Banks are increasingly encouraging the use of their online and mobile banking, as more customers are seeking ways to avoid public places amid the coronavirus pandemic.

Several banks have sent reminders to customers touting their digital banking facilities and urging customers to use them.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

“We strongly encourage you to use Capital One’s digital tools and other resources for self-service banking and 24/7 account access,” Captial One Financial Corp wrote to customers in an email, adding that representatives were always available.

JPMorgan Chase & Co and Citigroup are among the large banks that have appealed to the customers to avail themselves more of their digital channels.

“We want to make sure our clients know they can bank, invest, and make payments from wherever they are, particularly if they’re not able to come to a branch,” Chase said in a in a statement.

The reminders are also meant to ease the volume of calls at call centres as more people try do handle their banking needs remotely. Call wait time may be longer than usual, the banks warned.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

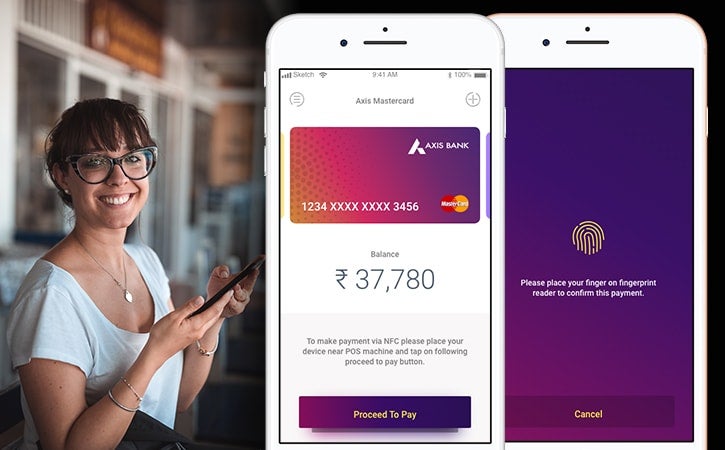

By GlobalDataEncouraging digital payments

Earlier this week, Reserve Bank of India (RBI) governor, Shaktikanta Das, asked customers to use digital banking facilities as far as possible.

“In the context of COVID 19, RBI and the government together are giving emphasis on encouraging digital payments. And over a period of time, various measures have already been taken to establish safe, secure, stable and affordable retail payment system such as the National Electronic Fund Transfer (NEFT) and the Immediate Payment Service (IMPS),” Das said.

He was speaking at a press briefing where he announced various measures to tackle the impact of the pandemic on Indian businesses and the economy.

As we go to press, 7,182 people have died worldwide from the coronavirus. 96,752 people are currently infected.