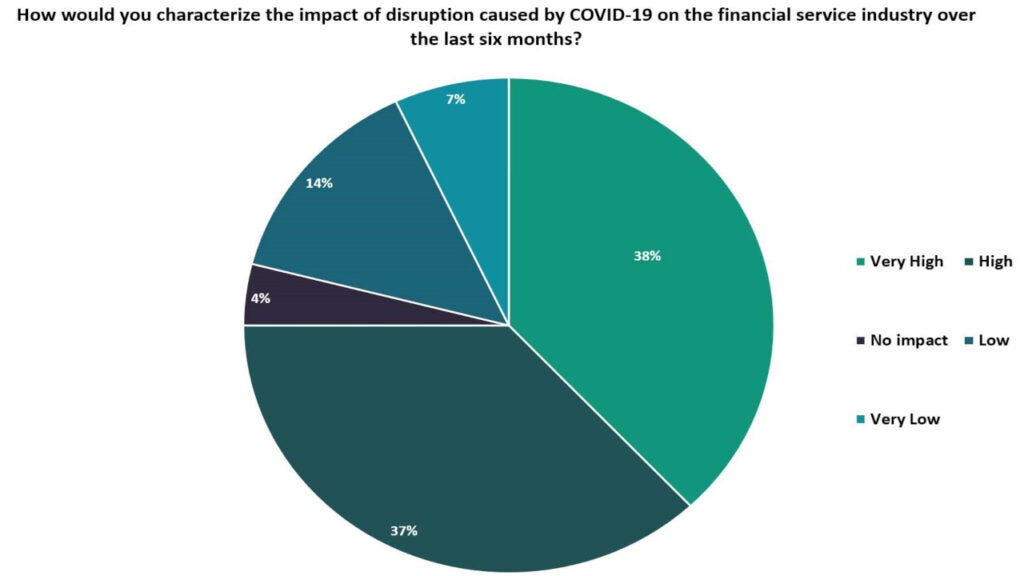

Verdict has conducted a poll to assess the impact of the disruption caused by COVID-19 on the financial services industry over the last six months.

The financial services industry was highly disrupted due to the pandemic, according to 75% of the respondents. While 38% of the respondents opined that the industry was highly impacted, 37% of the respondents voted that the impact was very high on the industry.

The financial services industry was highly disrupted due to the pandemic, according to 75% of the respondents. While 38% of the respondents opined that the industry was highly impacted, 37% of the respondents voted that the impact was very high on the industry.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Further, 14% of the respondents believed that the impact was low, while 7% opined that the impact was very low.

A minority of 4% of the respondents opined that the pandemic did not impact the industry.

The analysis is based on 254 responses received from the readers of Verdict network sites including Retail Banker International, Cards International, Electronic Payments International, and Private Banker International between 03 August 2020 and 13 January 2021.

Financial services industry forced to reassess operations amid COVID-19

The financial services industry, particularly the insurance and wealth management sectors, which is usually characterised with building a personal connection with customers was forced to adopt digital services.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInnovative ways of customer and staff interaction were introduced in an effort to ensure social distancing, such as appointment booking apps for offline visits, shuffling and re-shuffling of staff, home delivery apps, and options which led to a macro inclusion of different branches especially in banking.

Businesses and customers turned towards financial services sector for fulfilling funding requirements including short and long-term bail-outs, and operations funding among other needs. Digital maturity impacted the banking sector in many ways as organisations had to consider retraining employees.

The pandemic has accelerated the pace of digitalisation and demonstrated that a resilient digital financial system is essential for the industry, according to World Economic Forum.