The UKs’ move away from cash is undeniable but there are risks that come with a cashless society.

Today, consumers across the nation only use cash for three in every ten transactions. This is down from six in ten a decade ago. However, it could fall as low as one in 10 in the coming 15 years.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The UK is rapidly accelerating towards a cashless society, due to the popularity of contactless tehnology. Furthermore, contactless payments have rocketed, growing 99% in 2017 to 4.3 billion.

However, the surge in cashless payments has led a dangerously large amount of ATM and branch closures across the country.

The Access to Cash report noted that– as of today – the UK is not ready to go cashless. 17% of the UK population – over 8 million adults – would struggle financially in a cashless society. This would largely affect people in rural areas, the elderly and those who have mobility problems.

Digital payment solutions bring benefits to consumers. However, its important to note that the UK infrastructure is not ready to cope with a completely cashless society.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCurrently, there is no single regulator that oversees the use of cash and the infrastructure to support cash payments. That includes the use of ATMs and branches.

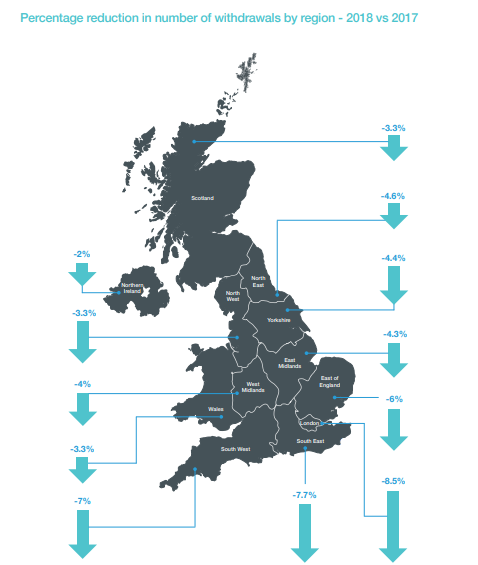

The volume of cash being withdrawn from cash machines is falling fast. Data from GlobalData’s 2018 Consumer Payments Insight (CPI) Survey revealed that over three quarters of respondents prefer card payments over cash.

The official line from banks and regulators is that customers are driving the digitalisation of money. However, it is not just consumers that cashless will threaten.

The Access to cash report highlighted that “the shift to online shopping has threatened the high street, with household names closing stores or, worse, going into administration.

“If we want to maintain cash as a viable part of the infrastructure of Britain, we need to think creatively and innovatively.”

Access to cash report: cashless will leave millions behind

Even Sweden, the most cashless country, has highlighted the risks of running blindly into a cashless society. While having more payment options offers choice, ditching cash for good would take away a method that is still prevalent to a small but significant group of people.

Mark Aldred, banking specialist at Auriga, commented:

“Protecting access to cash for all communities from inner cities to remotest rural areas is vital. This report raises a spectre of the cash access withering away and its findings demand close scrutiny. But, the report does miss the wider picture. Communities need access to not just cash but an array of banking services that support local economies.

“There is a need for greater imagination from some parts of the industry to use advances in self service banking technology that can give a community a bank branch in a box or rejuvenate their bank branch as a focal point for financial services. The ability to customise modern ATMs to offer additional services from paying a bill to doing a live video call with a financial product specialist also allows cash access to be subsidised through generating extra revenues. Perhaps government should stride in to help if the industry doesn’t do more to help itself but I am optimistic that we can evolve cash access to better serve customers if we break the old mould of how ATMs are operated.”

Government must act

The Access to Cash report recommends that the government and banks work together on making sure that consumers are financially included. Having numerous payment choices is important but the UK must ensure that all consumers have a choice on how they want to pay.

Nicky Morgan, chair of the Treasury Select Committee, said: “The complexity of this issue cannot be overstated, but the simple truth is that leaving the future of cash to be determined by market forces will not work.”

Across the pond in the US, legislation is being passed in state governments to ban cashless stores. Lawmakers argue that completely cashless stores discriminate against consumers that do not have access to cashless technologies.

By going completely cashless, the UK will drive further socioeconomic divide.