Polish lender Bank Pekao is unveiling Strategy 2024. As Douglas Blakey reports, it is an ambitious set of strategic goals in digitisation, profitability and efficiency.

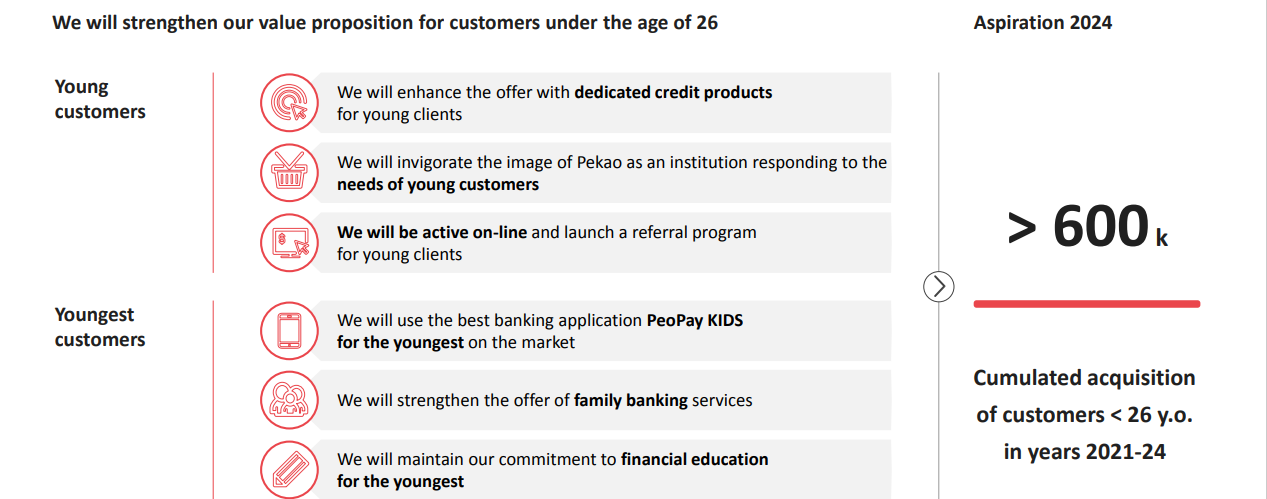

In particular, the bank is pursuing a strategy under the banner ‘Responsible bank. Modern banking’. To succeed, the Bank Pekao Strategy 2024 policy requires the lender to concentrate on young clients. Moreover, it must develop its presence on the e-commerce market.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

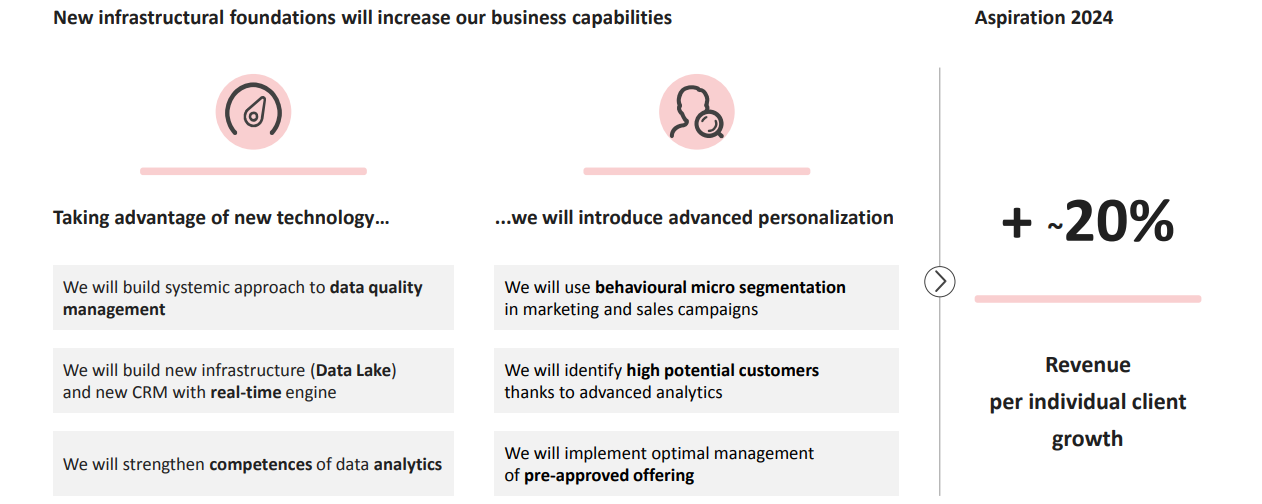

And the ultimate goal? Bank Pekao aims to increase profitability per customer by 20% in three years.

Specifically, the new policy is based on four pillars: Customer, Growth, Efficiency and Responsibility.

Bank Pekao Strategy 2024: dividend strategy

Meantime, the bank also discloses its dividend policy for the years 2021-2024. The initiative assumes a dividend payout ratio at 50-75% of the bank’s net profit each year until 2024.

The bank’s goals are ambitious and will only succeed if Pekao successfully ramps up customer use of digital channels. In addition, it is relying on optimisation of its use of data analytics.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor example, the goal to achieve a digitalisation rate of almost 100% is one of the key strategic aspirations. Rapid digital transformation is essential to improve cost and process efficiency.

Bank Pekao Strategy 2024 by numbers

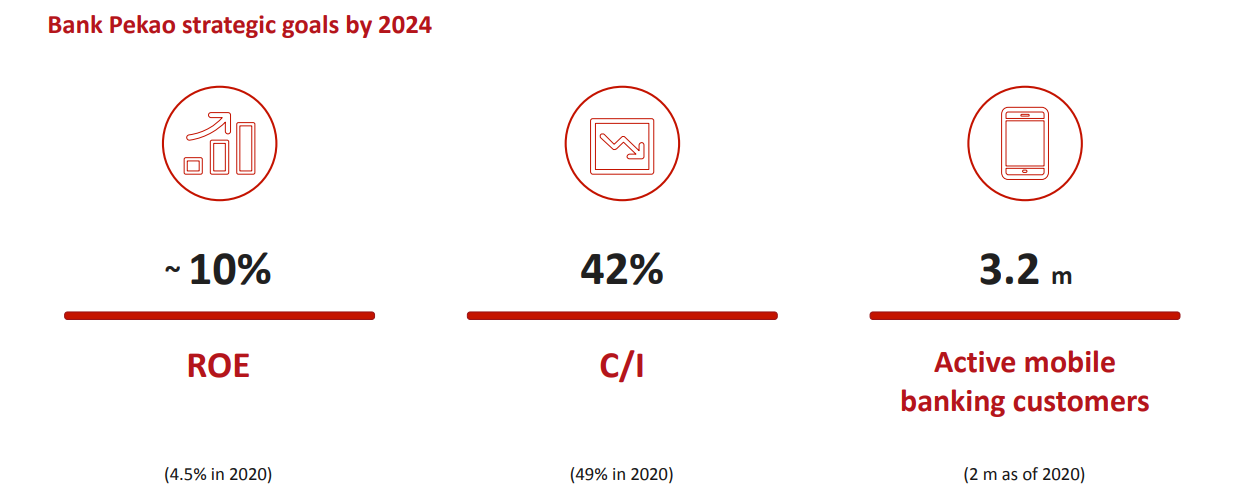

One of the highest hurdles to overcome is increasing the return on equity to around10%. At the same time, Pekao aims to reduce its cost-income ratio to 42%. In addition, it aims to grow the number of active mobile banking customers to 3.2 million. At present, Bank Pekao has about 2 million mobile banking customers. Moreover, its current cost-income ratio is about 49%.

On market share targets, again the bank is being optimistic. It wants to grow its share of cash loans from a 7% market share to 10% by 2024. In the SME sector, it aims for a market share of 12% up from 10%.

Demographic challenge: Pekao to target young customers

Pekao does start from a strong base, with around 5.5 million retail banking customers. However, the demographics of its customer base are a challenge. For example, 40% of its customers are aged over 55. And so, the bank is setting out a clear priority to strengthen as quickly as possible its proposition to young clients.

“As we wish to be the bank of first choice for young customers, we must become a leader in digital. Our goal is to acquire over 600,000 customers under 26 years of age by 2024,” says Leszek Skiba, Pekao CEO.

Overall, in the next four years Pekao expects to acquire over 400,000 retail customers each year.

Our goal is to restore profitability measured by ROE to the level above the cost of capital,” adds Skiba.

Factoring, leasing and insurance goals

Additionally, Pekao plans to develop leasing and factoring as well as expand the range of online financial management services.

Pekao will also concentrate on growth in investment products through digitisation of the offer. Over 80% sales volume of mutual funds is to be realised in remote channels.

The bank sees its cooperation with PZU as a trigger for insurance sales increase. Another ambitious goal is to double its gross written premium income by 2024.

Efficiency is the third pillar of the strategy. Pekao intends to accelerate its technological transformation and take advantage of customers migration to remote channels. It will extend solutions available in digital channels as well as rapidly increase of the level of operation automation.

Shortening the credit process

The bank plans to speed up credit procedures. It aims to shorten the decision time to eight days in the case of mortgages. At the same time, it aims for one day in the case of loans for micro-enterprises and SMEs.

“The driving force for the new strategy is our technology centre. It is flexible and quickly adapting to dynamically changing market conditions. We want to focus on mobile technologies, artificial intelligence, big data, hyper-automation and cloud solutions,” says Błażej Szczecki, deputy CEO supervising Pekao’s Operations and IT Division.

The fourth pillar: responsibility

Pekao intends to support economic development by focusing on governmental and EU programmes for economic recovery and climate transformation. At the same time, the bank’s commercial and operational activity will be more concentrated on sustainable development factors.

Pekao expects to maintain a safe risk profile and have one of the lowest risk costs among major banks. To this end, it will improve the infrastructure of risk models, automate credit assessment processes and ensure cybersecurity.

Pekao will finance sustainable projects and support an orderly transition to a low-carbon economy. It will increase financing of renewable energy.

“We intend to focus more on environmental, social and corporate governance factors,” explains Krzysztof Kozłowski, deputy CEO.

“It cannot happen without active support for development of Polish enterprises. We are going to offer them participation in a variety of programmes and accelerators. In order to achieve our goals, we need to be viewed as an attractive employer, focusing on employee development. We must also continue and strongly emphasise charity and educational activities. The highest standards of corporate governance and an institutional approach to ESG are an important framework for our development.”

Bank Pekao: strong capital, attractive investment?

Tomasz Kubiak, Pekao’s CFO, argues that the bank’s strong capital position means it can achieve its predicted growth.

“We also plan to maintain a safe level of capital, with the Tier 1 ratio above 14%. A generous dividend policy is based on an above-average in the sector payout ratio. It allows us to achieve ambitions of profitable growth and to guarantee dividends. These are important to many of our investors. We want to be an attractive company for a wide range of investors,” concludes Kubiak.