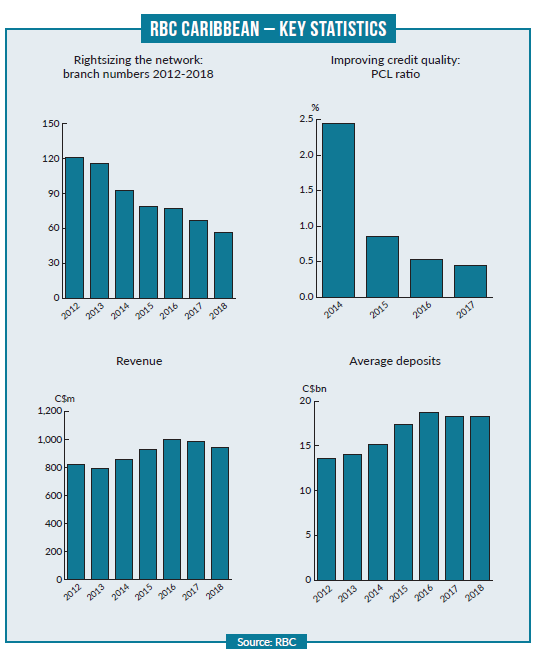

As recently as 2012 RBC’s Caribbean operations were a basket case. The unit reported minimal net income while bad loans were on the rise. Customer service was unacceptable and the entire franchise was unsustainable. As Douglas Blakey reports, the entire RBC Caribbean franchise has since been transformed

Royal Bank of Canada (RBC) has long established itself as a major player in international finance. The world’s 11th largest bank by market capitalisation, RBC serves over 16 million clients in 36 countries and territories.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Its presence stretches from its Toronto HQ to places like New York, London, Zurich, Beijing, Sydney, and points in between. And that includes RBC’s well established Caribbean operations, housed within RBC’s global Personal and Commercial Banking division.

RBC has had a branch presence in the Caribbean for over 100 years. But its most sizeable push into the region came in 2008 with its purchase of Royal Bank of Trinidad and Tobago (RBTT).

With that acquisition, RBC’s Caribbean footprint expanded to include 19 countries, 1.3 million clients, 117 branches, and nearly 6,000 employees. Timing is everything, and with that acquisition followed shortly by the global economic downturn, one thing quickly became clear. RBC needed to make major changes to enable the business to remain competitive and sustainable.

Setting the stage for transformation

In 2012, RBC leadership embarked on a process of radical turnaround and a re-imagining of the bank’s future. At that point, net-income after taxes (NIAT) was sitting at a dismal $8 million and on a downward trajectory. Revenue was falling while bad loans and delinquent accounts were increasing.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBranches routinely saw hours-long queues of frustrated clients. Moreover, customers were served by staff that spent most of their time performing basic transactions at the teller wickets.

The model was an unsustainable snapshot of banking history. It was time for the bank’s leaders to act. And act they did.

Today, just seven years later, the bank enjoys a NIAT of approximately $170m and that number is trending upward. Revenue has stabilised while operating costs have been reduced.

Core operations and essential teams were reorganised into centres of excellence providing support across the region. This centralised approach created economies of scale which allowed for significant workforce efficiency gains.

In the midst of this, RBC embarked on one of its most ambitious transformational projects. It re-imagined its branch network and helped redefine what it means to bank in the Caribbean.

From bricks to bytes

Rob Johnston became RBC’s Head of Caribbean Banking in 2015. He is a career banker with decades of experience working in diverse locations across RBC’s Canadian network. He has lived through transformation in Canada and is now helping to spearhead changes in the Caribbean.

“One of the things that stands out for me is the speed at which things are moving,” Johnston tells RBI. “It was a gradual transition from traditional banking halls to digital channels over the course of 20 years, in places like Canada, the US and Europe. It’s happening much more quickly in the Caribbean and we are very pleased with how the market is embracing it.”

From 2012 to 2019, RBC realigned its Caribbean network from 117 branches to the current 52. With each consolidation, critics of the bank questioned the vision and RBC’s commitment to the local markets. Speculation about RBC’s future in the region went into overdrive.

Branch transformation marks a new beginning

“People would tell me that they thought this would be the end of RBC in the Caribbean,” says Johnston. “In actual fact, our branch transformation marked a new beginning. In addition it puts RBC on the path for future growth and success.”

“Our investments in our digital capabilities, our ATM network and Client Advice Centres are key elements of our overarching client strategy,” he adds. “Our goal was to help our clients spend more time doing the things they love. And avoid them standing in line for hours on end just to pay a bill or move some money between accounts.”

Thanks to those investments, RBC’s clients can perform most day-to-day transactions 24/7 from anywhere, by phones, tablet or computer. Notably, more than 280,000 Caribbean clients make use of digital banking services.

While digital metrics are important, Johnston stresses that physical branches are still an important part of RBC’s footprint. The branches are turning into what the bank calls ‘digitally-enabled advice centres’.

In particular, clients can perform traditional transactions with a client service representative and enjoy further exposure to RBC’s digital offerings. New branches also offer comfortable space for clients to meet advisers and discuss the full range of products and services.

Johnston concedes that in the early days the branch transformation resulted in some growing pains. But he says that the digital options are quickly becoming the norm.

“It is important to remember this was a significant change. We needed to make sure we worked with every single client to get them comfortable. Now, I have people telling me they can’t imagine their lives without digital banking. I am proud that RBC was first out of the gate in the region with digital banking. We’re succeeding where others thought we’d fail.”

Transforming the bank to ensure future success

RBC is not only changing the Caribbean’s digital landscape for its clients. The bank is also transforming the actual way it does business. “The financial sector is not immune to the rapid changes impacting our world,” notes Johnston.

“Digitisation is one thing. We are also seeing new and different competitors emerge, and we’re seeing our clients’ expectations change. They want things to be simpler, faster, and better. That’s what we’re focusing our business on.”

Previously, RBC’s operations were segmented by geography, meaning each Caribbean territory was basically a separate bank within a bank. “This was no longer an efficient way of doing things,”.

In 2018, RBC retired its geography-based operating model. The bank realigned into three dedicated lines of business which were Pan-Caribbean in nature. Namely, Specialised Sales, High Net-Worth and Retail operations.

One RBC across the region

According to Johnston, these new areas are the foundation of much of RBC’s business in the Caribbean. By aligning into more streamlined areas, he contends that this new governance model enhances the end-to-end client experience. It also allows the bank’s teams to work better as “One RBC” across the region.

“We have a lot of expertise within our organisation. Under our new model, the sharing of best practices has increased and our operations are better connected than ever before.

“For our employees, this leads to improved performance outcomes while also encouraging ideas and innovation. For our clients, it increases our service speed and responsiveness to provide an improved experience and in reality, deepens our relationship with them.”

In fact, one of the most common criticisms RBC received when it started its transformational journey was that it would negatively affect the bank’s relationship with its clients as all-important face-to-face interactions would fall by the wayside. According to Johnston, the opposite has proven to be true.

“It is naïve to think that in 2019 life-long relationships are being formed when you come into a branch to deposit twenty dollars. Those interactions are mostly, to use an appropriate term, ‘transactional’.

“We see the most meaningful client relationships form when our employees help our clients with advice for the major milestones in their lives. Such as planning for and providing solutions to support them with the purchase of a home or car, funding education or retirement savings, etc.

Successfully deepening client relationships

“These are where life-long relationships begin – grounded in trust and support. It helps us better understand our clients and allows us to anticipate their needs, offer the most appropriate solutions and, ultimately, to help them and their families achieve their dreams.”

RBC’s new Specialised Sales line of business is leading the way when it comes to deepening those client relationships. Johnston notes that the bank’s specialised sales force is completely mobile and will meet with clients wherever they need them. “Quite often our mobile sales professionals will go to meet them at the car dealership, the realtor’s office, the client’s office or the kitchen table. They will go to wherever those major financial decisions are being made. They provide the same service and advice clients would expect in a branch setting. We want to bring our bank to our clients and not the other way around. This is how we can differentiate ourselves from the competition and how we can grow our business.”

HNW operations: RBC’s local USP

With respect to the High Net-Worth operations, RBC is unique. It is one of the few banks in the region which brings together all elements of its global wealth portfolio to serve its most discerning clients with their unique financial needs.

“RBC Wealth Management and RBC Dominion Securities are globally-recognised leaders in providing wealth solutions to clients around the world,” says Johnston. “Our team of private bankers are bringing those and other services to some of our most important marketplaces in the region. This is what gives us an edge with this important client segment.”

RBC is also proud of its business and corporate banking offerings. “We draw on the expertise of more than 86,000 RBC employees around the world to help businesses in the Caribbean reach the next level, grow their footprint, or expand into other markets.

“We work closely with our business and corporate clients and provide them with unique solutions tailored to their goals and objectives.”

He credits the talent of his team, the bank’s overall trustworthiness, and its stable reputation as being some of the main reasons why RBC has been the principal banker of the Government of The Bahamas and other governments across the Caribbean for decades.

Looking ahead, Johnston is very excited about what the future holds for RBC in the Caribbean. He is proud of the bank’s journey and he takes pride in how his team has embraced a dramatic volume of change in a short amount of time.

Numbers of Johnston’s side, rivals playing catch-up

In response to those initial critics who questioned RBC’s strategy, Johnston has numbers on his side. “The numbers we see speak for themselves,” he says. “In just seven years, we have seen an astounding 2,025% increase in our NIAT.

Our clients’ likelihood-to-recommend numbers have increased by 30% and our employee satisfaction numbers have increased by 16%. We were told we’d lose clients, our workforce would become demoralised, and our revenues would plummet. The exact opposite has been the case.

Today, our competitors are playing catch-up and RBC’s transformation is something others are hoping to emulate.”

When asked about why all of this is important, Johnston’s response is candid: “The Caribbean has been a home for RBC for more than 110 years. We are incredibly proud to be part of the fabric of this region.

‘Here for generations to come’

“We have been here through ups and downs, the opportunities and the challenges, and each year we are getting stronger and better. We want to ensure we are well-positioned to serve clients here for generations to come.

“Change is never easy, but in an era where new products and technologies emerge every single day, organisations cannot sit on the sidelines if they hope to remain relevant and viable.

Banks are no different. We need to adapt, we need to be agile, and we need to constantly remember that our clients are at the heart of everything we do. When we embrace those elements, then, and only then, can we position ourselves to be leaders and innovators.

“Only then, can we succeed where others have failed. This is what sets RBC apart. And this is how we will not only survive, but grow and thrive in our rapidly-changing and increasingly-disruptive modern world.”