Deutsche Bank’s US economists expect modest economic growth of about 2 per cent in the US this year, despite a resilient labour market and solid consumer spending.

US President Donald Trump has called it the greatest economy in the history of America. (And once at campaign rally, “the greatest in the history of mankind”.) “Some of the best economic numbers our country has ever experienced are happening right now,” he tweeted recently. However, Deutsche Bank’s experts are less than excited about the prospects for US economic growth in 2020.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The German multinational bank is gearing up for a 2 per cent growth rate this year. Beyond 2020, Deutsche Bank’s growth outlook picks up by a modest 0.1 percentage points per year due in part to further monetary policy accommodation.

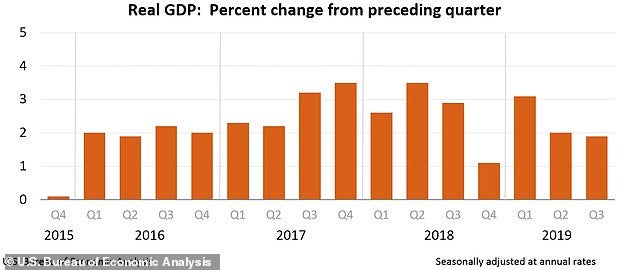

Real gross domestic product (GDP) increased 2.1 percent in the third quarter of 2019. In the second quarter, real GDP rose 2.0 percent.

However, the bank sees a resilient economy with an improved balance of risks entering 2020. An economy that has weathered several crosscurrents, including sputtering global growth and elevated trade policy uncertainty in 2019.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSupporting this view, global growth momentum has shown tentative signs of bottoming, more adverse outcomes from trade talks and Brexit have been avoided, and US leading indicators have stabilised.

Risk of a mild recession cannot be rule out

The Deutsche Bank team, led by US economist Matthew Luzzetti, believes upside risks to growth this year should remain capped. They expect the momentum for capital expenditure to be constrained by a transition from trade policy uncertainty to election doubts.

“Improved growth prospects for 2020 rest importantly on our assumptions that a trade escalation is avoided with China and auto tariffs are permanently put aside,” the team noted. “Escalation on these fronts, along with some generic election-year uncertainty, would put the fragile improvement in consumer and business sentiment in doubt and risk pushing the economy into a mild recession.”

Fed’s response to inflation is critical

In terms of the Federal Reserve, Luzzetti and his team expect the pivot point for policy in the coming years to be how the Committee responds to persistent inflation weakness. Fed Chairman Jerome Powell has called inflation “one of the major challenges of our time”.

Deutsche Bank does not see these inflation concerns pushing the Fed to cut rates in 2020. Rather, it expects the Fed’s initial response to pursue an “opportunistic reflation” by guiding markets toward unchanged rates for longer. But with the passive approach most likely failing to stoke inflation pressures.

The economists believe a desire to avoid the disinflationary fates of other major developed market economies will likely push the Committee to cut rates in 2021.

With the next US presidential election due 3 November 2020, Mr. Trump’s chances of a second term largely hinges on the performance of the economy. Assuming he survives the impeachment trial just started in the Republican-controlled Senate, as expected.