Fitch Ratings has revised upward its assessment for China’s bank operating environment (OE), to ‘bbb-’/Positive from ‘bb+’/Stable.

The upgrade reflects progress on financial reforms to curb systemic and contagion risks, as well as the country’s economic resilience during the Covid-19 pandemic.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

In line with this, the rating agency also upgraded Viability Ratings (VR) on the six big Chinese state banks by varying degrees.

“China’s relatively high degree of macroeconomic stability and the sovereign’s fiscal strength have created a backdrop against which policymakers have been able to enhance the efficacy of prudential supervision and reduce systemic financial risk in recent years,” Fitch said.

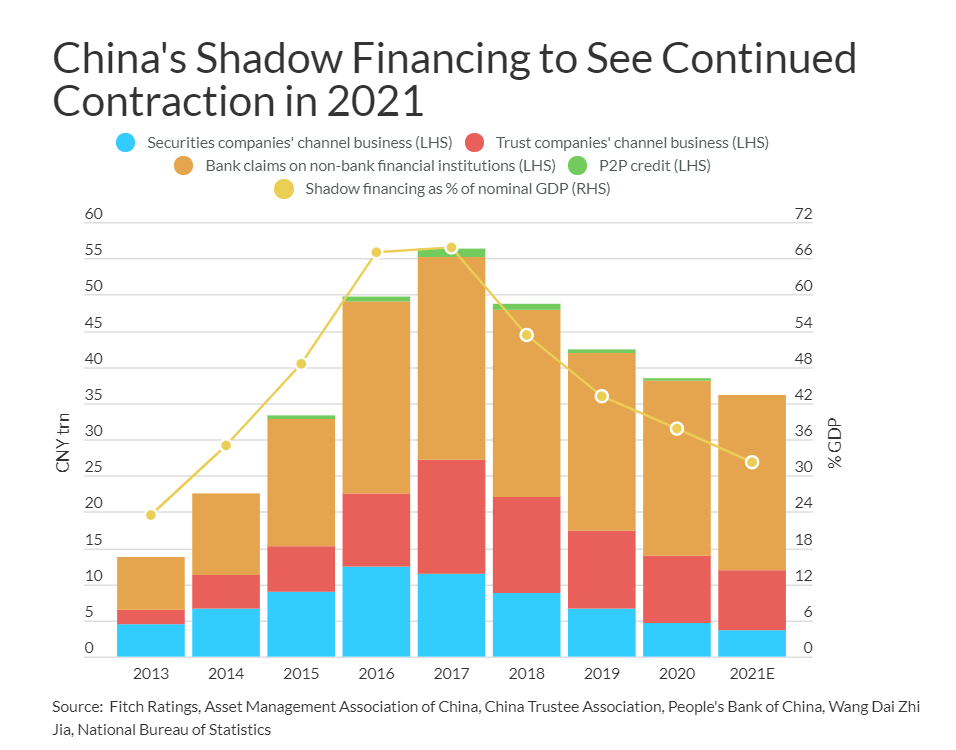

The higher OE score reflects progress in stabilising leverage, sustained strengthening of the regulatory framework, stricter asset-impairment recognition, and increased emphasis on capital sufficiency.

These developments, which have contributed to greater credit efficiency and a stabilising potential capital gap, will improve financial stability over time.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

There are still risks around the level of credit within China’s financial system

“We believe the regulatory reform process underway should help to address issues around the level and structure of system credit, as well as in financial transparency and disclosure,” Fitch said.

If sustained, it could lead to further upward revision of our OE scores, reflected in the positive outlook on our upgraded OE assessment.

The OE is one of the key factors we consider as part of our standalone bank VRs.

The upgrade to state bank VRs was underpinned by our view that their intrinsic credit profiles have become more resilient, because improvements in China’s bank OE have significantly reduced operational pressures and risks to their financial profiles.

Their Issuer Default Ratings (IDRs) remain unchanged, driven by our expectation of support from the Chinese sovereign (A+/Stable).