CaixaBank has relaunched imagin, a mobile-only bank for young people, into a digital platform dedicated to the creation of digital services.

The digital services will be both of a financial and non-financial nature designed for the younger user. The bank’s goal is to promote the growth and loyalty of the youngest customers, who are especially interested in using new technologies in their day-to-day lives and their future projects.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Benjamí Puigdevall, CaixaBank CEO, said: “imagin is taking a step forward in its evolution towards something well beyond a financial app. We went from being the young sector’s leading bank, to becoming a lifestyle-oriented user community.

“In doing so, our relationship with customers does not start with the registration of a bank account, as is the case with most banking institutions, but instead when the user decides to download the application and sign up to the platform using their email address. Customers will no longer come to imagin just in search of financial products, but instead through an interest in worthwhile content and unique experiences.”

imagin proposal

The relaunch is earmarked by a new corporate image, new customer relationship model, and an offering of three mobile applications.

imagin’s new multi-service proposal consists of:

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

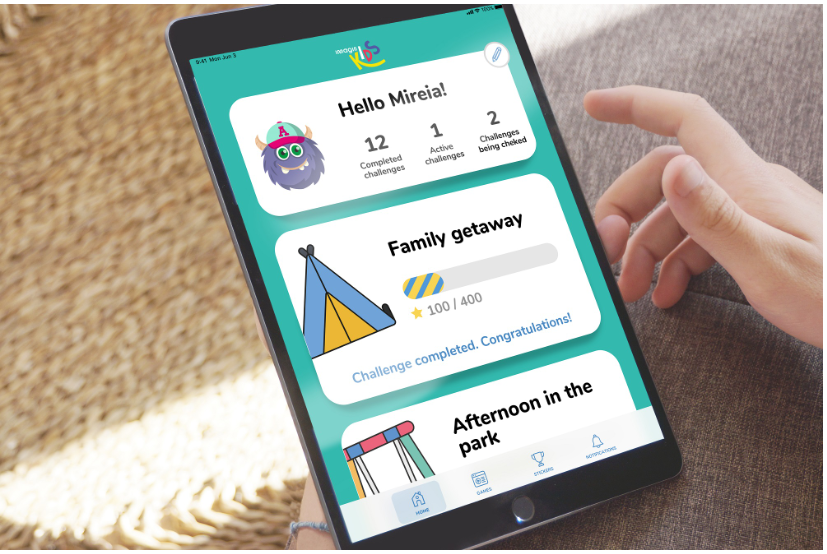

By GlobalDataimaginKids – intended for children aged between 0 to 11 and highly focused on financial education through gaming

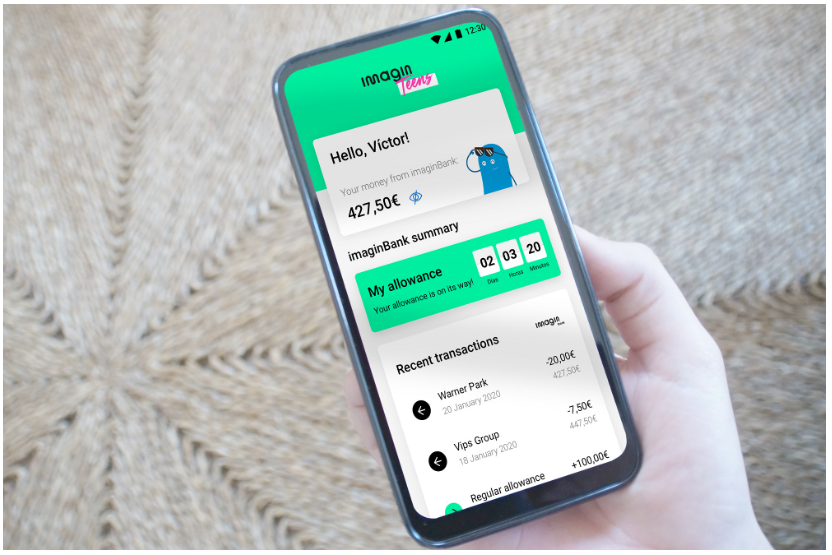

imaginTeens – designed for adolescents between 12 and 17 years of age. It has content and services intended for young people who are beginning to require solutions for their first purchases and to start learning how to manage their personal finances

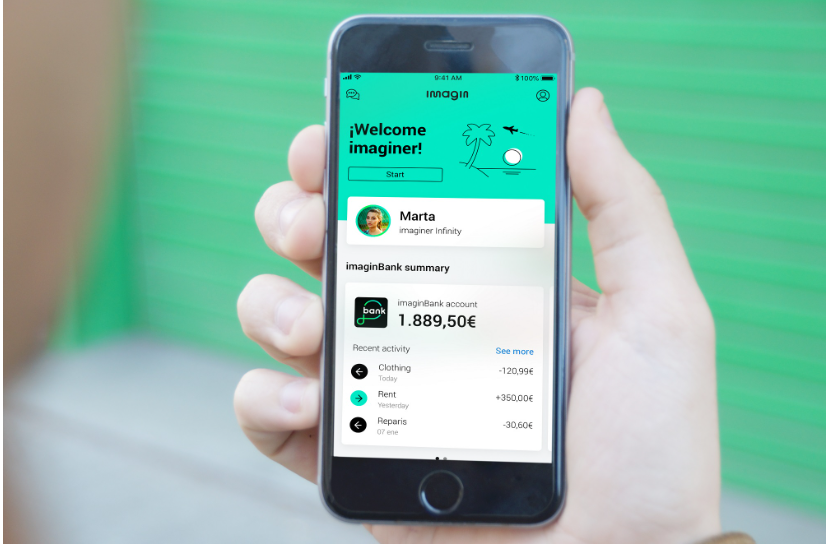

imagin – with a comprehensive financial and non-financial offering for users from 18 years of age

To date, imagin has 2.6 million customers, including users of the mobile-only imaginBank.

Puigdevall added: “imagin appeared for the first time in 2016 as Spain’s first mobile-only bank. The market instantly acknowledged it as an truly innovative project. During this time, imagin has been the first bank to introduce advanced services such as the customer service chatbot, at a time in which there were practically no chatbots in the financial sector, as well as the application of artificial intelligence to help customers finance their purchases. Now we believe that the time has come to go beyond and take innovation to the very heart of the business model.”