JP Morgan Chase Q2 2019 results yet again beat analyst forecasts. Chase reports net income of $9.65bn for the three months to end June, up 16% year-on-year.

In the year ago quarter Chase reported net income of $8.3bn. The rise in net income is driven by strong retail banking metrics. In particular, mortgage, auto originations and deposits all show strong growth.

Other highlights include a reduction in the cost-income ratio to 57% from 58% a year ago.

On the other hand, Chase reports reduced equity trading activity.

The bank also reports another strong quarter at its asset and wealth management unit. Assets under management and client assets rise by 7% due to higher asset values and net inflows into long-term and liquidity products.

JP Morgan Chase Q2 2019 results: retail banking highlights

Chase’s Consumer & Business Banking net revenue rises by 11% to $6.8bn. This is predominantly driven by higher net interest income as a result of higher deposit margins and balance growth.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataChase reports double-digit growth in credit card sales. Merchant processing volume is up by 12% year-on-year and reflects healthy consumer spending. This helps Chase to post an 8% increase in credit card loans. Specifically, Card, Merchant Services & Auto net revenue is up by 18% to $5.9bn.

Meantime, deposits are up 3%. At the same time, client investment assets rise by 16%, driven by both physical and digital channels.

JP Morgan Chase Q2 2019 results: channel highlights

Of the major US retail banks, Chase has been the most enthusiastic advocate of the branch channel since the crisis. In 2008, as the banking crisis peaked, Chase operated 3,195 units. The acquisition of the failed Washington Mutual added 2,213 units with Chase ending 2010 with just over 5,250 units.

It then bucked the trend towards shrinking branch numbers by adding to its branch channel. The Chase branch network peaked at 5,697 in 2013.

Since then, Chase’s total network has inched down despite opening a number of branches in new markets. It ends the second quarter with 4,970 branches down by a net 121 outlets a year ago.

Active digital banking customers rise by 6.5% from 47.9 million a year ago to 51 million. Meantime, active mobile banking customers increase by 12% to 35.4 million.

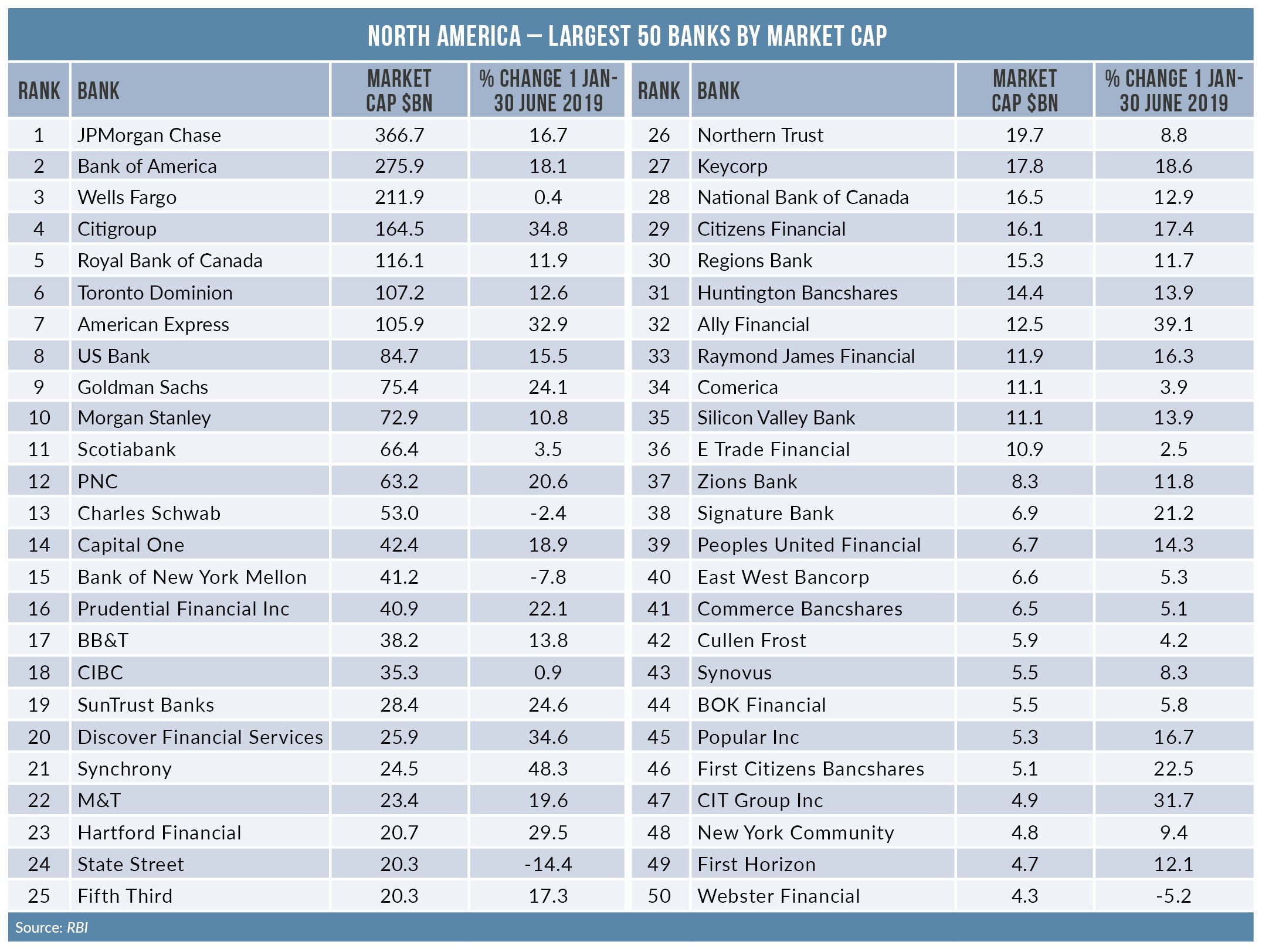

Chase’s share price is up by 17% in the period 1 January to 30 June (see table).