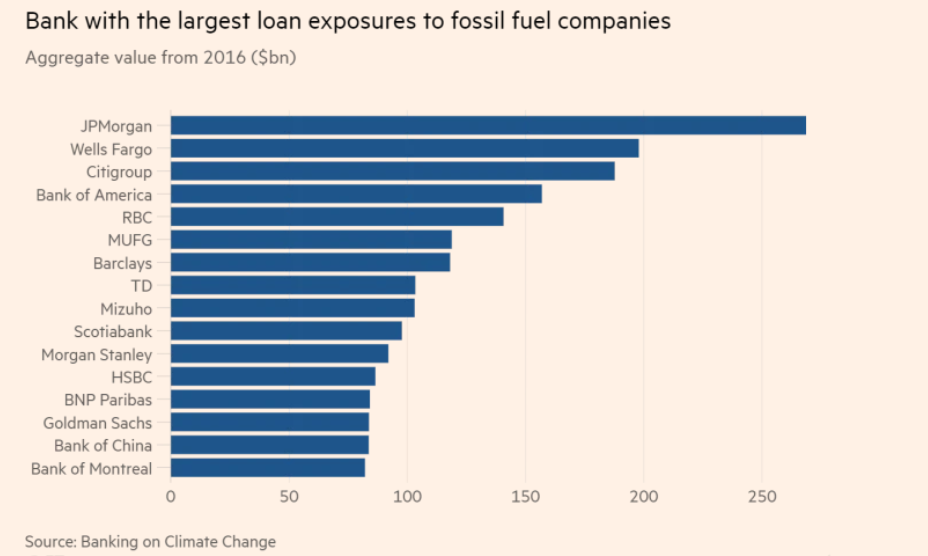

Barclays and HSBC have been taken to task by environmental activists, after the banks increased their fossil fuel investments in 2020.

Both lenders had recently pledged (Barclay in March; HSBC in October) to be carbon neutral by 2050, and the protesters say the banks’ latest support for fossil fuel companies is a repudiation of their pledges.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Rainforest Action Network, a California-based pressure group, has published figures claiming that Barclays provided $24.58bn in underwriting and lending to major fossil fuel companies between January and the end of September this year, $200m more than in the same period last year.

HSBC’s $19bn of fossil finance so far in 2020, while significantly down from $21.58bn in the same period in 2019, “does not represent a significant enough curbing of fossil fuel financing for a bank that is committed to becoming net-zero,” the group said.

Adam McGibbon, UK campaigner at Market Forces, said: “HSBC and Barclays’ climate hypocrisy knows no bounds. These banks claim to support climate action, but there is no climate action that involves pumping more money into the fossil fuel industry.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“We said net zero by 2050, not now,” banks say

The banks contend they had promised to achieve zero carbon dioxide emission only by 2050, not in 2020, arguing they still have plenty of time to fulfil their pledge. A Barclays spokesperson said:

“We agree that the end goal for all of us is a zero carbon economy, which is why we set an ambition to be a net zero bank by 2050.”

Meanwhile, Barclays says, it provides finance to some fossil companies to help them move their business away from polluting industries.

An HSBC spokesman said: “This year HSBC amended its coal-fired power plants policy, removing the exception of Bangladesh, Indonesia and Vietnam from its policy, and support their governments in taking effective steps to help reduce the world’s dependency on fossil fuels.”

Meanwhile, UK government is working towards a zero-carbon economy

Bank of England governor Andrew Bailey promised this week a “greater ambition” on climate change in banking regulations throughout 2021, as the UK government gears up to host the COP26 UN climate change conference in December next year.

UK Chancellor Rishi Sunak, also this week, announced plans to make CO2 emissions disclosures compulsory for UK firms, alongside the country’s first ever issuance of green bonds.