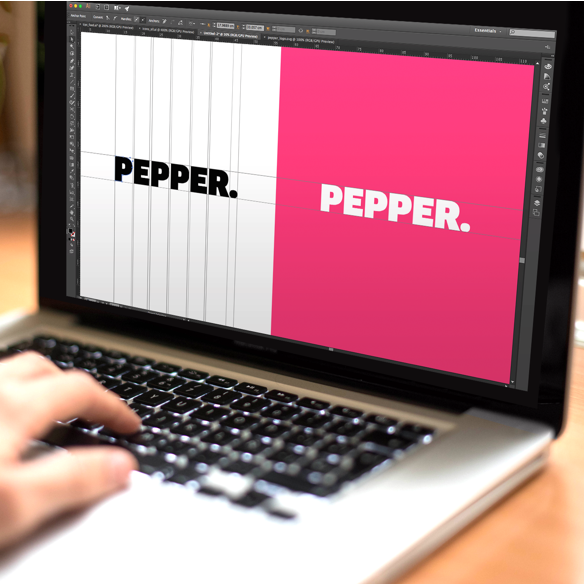

Israel-based lender Bank Leumi is planning to launch the Bank Leumi online-only bank offering Pepper in the US.

Currently, the bank is in talks with potential partners to roll-out Pepper.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The move may disrupt the US banking sector where most of the lenders charge high fees against services.

Bank Leumi online bank

Launched in June last year, Pepper provides all conventional banking services through the app with any account fees. The customers can make fund transfers, apply loans, order credit cards and cheque books as well as manage savings deposit through the app.

Additionally, the bank utilises artificial intelligence to provide customised insights to the customers.

In New York, Bank Leumi CEO Rakefet Russak-Aminoach was quoted by the FT as saying: “We said we wanted to go overseas and we searched wide.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile the bank also mulled expanding to India, the US was selected as its first international venture due to the vast size.

She also added that expansion was influenced by ‘inquiries from foreign banks and potential partners’.

Russak-Aminoach added: “We . . . are currently pursuing several options for collaborations in the US with significant and interesting players.”

However, she did not reveal the identities of possible partners.

In 2016, Goldman Sachs rolled-out its online lending platform in the US. Some other regional banks have also launched their online segments in the market, while Barclays is expected to roll-out its US-based online bank next year.