Bank of Montreal Q119 adjusted net income rises by 8% year-on-year to C$1.54bn.

For the first quarter ended January 31, 2019 Bank of Montreal net revenue rises by 6% to C$5.6bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Q1 highlights include a 42% rise in adjusted net income to C$454m at BMOs US personal and commercial banking business.

Bank of Montreal Q119 adjusted and reported net income is flat at its Canada-based personal and commercial banking business.

Revenue rises by 3% year-on-year with average loans up by 5%. Meantime, average deposits are up by 7%. The net interest margin rises by 1 basis point from a year ago to 2.61%.

Bank of Montreal Q119: net interest margin inches up

Meantime, revenue rises by 8% year-on-year at BMO’s US personal and commercial banking business. Average loans rise by 11% with average deposits up by 16%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe US net interest margin is up by 1 basis point y-o-y to 3.71%.

“BMO’s good performance this quarter reflects the benefits of our diversified and attractive business mix. This continues to deliver sustainable growth with adjusted earnings per share up 10% from last year says Darryl White, CEO BMO Financial Group.

Bank of Montreal ends the first quarter with 908 branches in Canada and 570 in the US. That compares with 941 and 578 branches in Canada and the US a year ago a net reduction of 41 outlets.

Channel highlights in 2018 include the roll out of smart branches.

BMO has invested heavily in its technology infrastructure. The new Smart Branch aims to create a more engaging banking experience for customers.

Smart Branches harness different methods of biometric authentication. These include, behavioural analytics and AI to develop tailored and seamless services.

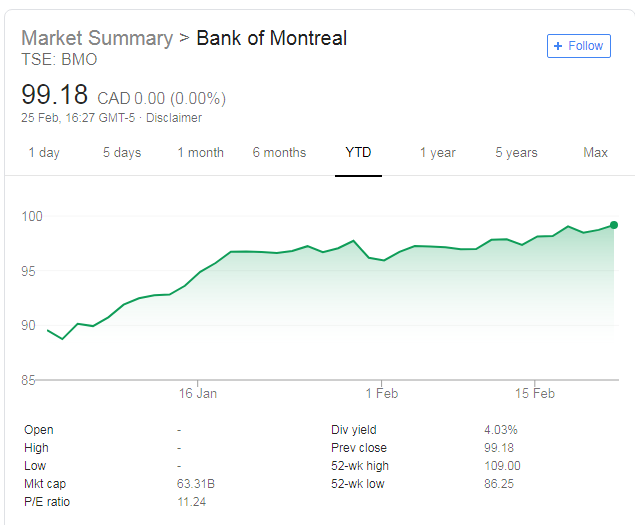

Bank of Montreal’s share price is ahead by 11% for the year to date.