Citi 2018 results kick off the US reporting season.

For fiscal 2018 Citi posts net income of $18.0bn compared to a net loss of $6.8bn for the full year 2017. Excluding the one-time impact of Tax Reform, Citi’s net income of $18.0bn is up by 14% year-on-year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In Q4, Citi reports net income of $4.3bn, on revenues of $17.1bn. This compares to a net loss of $18.9bn on revenues of $17.5bn billion for the fourth quarter of 2017.

The Q4 revenue figures miss analyst forecasts due to reduced revenue from fixed income, currency and commodities trading.

But Citi’s Q4 net profit is ahead of analyst estimates on improved expenses cuts and reduced loan losses.

In particular, Citi’s efficiency ratio improved by 86 basis points to 57.4% for fiscal 2018.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn addition, Citi beats its target for returns on tangible common equity. It reports a 2018 RoTCE of 10.9% against its 10.5% target.

Citi 2018 results: US retail banking highlights

In Q4, Citi posts solid growth in US branded cards, Retail Services and Latin America consumer banking.

US retail banking revenues excluding mortgages increase by 5% in the fourth quarter.

For fiscal 2018, Citi reports North American consumer banking net income of $3.3bn, up 22% year-on-year.

Citi ends 2018 with 689 US retail bank branches. As recently as 2013 Citi’s US network comprised 1,043 branches.

Citi digital banking highlights in 2018 include a 12% rise in active mobile banking users to 11 million customers.

Overall, total US digital banking customers increase by 5% year-on-year to 18 million.

Citi 2018 results: International consumer banking highlights

For fiscal 2018, Citi’s international consumer banking net income of $2.4bn is up by 31% year-on-year.

Latin America retail banking revenues are up by 13% for the full year.

Citi ends 2018 with 1,721 international branches, down 2% y-o-y.

Notably, active international mobile users soar by 46% to 8 million.

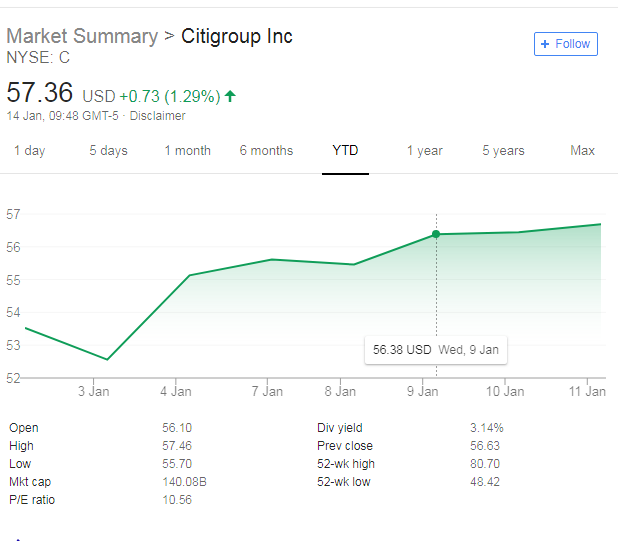

In 2018, Citi’s share price fell by more than 20%. But for the year to date Citi’s shares are up by 6%.