Citi Q2 2019 results beat analyst forecasts with a net profit of $4.8bn for the three months to end June.

In the year ago quarter Citi reported net income of $4.5bn. The rise in net income is driven by higher revenues and a reduction in expenses. Specifically, there is a 2% fall in expenses, the 11th consecutive quarter of positive operating leverage.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

This helps to reduce the Citi cost-income ratio in the second quarter to 56.7% from 57.9% in the year ago quarter.

Citi’s revenues increase by 2% from the prior-year period.

On the other hand, Citi Q2 2019 results show a decline in Investment Banking and Fixed Income and Equity Markets revenues.

Citi Q2 2019 results: retail banking highlights

Global consumer banking revenue rises by 3% y-o-y to $8.5bn. Retail banking net income also rises by 3% y-o-y to $3.57bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCiti-branded cards revenues of $2.2bn increases 7%, primarily driven by continued growth in interest-earning balances.

Citi’s return on average common equity of 10.1% compares with 9.2% in the year ago period.

Citi Q2 2019 results: channel highlights

Citi ends the second quarter with 688 branches in North America, down by 5 outlets from a year ago.

Active North American digital banking customers rise by 6% from 17.8 million to 18.8 million.

Mobile banking active customers rise by 12% y-o-y to 11.4 million from 10.1 million.

International branches inch down by 24 outlets from 1,735 to 1,711.

Active digital banking customers outside North America are up by 21% to 11.8 million. Mobile banking active customers rises by 39% to 8.9 million.

Other digital highlights include a rise to 50% from 47% for e-statement penetration. At the same time, e-payment penetration rises from 72% to 75%.

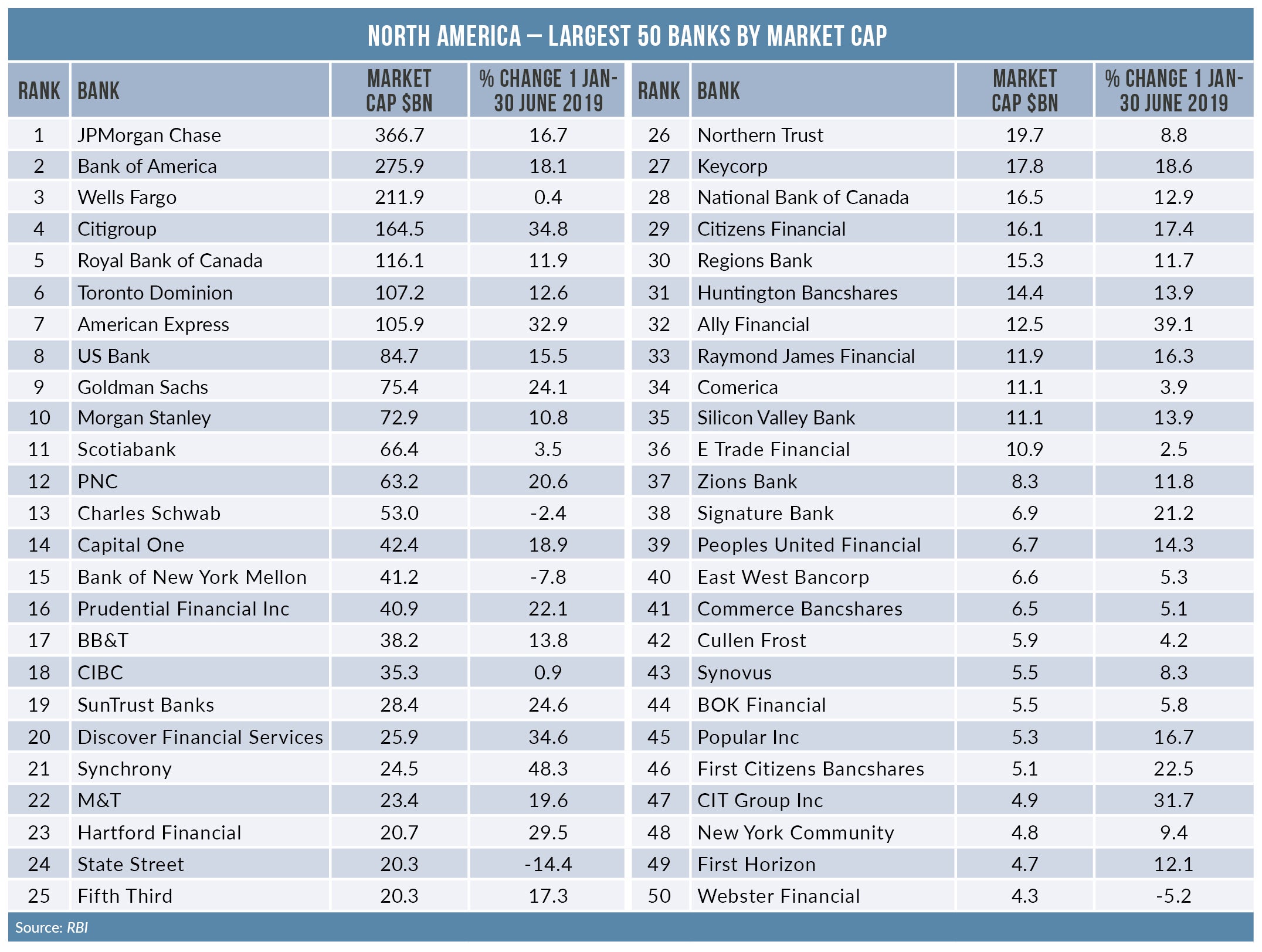

Citi’s share price is up by 35% in the period 1 January to 30 June (see table).