Bank Hapoalim 2018 results highlight the scale of its exceptional items. Hapoalim is under investigation by US regulators for alleged tax evasion.

Bank Hapoalim reports a net profit of NIS2.59bn ($720m) for fiscal 2018, down by 2.5% year-on-year.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The bank is making a provision of NIS982m in the fourth quarter. This brings total provisions for the investigation to around NIS2.2bn.

Rival Mizrahi Tefahot Bank is paying $195m in penalties to settle an ongoing five-year investigation in the US.

Mizrahi-Tefahot admits that between 2002 and 2012 it was involved in schemes to help its customers evade US taxes.

On an underlying basis, excluding the costs of the US investigation, Hapoalim posts a net profit of NIS3.58bn..

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBank Hapoalim 2018 results: highlights

The bank’s total credit portfolio rises by 6.3% in 2018 to NIS282.5bn.Other highlights include:

- Retail deposits increase by 9.4% y-o-y;

- Housing loans increase by 9.9% y-o-y;

- Successful cost cuts helps Hapoalim to reduce its cost-income ratio by 130 basis points to 57.8%, and

- Improved margins with an 18 basis point rise in the net interest margin to 2.31%.

On the other hand, the Bank Hapoalim return on equity dips to 7.1% in 2018 from 7.5% in 2017.

Bank Hapoalim ends 2018 with a branch network of 225 outlets. As recently as 2012 Hapoalim’s domestic network comprised 280 branches. Rivals Leumi, Israel Discount Bank and First International are also shrinking their networks as digital banking accelerates.

By contrast, Mizrahi Tefahot Bank is bucking the trend. Mizrahi Tefahot opened four new outlets in 2018, increasing its estate to 191 units. In the past three years, it has opened 16 new branches.

Israel: largest 5 banks by branches

- Bank Leumi 250

- Hapoalim 225

- Mizrahi Tefahot Bank 191

- Israel Discount Bank 182

- First International Bank 71

Bank Hapoalim 2018 results: total assets inch up

Hapoalim total assets rise by 1.4% in fiscal 2018 to NIS460.9bn. Bank Hapoalim remains the largest bank in Israel by assets.

Israel largest banks by assets (NISbn)

- Hapoalim 460.9

- Bank Leumi 460.6

- Mizrahi Tefahot Bank 248.8

- Israel Discount Bank 239.2

- First International Bank 134.1

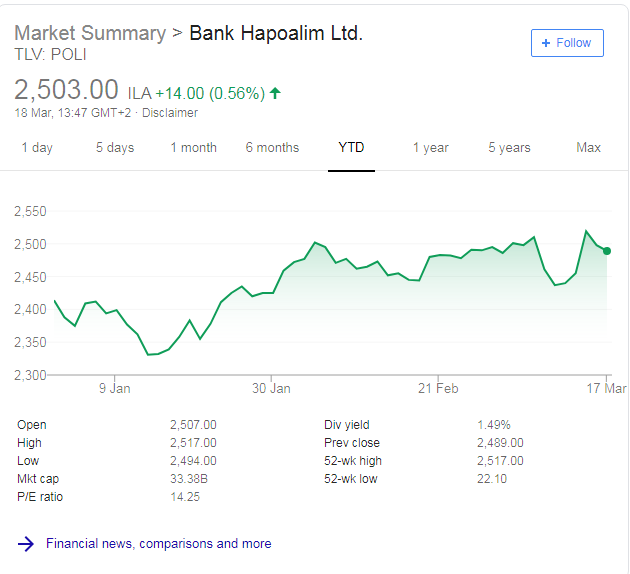

Bank Hapoalim’s share price is ahead by almost 4% for the year to date.