According to GlobalData’s “Thematic Research: Cryptocurrencies” report, the narrative has significantly shifted from talks of outright bans to a focus on proper regulation. This indicates growing acceptance among governments and institutions that cryptocurrencies are here to stay.

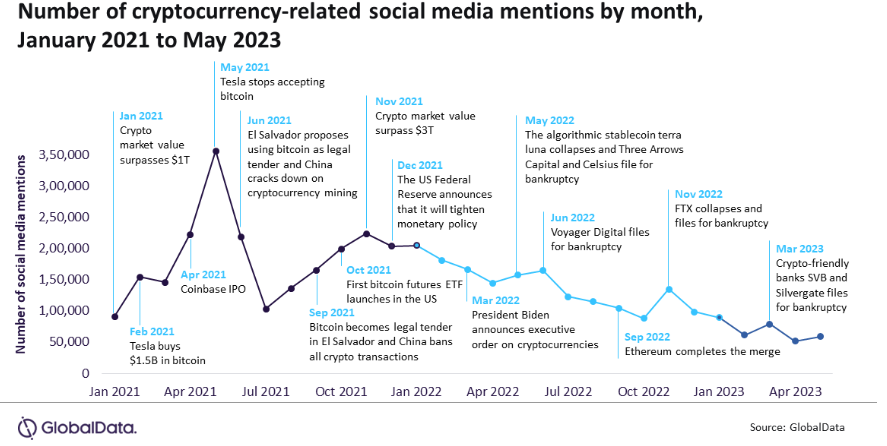

Nicklas Nilsson, a consultant working with the Thematic Intelligence team at GlobalData, commented: “Tracking the crypto market is challenging due to its polarising nature and fast-paced evolution. GlobalData’s social media analytics indicates that major crypto events regularly spur discussions on social media platforms.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Crypto market: A roller-coaster of crashes and combacks

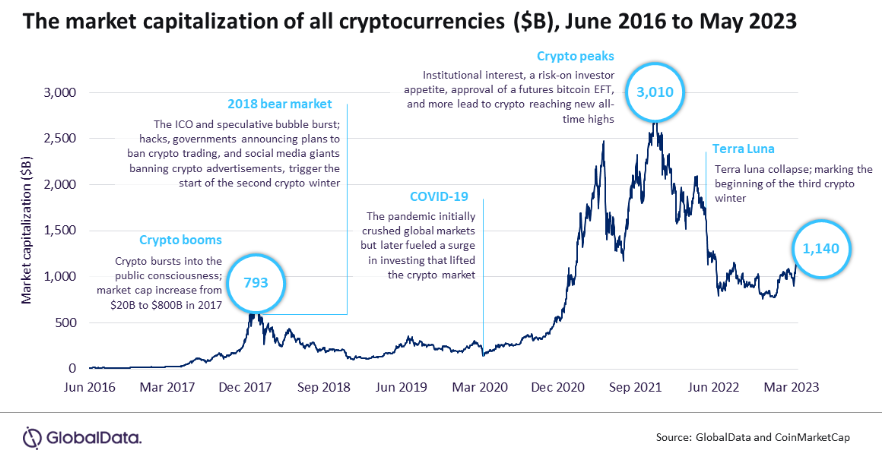

According to GlobalData analysts, the combined market value of all cryptocurrencies hit a record-breaking $3tn in November 2021 before crashing. The swift market depreciation was exacerbated in part because of the collapse of Terra and its fiat stablecoin, terraUSD.

However, the market has since stabilised, reaching $1.14bn in March 2023. The collective market value of cryptocurrencies has seen a near 400% increase compared to pre-pandemic levels, while developer activity has reached new heights.

“The crypto space continues to experience rapid innovation, from new token types to scalability solutions”, Nilsson added.

Despite this, many countries have stepped up their efforts to regulate the crypto market in the wake of the 2022 crypto crash market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

In November last year, the trading platform FTX collapsed, and its founder, Sam Bankman-Fried, was arrested. Four months later, in March 2023, Silicon Valley Bank and Signature – two medium-sized, crypto-friendly banks from the US – caved in after desperate customers started withdrawing their deposits. This raised fears from experts that a new financial crisis would emerge from under the rubble and prompted calls to impose stringent rules around crypto use.

The EU leads the way with its Markets in Crypto-Assets (MiCA) bill, introducing tougher but consistent rules across member states by 2025. The UK, Singapore and Japan follow suit in actively developing their own crypto regulatory frameworks, marking a step back from previously lobbying for their outright ban.

“Cryptocurrencies face numerous obstacles to achieve mainstream acceptance, as they are still in the early stages”, Nilsson concluded. “For instance, the world’s richest person, Bernard Arnault, could acquire most of the circulating bitcoins, and the total cryptocurrency value is still lower than Amazon’s market cap. The crypto market is expected to remain volatile, but significant changes are anticipated in the coming years. If recent history serves as a guide, progress can be expected amidst all the noise.”