Bank of America Q2 2019 results highlight the strength of the bank’s retail banking franchise.

Net income for the quarter to end June rises by 8% year-on-year to $7.3bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Bank of America Q2 2019 revenues, net of interest expense rise by 2% to $23.1bn.

On the other hand, less positive metrics include a 7 basis point fall in the net interest margin to 2.44%.

Bank of America Q2 2019: retail banking highlights

But it is the bank’s strong retail banking metrics that will grab the headlines. The consumer banking division posts net income up by 13% to $3,3bn. Retail loans are up by 6% to $296bn. At the same time, deposits rise by 3% to $3.3bn while consumer investment assets are up 15% to $220bn.

Other notable highlights include a 2 percentage drop in the bank’s cost-income ratio to 45%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe bank’s wealth and investment banking unit also posts a strong quarter. Net income rises by 11% to $1.1bn. The unit also records a record pre-tax margin of 29%. At the same time the unit records loans up 3% and deposits up 7%. Moreover, year-to-date net new Merrill Lynch households soar by 45%.

Bank of America Q2 2019: channel highlights

The bank ends the second quarter with 4,349 branches. This represents a net reduction of 62 outlets in the past 12 months. Bank of America’s branch network has reduced each year since peaking at 6,238 branches in 2009. In the past ten years, Bank of America has axed almost 1,900 branches, approaching one in three of its branches.

Digital sales now account for 25% of all retail banking sales, up from 24% a year ago.

The bank ends the quarter with 27.8 million active mobile banking users up 10% from 25.3 million a year ago.

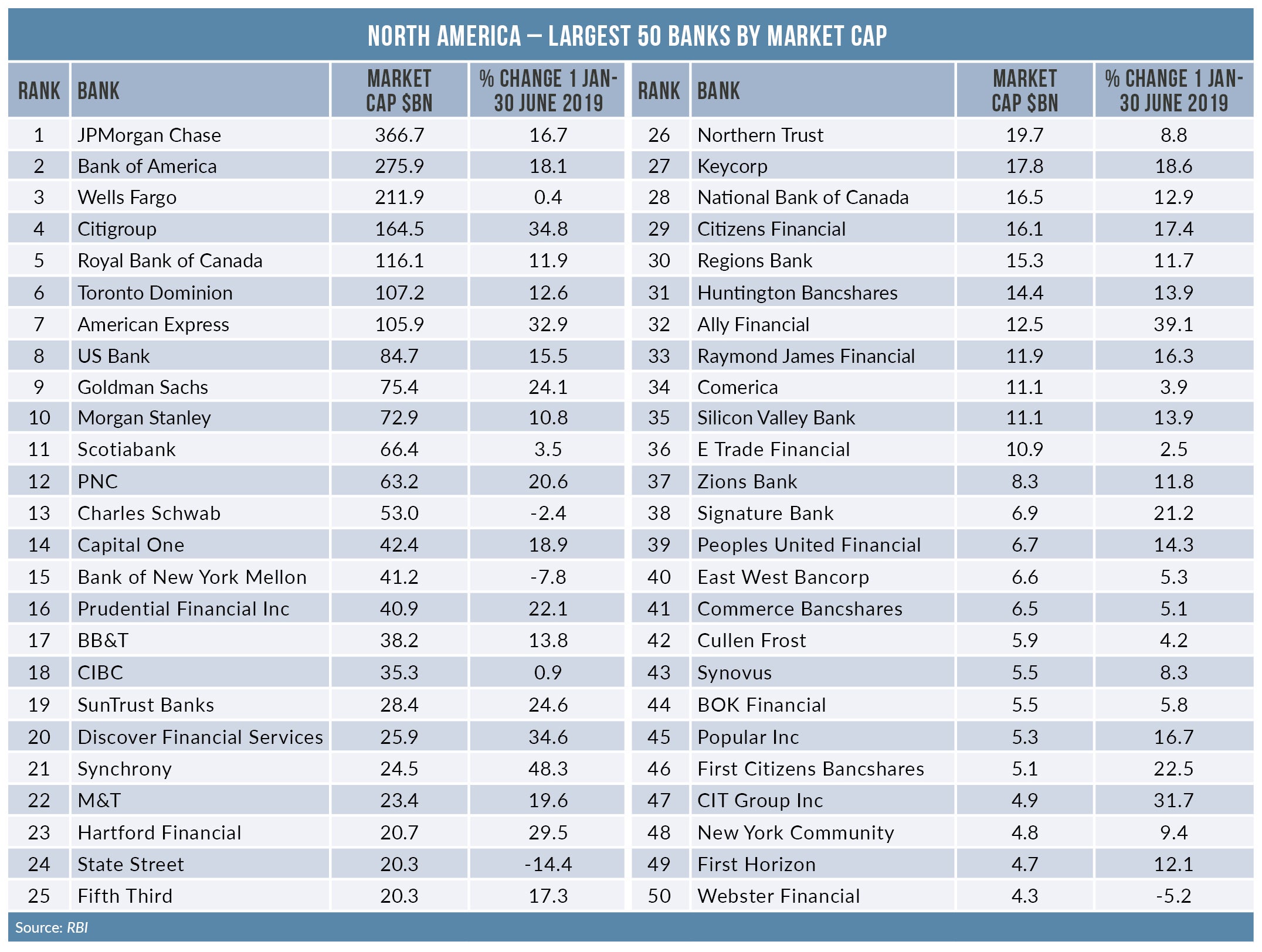

In the period from 1 January to 30 June the Bank of America share price is up by 18.1%.